Agree with smallville,but i won't say oops

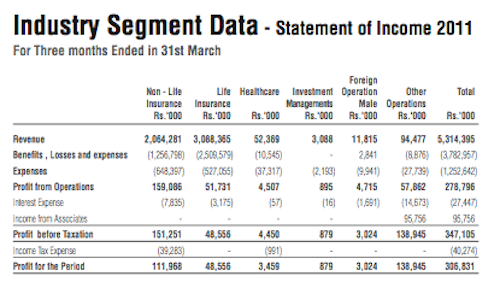

*In insurance, company revenues derives mainly from underwriting and investment. Insurance companies make money first, by underwriting good risks so that their premium cover claims losses and expenses (the money left over being called underwriting income), and second, by investing premiums until claims have to be paid (called investment income), sometimes casualty companies lost money on underwriting but made up for the loss with a gain in investment income.

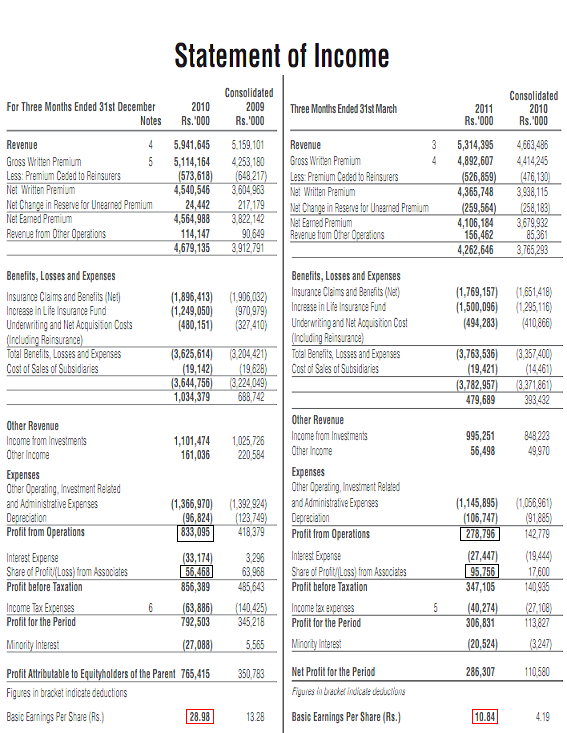

*earning pattern(group-EPS)

2009-1Q-3.83

2009-2Q-4.81

2009-3Q-4.58

2009-4Q-13.282010-1Q-4.19

2010-2Q-0.75

2010-3Q-3.75

2010-4Q-28.982011-1Q-10.84

as highlighted above last quarters of financial years done exceptionally,but 1Q profits came down(didn't looked into steep,so there may be little miscalculations,but not huge deviations)

*Net Change in Reserve for Unearned Premium-there is a considerable deviation in this item(in quarter results)-this unearned premiums may come realized in coming quarters.

---Written premium is premium registered on the books of an insurer or reinsurer at the time a policy is issued and paid for. Premium for a future exposure period is said to be unearned premium for an individual policy, written premium minus unearned premium equals earned premium. Earned premium is income for the accounting period, while unearned premium will be income in a future accounting period.

*Investment income is likely to come under threat in the medium term given lower

returns on both equity and government securities(ASI and MPI fluctuate)

*total investments-(32Bn)

anyway thanks given to smallville for point out this,but still considering growth phase, this as a good share.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home