smallville wrote:Hani, first you start a thread and ask whether its time to enter? So u wanted the opinion of the forum.. Then u go on and tell us how great the share is by looking at director buying when it has also been inconsistent.

Looking at Director dealings, after June 2012, in Feb 2013, another bought in could be seen.. So its infrequent.

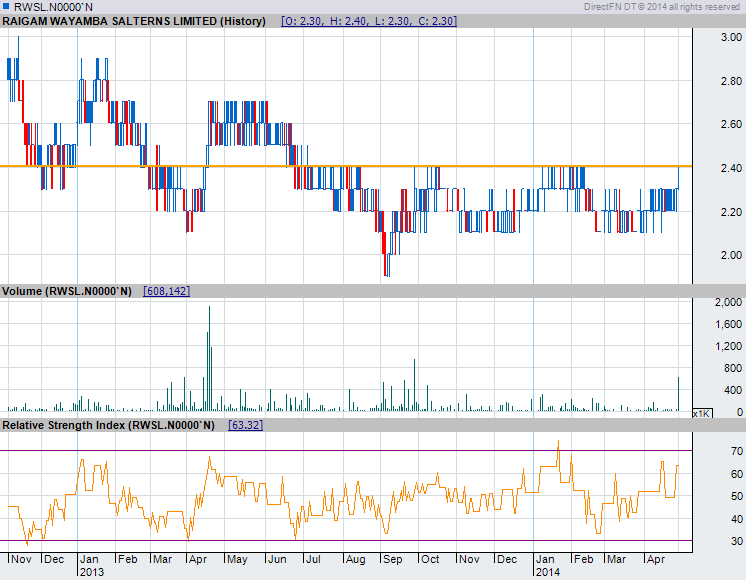

EPS is on a declining trend, NAV 2.9 but No dividends after 2011.

EPF Holds 9.9% (28.1 Mil) shares.

Div yield(5 year avg) - 0.52%

http://markets.ft.com/research/Markets/Tearsheets/Financials?s=RWSL.N0000:CSE

See the financial summary for 5yrs;

We can see earning improved in 2013 but when EPS is considere, where's the growth? This is worth for the NAV but not much growth as expected considering the last 5 years..

Thanks small for details. It's logical as always.

RWSL is one of my base shares as well. I'm not sure if im in correct view, but not only directors collecting it. It's been collected by someone/group time to time.

may be not collected. may be it's traded.

It is a one share that has potential to gave the effect what SEMB did recently. it is worth per nav/eps basics. current prices are encouraging. but yes, its improvement is not satisfied. EPS hopes good return in future, so do I. malan, it's ipo price is 2.50 as i rem, I have invested in the IPO and it was a one good IPO at that time. just my view.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home