U.S. shale-oil production is high, but Saudi Arabia, betting it can withstand losses better than its new rival, is pumping more crude.

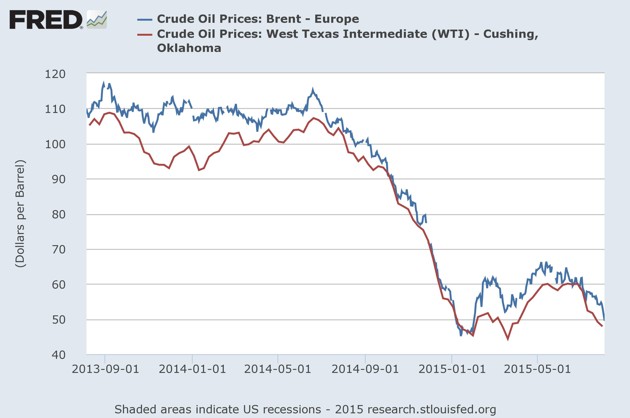

Oil prices are now near a six-year low, moving down earlier today to about $44 a barrel. Friday’s decline came on the back of an upbeat jobs report, which strengthened the dollar, lowering oil prices. The fall has been precipitous: Only a year ago, crude oil was more than $100 a barrel.

Two major indicators of oil prices show that they’ve been plunging. (FRED)

Two major indicators of oil prices show that they’ve been plunging. (FRED)The slide has prompted fears the market may be oversupplied with oil. In some sense, the story is the same as when oil prices first started falling last summer: one of increased supply, paired with a slow recovery (America) and a slowdown (China) in oil-guzzling economies.

But there’s another story: Amid the glut and falling prices, Saudi Arabia, one of the world’s top oil producers, reported in June its highest level of crude oil outputon record. OPEC, the cartel of oil-producing countries, made a gamble to keep production steady in a high-stakes game of chicken with the U.S. shale-oil industry—a gamble that’s projected to result in trillions of dollars in revenue losses for the oil industry over the next several years.

A report from the Saudi central bank suggests while non-OPEC producers are not losing in the price war, more patience is needed from OPEC producers. But the effort to hurt other producers may be backfiring: Saudi Arabia is facing huge budget deficits this year due to low oil prices—the government has started dipping into its reserves and the deficit for 2015 is expected to be 20 percent of gross domestic product.

Analysts say U.S. oil producers need to cut production by 500,000 barrels a dayto bring supply levels down to boost prices. If not, some analysts are now predicting that oil could briefly hit $30 a barrel before the price war ends.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home