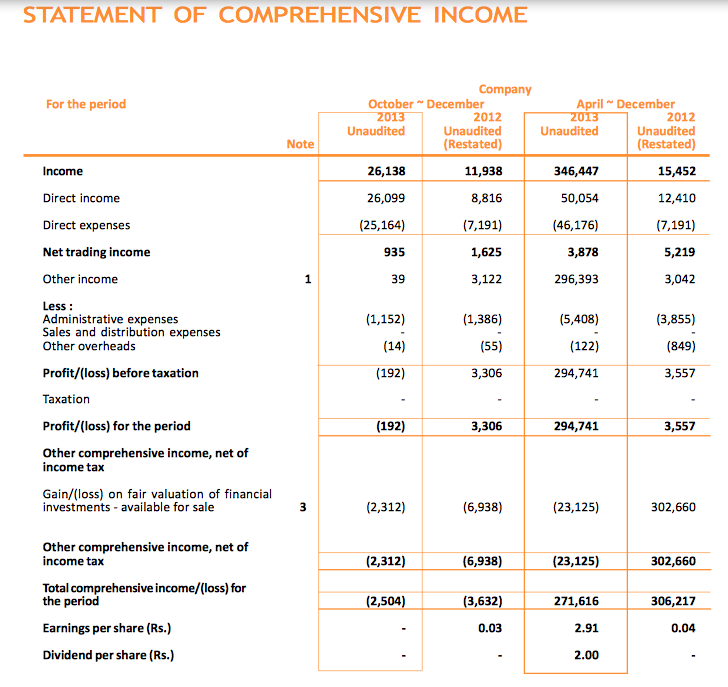

First Capital Treasuries Limited, the group’s primary dealer arm was again the primary source of revenue, taking advantage of interest rate movements and exceeding targets. Other business segments like Structuring and Placement of Corporate Debt Securities and Investment Management (Corporate Debt Securities) also contributed to the results, although performance was below expectations. We were able to hold strategic trading positions in the primary dealer business and benefited through the continuous reduction of policy rates made by the Central Bank of Sri Lanka (CBSL). Both the Standing Deposit Facility Rate (Repurchase) and Standing Lending Facility Rate(Reverse Repurchase) were reduced by 1% and 1.5% respectively during the period under review. Currently the Standing Deposit Facility Rate and Standing Lending Facility Rate stand at 6.50% and 8.00% respectively.

In the light of relaxation of governing protocols relating to primary dealer operations and the issue of new licenses, the competition is now more intense. We have taken steps to protect our human resource base and to aggressively maintain and build on our client relationships.

First Capital Limited continues to seek mandates in the listed corporate debt market and we expect to close some mandates in the last quarter of 2013/14. First Capital Asset Management Limited has been undertaking many sales calls across a wide range of personal and institutional clients and we expect to keep growing our assets under management, especially in the unit trust business.

There was muted activity in the stock market and we struggled to make both brokerage and margin trading revenues. However we have seen a minor bounce back in January 2014 and we hope this will continue and increase during the rest of the year.

The Group continues to explore other business opportunities, especially in the corporate advisory space and will also remain committed to managing risk effectively and being fully compliant with regulations at all times. We are thus confident that we are well on the way towards becoming a fully-fledged investment bank.

(Sgd.)

Jehaan Ismail Director/CEO

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home