BIL purchased 100% LOLC Liesure with all the above hotel at a price of Rs 2.4bn (2.8bn Less 0.435bn Buy Back revenue)

@ Rs 2.40 it seems attractive to me.

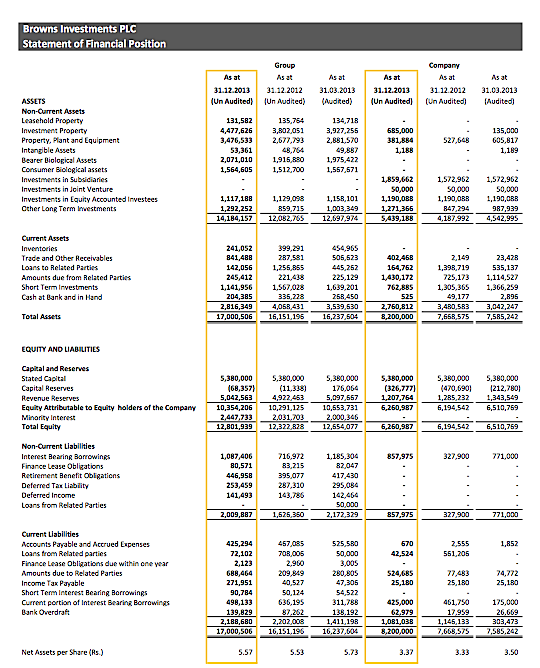

Please find below the BIL Balance sheet before the acquisition of 100% of LOLC Leisure (Buy Back and Purchase). Accordingly NAV of BIL seems to be around Rs 5/57. With the amalgamation of LOLC Leisure the NAV likely to be around Rs 8/=. Share is trading at a discount of more than 50% to Book Value. I wonder why investors ate trying to by Finance Companies at 1.5 X BV when this type of investments are available in the market.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home