The Sri Lankan equity market experienced certain developments during the past few years and is currently poised for growth. The daily average turnover for the current year is Rs.1,132 million, while the net foreign inflow is Rs.826.6 million.

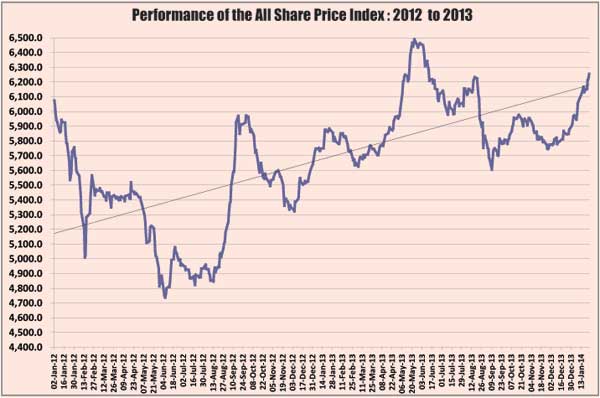

Further on, the All Share Price Index (ASPI) has grown by 5.8 percent since the beginning of the year. The incentives given by the 2013 and 2014 budgets, prevailing monetary indicators (lowering interest rates) and the initiatives taken by the regulator and other stakeholders will continue to have a positive impact on the market.

If we are to maintain growth, it is vital that market stakeholders act with precision and caution. It is only then that we could maximize the returns of a growing market.

At this juncture, it is timely to highlight the initiatives taken by the Securities and Exchange Commission of Sri Lanka (SEC) and the Colombo Stock Exchange (CSE) in the recent past to create a fair and transparent market in which interests of the investors are protected. It is undoubted that a suitable environment is created for new investors to enter the market, while existing investors can be more active.

Yet, it is equally important to note that it does not allow investors to blindly enter the market. It is the duty of the investors to assist the regulator in maintaining fair markets by acting with responsibility.

On that note, today’s article will unfold a few areas that investors should look sharp on when investing in a growing market. It is important to bear in mind that your decisions will not only determine your return to investment but also the performance of the market in general.

Invest based on financial goals.

Almost all the stocks seem lucrative in a growing market. Don’t get carried away as all of those stocks might not be the ideal pick for you. Make sure that your transactions go in line with your investment goals.

Diversify your investment portfolio.

It is vital to maintain a balance portfolio if you are to maximize returns. Invest in all types of asset classes ranging from risk-free investments as Treasury bills to real estate, bonds and equity while keeping in line with your investment goals. When the market reaps high returns, rational investors will divert the money in other assets/financial tools to the market. Diversion is acceptable as long as it is kept within manageable limits.

Research before you invest.

It is important for investors to do their own research before they enter the market. When you are given recommendations always ask for a justification on the same. More over take time to do your own independent research on the matter.

Never base your decisions simply on unsolicited emails, message board postings and company news releases. Verify the details. Understand a company’s business and its products or services before investing. Look for the company’s financial statements on the CSE website (www.cse.lk). Interpret them in the light of current economic, political, legal and economic framework.

Know your investment advisor.

Spend some time checking out the person touting the investment before you invest – even if you already know the person socially. Always find out whether the advisor who contacted you is licenced to act in the capacity of an investment advisor. You can check out the relevant details from the SEC.

Take time off from your busy schedule to talk to your advisor and see if he understands your investment goals. He should have a wide knowledge on financial markets and update himself on current happenings. Above all, bear in mind that knowledge can be gained but integrity cannot.

Be informed about documents and agreements you sign.

There are several documents and agreements you will have to sign when investing in the market. The Client Agreement and the Agreements on Discretionary Accounts are two important agreements investors should pay attention to. Read and understand the terms and conditions prior to signing them. Further on, certain individuals hand over the discretionary power to their advisors. Think twice before you do so.

If it sounds too good to be true, think twice before you invest.

Any investment opportunity that claims you’ll receive “incredible gains” or “a pre-determined rate of return” should be dealt with caution. It is true that investors have earned more by investing in the market compared to risk-free instruments as Treasury bills. Yet, any stock cannot generate abnormal returns within a short time period and the return for a stock cannot be guaranteed in advance. Never enter the market with such a mind frame.

Be especially careful if you receive an unsolicited pitch to invest in a company or see it praised online but can’t find current financial information about it from independent sources.

Protect yourself online.

In present days investors prefer to trade online by themselves. When they are in front of the computer and see prices shooting up, they are tempted to do transactions. This method is recommended for seasoned investors. History taught us bitter lessons of how new investors randomly traded on stocks without sufficient knowledge on the market or the stock.

Credit increases liquidity in the market.

Investing on credit is important to increase liquidity in the market and can be rather profitable in a growing and liquid market. Yet, it is important that investors refrain from overly trading on credit. However, lucrative the market may be, don’t get carried away.

Don’t blindly follow others.

At times some people might blindly purchase shares simply because others are buying it. Think about whether you are interested in the product and infer why the demand is building up.

Be patient.

However lucrative an opportunity may be and fear that the opportunity will not last, don’t make rash decisions. Resist the pressure to invest quickly and take the time you need to investigate before investing.

As an investor you should keep the following points in your mind

Stocks aren’t just pieces of paper.

When you buy a share of stock, you are taking a share of ownership in a company. Collectively, the company is owned by all the shareholders and each share represents a claim on assets and earnings.

There are many different kinds of stocks.

The most common ways to divide the market are by company size (measured by market capitalization), sector and types of growth patterns. Investors may talk about large-cap vs. small-cap stocks or growth vs. value stocks, for example.

Stock prices track earnings.

Over the short term, the behaviour of the market is based on enthusiasm, fear, rumours and news. Over the long term though, it is mainly company earnings that determine whether a stock’s price will go up, down or sideways.

Stocks are your best shot for getting a return over and above the pace of inflation.

Since the end of war, through many ups and downs, the average yearly return of the stock market is 44 percent -- well ahead of inflation and the return of bonds, real estate and other savings vehicles. As a result, stocks are the best way to save money for long-term goals like retirement.

Individual stocks are not the market.

A good stock may go up even when the market is going down, while a stinker can go down even when the market is booming.

A great track record does not guarantee strong performance in the future.

Stock prices are based on projections of future earnings. A strong track record bodes well but even the best companies can slip.

You can’t tell how expensive a stock is by looking only at its price.

Because a stock’s value depends on earnings, a Rs.100 stock can be cheap if the company’s earnings prospects are high enough, while a Rs.20 stock can be expensive if earnings potential is dim.

Investors compare stock prices to other factors to assess value.

To get a sense of whether a stock is over- or undervalued, investors compare its price to revenue, earnings, cash flow and other fundamental criteria. Comparing a company’s performance expectations to those of its industry is also common -- firms operating in slow-growth industries are judged differently than those whose sectors are more robust.

A smart portfolio positioned for long-term growth includes strong stocks from different industries.

As a general rule, it’s best to hold stocks from several different industries. That way, if one area of the economy goes into the dumps, you have something to fall back on.

It’s smarter to buy and hold good stocks than to engage in rapid-fire trading.

Active trading requires paying close attention to stock-price fluctuations. That’s not so easy to do if you’ve got a full-time job elsewhere. And it’s especially difficult if you are a risk-averse person, in which case the shock of quickly losing a substantial amount of your own money may prove extremely nerve-wracking.

“To know values is to know the meaning of the market”

-Charles Dow

(Charles Dow invented the Dow Jones Industrial Average as a journalist in 1896, so his thoughts on stocks should be listened to rather closely)

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home