- Gradual approach to rates will follow 25 basis-point hike

- Oil back below $36 a barrel after tumble on U.S. supplies

Stocks and the dollar climbed, while Treasuries clawed back some gains as the first U.S. interest-rate increase in almost a decade was welcomed across Asian markets.

Japanese shares jumped more than 2 percent, Chinese stocks advanced and gauges of regional equity volatility declined after the well-telegraphed decision, which saw Federal Reserve Chair Janet Yellen emphasize further tightening would be slow. The dollar was roused from its post-decision meandering, climbing versus the euro and the New Zealand currency, while the yuan was fixed at the lowest since June 2011. Treasuries gained, with 30-year notes reversing Wednesday’s drop. Oil traded below $36 a barrel after tumbling to the lowest since 2009.

[size=11]Developing-nation assets got a boost from the Fed hike.

The reaction in financial markets to the first rate increase since before the 2008 recession reflected a growing conviction among investors that the U.S. economy is strong enough to withstand a higher cost of borrowing, even amid lackluster inflation. U.S. equities built on their gains in the wake of the decision as Yellen stressed the Fed’s gradual approach, noted growth is strengthening in developing markets and repeatedly dismissed concerns about consumer prices, saying wages showed evidence of strength.

“There’s a sense of relief that they finally raised rates,” Chris Green, an Auckland-based strategist at First NZ Capital Group Ltd., a brokerage and wealth management firm, said by phone. “This is a net positive in terms of market sentiment. It’s removed the point of liftoff from the discussion, we’re over that hurdle. Now the question is: how gradual is that normalization profile and where do the risks lie.”

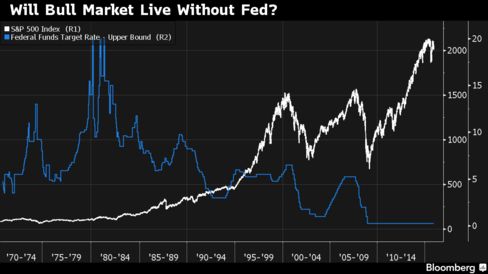

The decision ends an era of unprecedented monetary stimulus that pushed stocks higher by more than 200 percent and added $15 trillion in value during a 6 1/2-year bull market. Investors will now find out what stocks and the dollar are worth without the central bank stoking economic growth as aggressively. The rate increase came in a widely predicted move, with Yellen signaling that the pace of subsequent increases will be “gradual” and in line with previous projections.

“The market likes what she has to say,” said Michael Arone, chief investment strategist at State Street Global Advisors’ U.S. Intermediary Business in Boston, which oversees $2.4 trillion. “A few of the things I was looking for they came out and said: that conditions remain very accommodate and the pace of tightening will be gradual. This is a sign of their confidence in the U.S. economy.”

Stocks

The MSCI Asia Pacific Index climbed 1.3 percent as of 11:06 a.m. Tokyo time, extending Wednesday’s 2.2 percent surge as Japan’s Topix index rose to the highest level since Dec. 7. Japan’s Nikkei Stock Average Volatility Index slid 12 percent, headed for its biggest daily drop since the end of October.

Australia’s S&P/ASX 200 Index jumped 1.6 percent, led by gains in utilities and phone stocks, while the Kospi index advanced 0.2 percent in Seoul. The Shanghai Composite rallied 1.2 percent and Hong Kong’s Hang Seng Index climbed 1.3 percent after the city’s monetary authority increased interest rates in line with the Fed’s move.

Standard & Poor’s 500 Index futures dropped 0.2 percent after the U.S. benchmark climbed 1.5 percent to cap its best three-day climb since Oct. 5. The rally was fueled by Yellen indicating that the economy could overshoot if the Fed hadn’t raised rates by 25 basis points. The Chicago Board Options Volatility Index, a gauge of anticipated swings in the U.S. stock market, sank the most since Dec. 4 on Wednesday. Volatility surged last week as stocks had their worst period since August.

