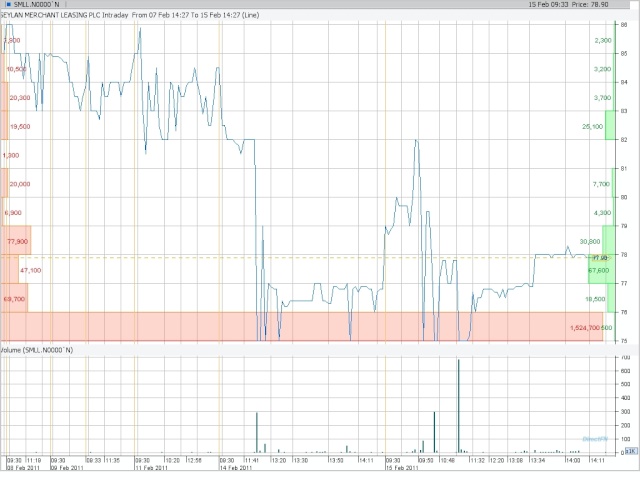

I guess that there EPS might have gone up this qtr as well and possible this could have a run soon..

But I'm thinking again what kind of share movement this could have giventhe fact last run made it pass 100 and again brought it back to 83/-.

Now a 0.50/- divident has been announced but it had gone down..

Anyone can hop in for a further analysis pls?

Figures taken from last financial report;

Net Interest Income 134,099,807 51,364,783

Other Income 42,431,362 5,972,773

total 176,531,169 51,364,783

PAT 36,474,241

EPS 1.61 (Six Months ended 30th Sep 2010)

Net Assets Per Share (Rs.) 11.28

Public shareholding percentage as at 30th September 2010 was 2.81%.

Shares before rights 22,713,639 shares

After 1:1 rights issue = 45,427,278

BFI Sector PER = 20.80

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home