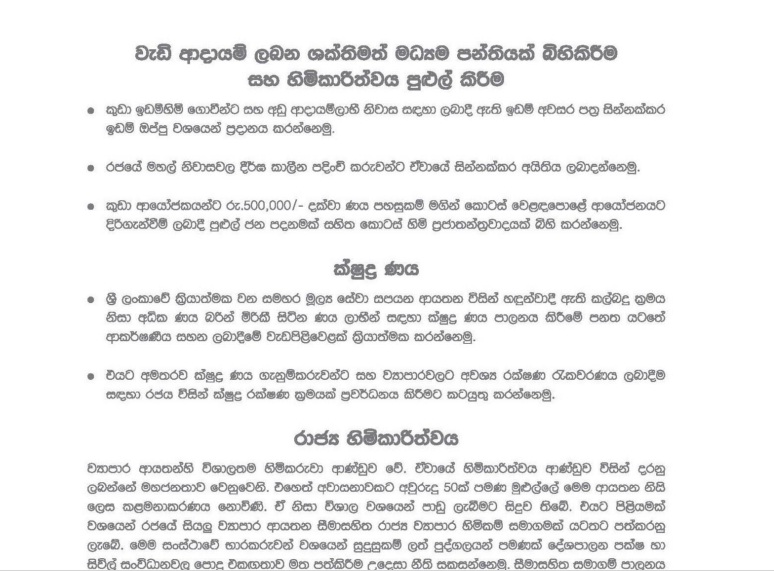

Meanwhile Presently sworn in Prime Minister Ranil Wickrmesinghe has already promised on the Page 10 (Sinhala Language Version) of United National Party (UNP) lead United National Front for Good Governance' (UNFGG) Manifesto that each Small investor in Colombo Stock Exchange will be given Rs.500,000 to trade on Colombo Stocks via Margin Trading Facilities.And some market analysts said that small investors are thus planning to buy stocks at huge discounts whilst they will be framed in 'Margin Trading Fiasco' where as Sri Lankan Stock Brokering houses and Margin Trading Providers are charging over 16% to 31% per annum as Margin Trading Interest.

Some market insiders told that it is possible that Perpetual Holdings a unit owned by Ranil Wickremesinghe appointed Central Bank Governor Arjuna Mahendran's Son-In-Law Arjun Aloysius who has become the 'Bond Emperor' of Sri Lanka in less that 8 months in year 2015 will soon venture into Margin Trading Business providing Margin facilities via a new 'Perpetual Company' in which thousands of small investors will be given Rs.500,000 margin trading facilities for each account. Some insiders also said that Arjun Aloysius is also looking out to acquire a Stock Brokerage or to get Stock Brokering license soon to one of his 'Perpetual' entities.

Blood Bath of Colombo Stock Exchange recorded amidst Sri Lanka's former and famous Bond King Ajith Devasurendra who was silent for over two years after his 'Controversial Involvement' in the 'NSB-TFC Deal coming out on Monday the August 24th and buying over 310 million shares of his own company - Taprobane Holdings PLC (TAP) at Rs.5.50 per share via another company of Devasurendra named C H C Investment (Pvt) Ltd.

Analysts note that there are nearly 570,103 domestic Sri Lankan individuals investing as per (Central Depository System) CDS and this means that nearly little over 500,000 of them are retail small investors in Sri Lankan Stock Market, and they will face a Rs.250 billion or US $ 2 billion Market Bubble as a result of UNP's policy on Rs.500,000 Margin Trading per person that is promised small investors.

Currently brokers provide a maximum of only 20%-50% Margin for Stock Investments based on portfolio value and 100% Margin based on portfolio value is only provided via bank and finance companies.Margin interest charged by small time investors by Market Intermediary margin providers vary from 16%-31% per annum. Some argue that there will soon be a 'Big Bubble' of the Stock market with UNP's Margin Trading promise whilst public is now going to question UNP candidates such as 'Dr. Harsha De Silva' who used to criticize stock market highlighting that 'It is a Casino' during previous government of UPFA, whilst now under UNP giving over Rs.250 billion credit for small investors with Margin will definitely create a 'Margin Trading Bubble' and a 'Stock Market Bubble' in economy creating 'Casino' type Colombo Stock Exchange under UNFGG government.

Reference - Bond King buying Taprobane http://www.cse.lk/cmt/upload_cse_announcements/9471440394639_.pdf

Reference UNP lead UNFGG Manifesto

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home