When it comes to equities, history suggests two immediate consequences from Fed policy tightening: higher volatility and lower valuations, meaning earnings and ultimately the economy are left to drive prices. The Fed is raising rates at a time when profits are in decline, a combination that hasn’t occurred in five decades.

Investors have spent the second half of 2015 coping with the first correction in four years and an increase in volatility that by some measures was a record. From plunging oil to emerging market turmoils and the selloff in junk bonds, anticipation of the Fed’s retreat added to anxiety that’s already pushed the VIX above levels at the start of past Fed liftoffs.

Currencies

The greenback extended gains against the euro and the yen and rallied versus the kiwi and the Australian dollar. The kiwi slipped 0.9 percent despite a steeper-than-expected acceleration in quarterly economic growth. The Aussie slid 0.8 percent and the yen was down 0.3 percent.

The Bloomberg Dollar Spot Index, a gauge of the currency against 10 major peers, climbed 0.4 percent after closing little changed last session. It has rallied 9 percent this year in anticipation of the Fed hike.

Currency traders are on alert for a repeat of the dollar weakness that followed the start of tightening cycles in 2004, 1999 and 1994.

Bonds

Long-dated Treasuries fluctuated after the Fed decision, which brings the new target range for the federal funds rate to 0.25 percent to 0.5 percent from zero to 0.25 percent. Thirty-year Treasury notes more than wiped out Wednesday’s losses, with yields down three basis points to 2.97 percent after rising two basis points last session.

Two-year U.S. yields, which touched a five-year high after the rate move, were little changed at 1 percent, while yields on Treasuries due in a decade fell three basis points to 2.27 percent, halting three days of increases.

The most-accurate forecaster of the $13.1 trillion Treasuries market this year expects that lackluster inflation and tepid economic growth will limit the Fed to two rate increases next year. Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott LLC, anticipates that 10-year yields will end 2016 at 2.22 percent. The median forecast in a Bloomberg survey is 2.78 percent.

Yields on 10-year Australian bonds rose by two basis points, or 0.02 percentage point, to 2.88 percent Thursday, while those on similar maturity Japanese debt lost 0.5 basis point to 0.295 percent.

Asian bond risk headed for a third straight daily drop, with the Markit iTraxx Asia index of credit-default swaps slipping two basis points to 135 basis points in Hong Kong.

Emerging Markets

The Thai baht rose 0.1 percent as the Malaysian ringgit declined 0.1 percent. The PBOC cut the yuan reference rate by 0.2 percent to 6.4757 per U.S. dollar, the weakest level since June 16, 2011.

Emerging-market stocks rose the most this month Wednesday, with the MSCI Emerging Markets Index jumping 1.4 percent in a second day of gains following a nine-day rout. It added 0.7 percent on Thursday, and is still down by almost 17 percent this year.

“The U.S. market is taking the decision of the Federal Reserve as a positive sign, and this will be positive for emerging markets in the short term as well,” said Paul Christopher, global market strategist for Wells Fargo Investment Institute in St Louis. “The fact that the Fed will move gradually is reassuring investors in both developed and developing nations.”

Commodities

West Texas Intermediate oil was little changed at $35.54 a barrel after sinking 4.9 percent last session.

Oil tumbled Wednesday after U.S. crude inventories climbed to the highest level for this time of year since 1930. Supplies rose to 490.7 million barrels, leaving stockpiles more than 120 million barrels above the five-year seasonal average, government data showed. The U.S. benchmark slid below $35 a barrel Monday for the first time since February 2009 amid persistent concern over lack of action to curb a global glut in the commodity.

Gold for immediate delivery declined 0.5 percent to $1,067.23 an ounce after jumping 1.1 percent on Wednesday. Higher rates normally reduce the appeal of metals, which don’t pay interest like competing assets. With gold trading near the cheapest level since 2010 and copper close to a six-year low, some traders say prices may be near a bottom as the focus shifts to the timing of the next U.S. rate increase.

[/size]

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home