would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

Go to page : 1, 2

MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 08, 2014 10:24 am

MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 08, 2014 10:24 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 08, 2014 4:33 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 08, 2014 4:33 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 08, 2014 6:38 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 08, 2014 6:38 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 08, 2014 7:47 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 08, 2014 7:47 pm

Invest-Wise wrote:Certainly a good stock I also bought at 32 levels....12,000

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Sat Aug 09, 2014 2:06 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Sat Aug 09, 2014 2:06 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Mon Aug 18, 2014 12:13 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Mon Aug 18, 2014 12:13 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Mon Aug 18, 2014 12:48 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Mon Aug 18, 2014 12:48 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Mon Aug 18, 2014 10:27 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Mon Aug 18, 2014 10:27 pm

VALUEPICK wrote:As I said before you are real Star! All the best!

Some of these stocks still have legs. There are plenty of stocks trading great discount to the market and some are massively undervalued. It is time to identity these great stocks now.

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Mon Aug 18, 2014 11:06 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Mon Aug 18, 2014 11:06 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Tue Aug 19, 2014 1:12 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Tue Aug 19, 2014 1:12 am

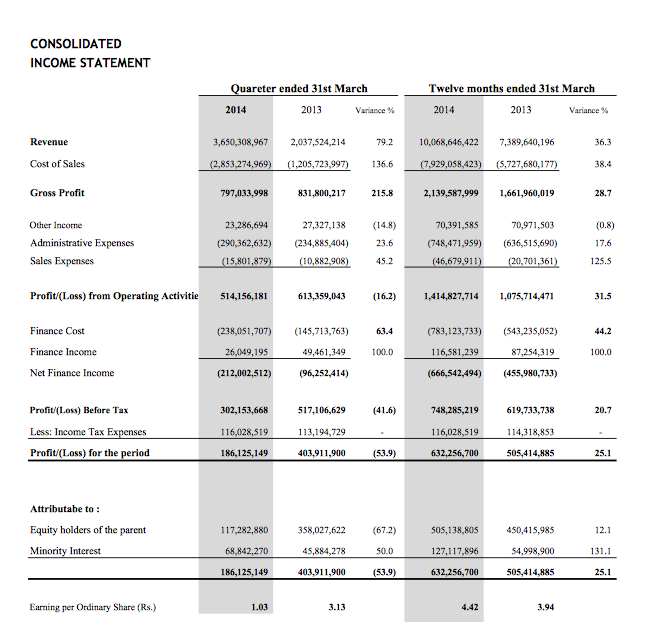

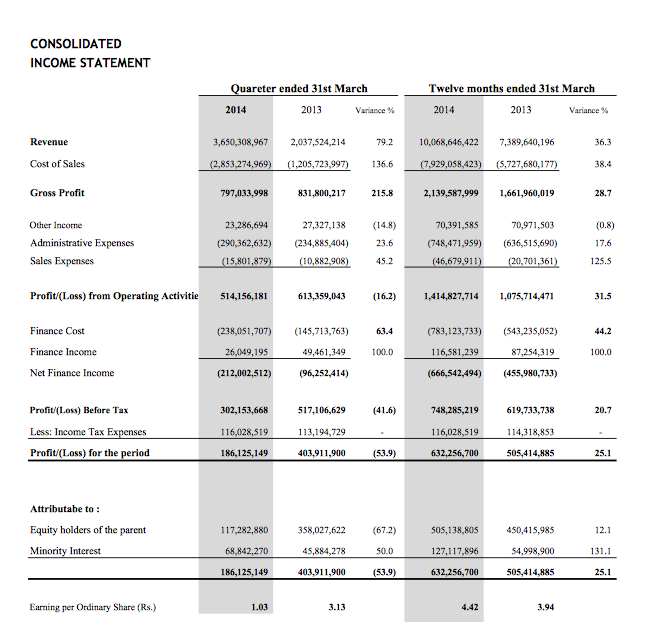

Sstar wrote:MTD Walkers (KAPI) is attractive at current prices considering the current EPS 2013/14 of 4.42 and @ 10PER its worth about Rs 44/= also Net Asset Value (NAV) of the Company is Rs 42 and expected to be around 50 levels in the July results not yet released. At current Market Price the PER is below 8X and Profit growth of the company of 25% makes the PEG Ratio <1. I own 10,000 shares of this company bought at Rs 35/=.

/img][/url]

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 29, 2014 10:13 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 29, 2014 10:13 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 29, 2014 11:29 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Aug 29, 2014 11:29 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Sat Aug 30, 2014 7:31 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Sat Aug 30, 2014 7:31 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Sun Aug 31, 2014 1:13 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Sun Aug 31, 2014 1:13 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Sun Aug 31, 2014 9:04 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Sun Aug 31, 2014 9:04 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Mon Sep 01, 2014 7:19 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Mon Sep 01, 2014 7:19 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Sep 05, 2014 1:33 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Sep 05, 2014 1:33 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Sep 05, 2014 1:48 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Sep 05, 2014 1:48 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Sep 05, 2014 2:43 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Sep 05, 2014 2:43 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Sep 05, 2014 9:32 pm

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Fri Sep 05, 2014 9:32 pm

Sstar wrote:I think the new trend seems to started. Where will it end. 75/=?

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Wed Sep 24, 2014 6:22 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Wed Sep 24, 2014 6:22 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Wed Sep 24, 2014 7:34 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Wed Sep 24, 2014 7:34 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Wed Sep 24, 2014 7:40 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Wed Sep 24, 2014 7:40 am

Sstar wrote:Heading towards the next level.

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Wed Sep 24, 2014 7:42 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Wed Sep 24, 2014 7:42 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Wed Sep 24, 2014 8:33 am

Re: MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015 Wed Sep 24, 2014 8:33 am

Go to page : 1, 2

FINANCIAL CHRONICLE™ » CORPORATE CHRONICLE™ » MTD Walkers Plc (KAPI.N0000) targets 20bn Turnover in 2015

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum