Govt. oil price cut is a white elephant/its a joke:Monday LIOC could drop due to this news. However, many panic sellers're now out of the market.

From Global perspective:Oil price slashed from 107.10 (06/2014) to 65.6 (Last closed price), which is a significant

drop of around 40%.

Thus OPEC has officially decided to not to cut the oil production, saying market will determine the price itself.

The main factors beyond this drops;

- US now moving to alternative/renewable energies, and their consumption is reducing year by year.

- Slow down economy of China, and recession of EU still continued. Hence, the demand has reduced.

- US want to plunged Russian economy, by this price drop, as Russia is the 2nd largest oil exporter in the world.

Hence, there's a good possibility of global oil price drop moreover in next year.

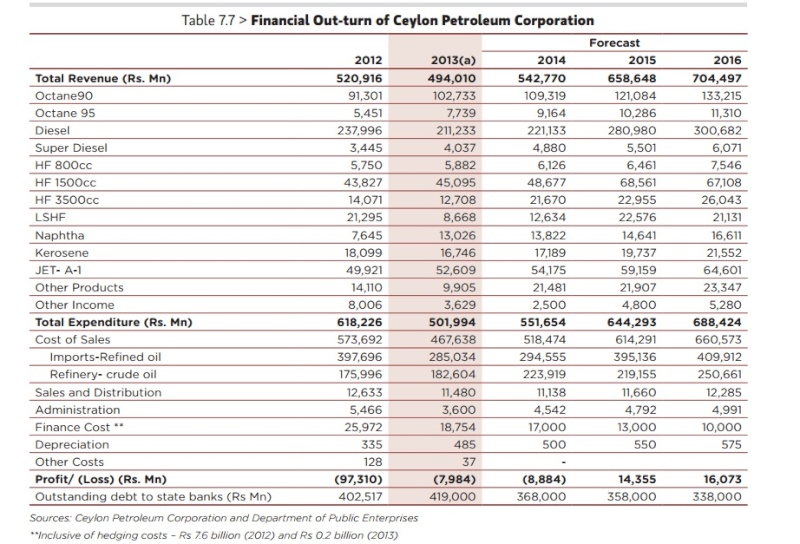

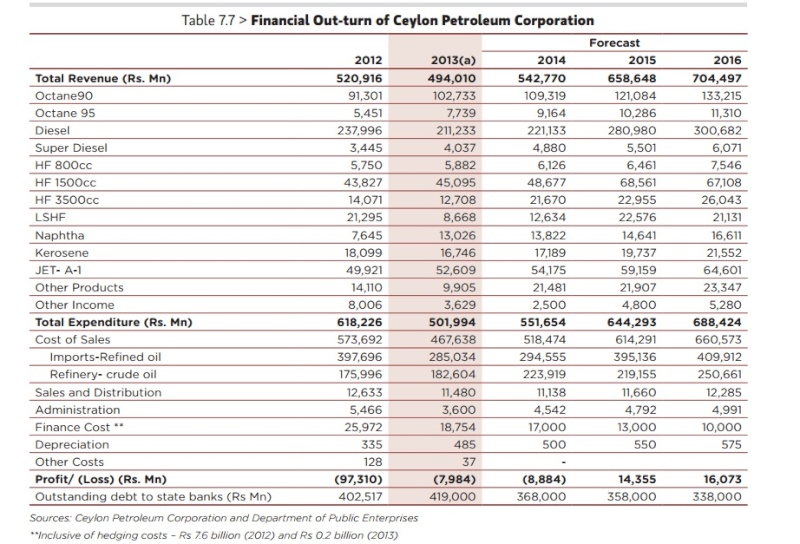

Local Perspective:This the financial outlook of CPC.

The treasury is expecting a loss. But, CPC saying they recorded LKR 3 Bn profit for this year. However, their loss accumulation is still there and plus a huge debt for State Banks amonut exceeding LKR 400 Bn.

Comparing with the the debts for banks LKR 400Bn, this year profit LKR 3bn is a piece of joke/shit. Obviously, its not even marginally sufficient. Hence, its a problem that Govt. how long they'll continue this price reduction

Price Drop:

Price Drop:Due to election, Govt reduced the price, unless we cannot even think of it, comparing above CPC facts.

Now Govt, reduced oil prices two times recently.

95 Petrol: 170 -5 -7= 158 (7% reduction)

Diesel (LSD): 145 -5 -7= 133 (8% reduction)

But world oil prices drop around 40%. But still less than 7%-9% reduced by Govt.CPC forwards their contracts: CPC forward their contracts exceeding another year with Singapore company, based on fixed average monthly price in Singapore market plus a considerable premium. So, its obvious that CPC/ Govt. would not take the direct benefit of price reduction. (http://www.sundaytimes.lk/141026/news/oil-prices-falling-but-cpc-signs-long-term-deal-124699.html)

LIOC perspective:Revenue growth YoY - 11%

Annullazied profit this year- LKR 4.7bn

NAV- LKR 42/-

EPS (annualized)- LKR 8.8/-

P/E - 6.3

Valuation - LKR 91.2/-

Conclusion:- Big potential in global oil price drop continuation in next year.

- Global oil prices slashed 40% but, Govt, reduced oil retail prices by 7%-9%.

- CPC wouldn't take the direct benefit of oil price drop due to forward of contracts.

- CPC having LKR 400bn debt. This year profit Lkr 3bn. Price reduction is not afforadable for CPC. Hence, expecting oil price will increase again after the election.

- Solid earnings, revenue and profit growth of LIOC.

Collect LIOC at key support levels...

-NC

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home