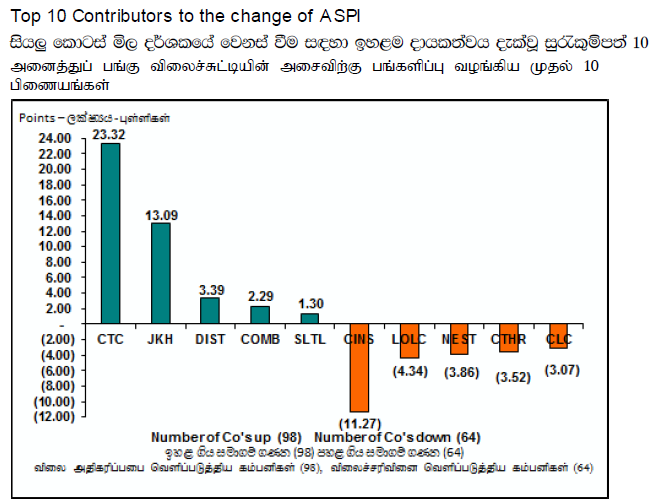

Colombo bourse started the week with positive signs as the main share index closed on the positive territory for the third consecutive day. The ASI closed at 5,899.20, up by 22.54 points or 0.4% while 20-script S&P SL index closed at 3,267.45, up by 26.82 points or 0.8%. The gains in the indices were led by price appreciations in blue chips such as Ceylon Tobacco (LKR 1,184.00,+4.9%), John Keells Holdings (LKR 230.00,+2.2%), Commercial Bank (LKR 122.50,+1.3%) and Distilleries (LKR 195.00,+2.5%).

Gainers outweighed the losers 109 to 68 today and cash map closed at 42%.

The market turnover for the day was LKR 515mn and the trading session was dominated by John Keells Holdings and its two warrants. The three scripts were the top three heavily traded stocks of the day and accounted for 51% of the market turnover. JKH Warrant 22 closed at LKR 79.10 up by 6.6%. JKH Warrant 23 closed at LKR 95.00, up by 6.2%.

Apart from John Keells Holdings voting share (LKR 200mn) and its warrant-22 (LKR 52mn), Commercial Bank (LKR 50mn) and Aitken Spence Hotels (LKR 37mn) emerged as top contributors to the days’ turnover. Aitken Spence Hotels closed at LKR 66.00,-1.5%.

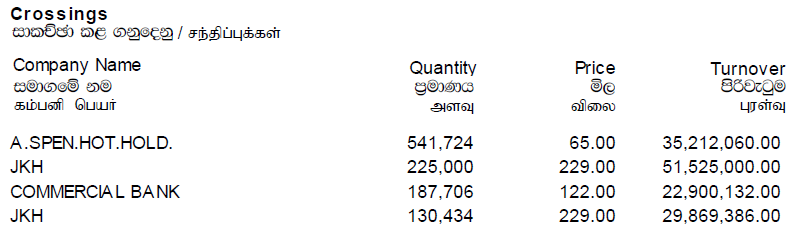

Four crossings were recorded today where 0.5mn shares of Aitken Spence Hotels (at LKR 65.00), 0.2mn shares of Commercial Bank (at LKR 122.00) and 0.4mn shares of John Keells Holdings (at LKR 229.00) changed hands as crossings. Off-the-floor deals accounted for 27% of the daily market turnover.

Apart from JKH, penny stocks such as E-Channeling (LKR 12.50,+0.8%), Touchwood Investments (LKR 2.70,-3.6%) and Textured Jersey (LKR 15.30,+0.7%) witnessed relatively high activity levels.

CT Land and Chevron Lubricants closed lower at LKR 30.60 (-4.1%) and LKR 266.00 (-2.1%) on the ex-dividend date.

Notable price depreciations were reported in Ceylinco Insurance (LKR 1,100.00,-17.9%), Blue Diamond (LKR 3.40,-5.6%) and Citrus Leisure warrant 19 (LKR 1.40,-6.7%).

Foreign investors were net buyers for the fifth consecutive day with an inflow of LKR 177mn. Net foreign inflows were seen in stocks such as John Keells Holdings (LKR 131mn), Commercial Bank (LKR 45mn) and Ceylon Tobacco (LKR 8mn) while net outflows were reported in stocks such as Hatton National Bank (LKR 19mn) and Aitken Spence (LKR 9mn).

Meanwhile, Ceylon Tobacco announced the fourth interim dividend of LKR 5.10 (XD: 09 Jan 2014) today. With this dividend, CTC has declared a total of LKR 40.20 (per share) as dividends for 2013 and based on its dividend record, a final dividend can be expected in February 2014. (2012 DPS: LKR 43.60)

The ex-dividend date of Asian Hotels & Properties falls on tomorrow (DPS: LKR 1.00). The stock closed at LKR 65.40,+0.6% in today’s trading session.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

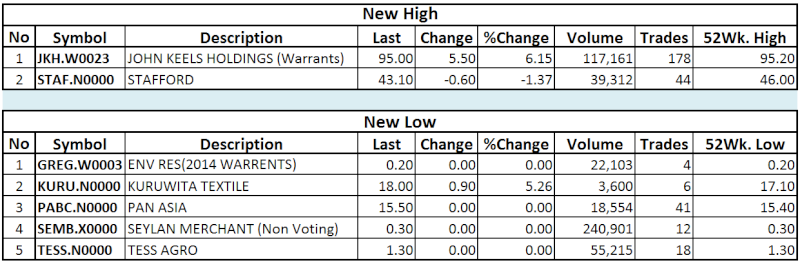

Following Stocks Reached New High / Low on 30/12/2013 Mon Dec 30, 2013 4:00 pm

Following Stocks Reached New High / Low on 30/12/2013 Mon Dec 30, 2013 4:00 pm

Crossings - 30/12/2013 & Top 10 Contributors to Change ASPI Mon Dec 30, 2013 4:04 pm

Crossings - 30/12/2013 & Top 10 Contributors to Change ASPI Mon Dec 30, 2013 4:04 pm

LSL Market Review – 30th Dec 2013 Mon Dec 30, 2013 6:15 pm

LSL Market Review – 30th Dec 2013 Mon Dec 30, 2013 6:15 pm

Big caps push index into green Mon Dec 30, 2013 9:59 pm

Big caps push index into green Mon Dec 30, 2013 9:59 pm