cse.alpha wrote:WAPO has 25.8 mn shares in issue now - its net asset value (NAV) per share, even after allowing for 350% appreciation in 41.6 mn Expolanka shares (cost Rs 6 each - at Rs21, capital gain is around Rs 624 mn) is still under Rs 50 per share.

After 75 for 2 rights issue @ Rs 20 per share that raised Rs 503 million, WAPO's adjusted net book value (NBV) per share would be approx Rs 20 - total NBV of Rs 524 mn (Rs 250 mn worth of Expo Lanka shares, and Rs 270 mn of cash).

If ExpoLanka trades at Rs 21 (up 50% from Rs 14 IPO price), WAPO's Expo investment would be worth Rs 874 mn.

That would still raise WAPO's adjusted NBV per share by only around Rs 24 to approximately Rs 45 per share.

At Rs290, investors paying more than 6 times adjusted NBV, for what is basically an investment trust where net asset value is better valuation method than PER or discounted free cash flows methods, seem to be very confident of management ability to deliver exceptional super normal returns on adjusted asset base.

WAPO will do well, but will it do well enough to justify current prices of around Rs 290? Similar, but much larger investment trusts such as CINV and GUAR do not trade at such 6 times premiums to NAV.

Im too agree with cse. I calculate when the WAPO made thr initial announcement that period wapo arnd 800 & aftr increase and right issue. i check with 800 levels it should be arnd 40 - 45 .... bt now its higher Rs. 280 + ....

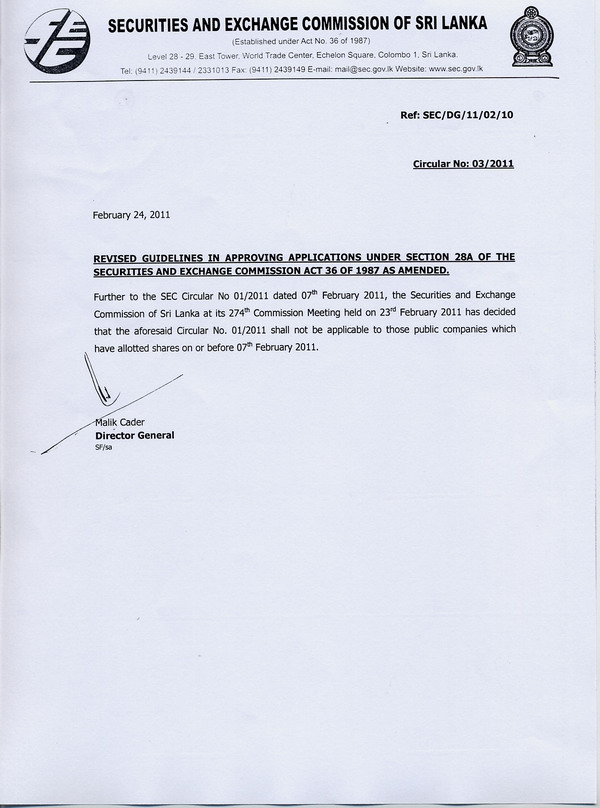

Further with new rules WAPO cant sell on EXPO 1st day @ Mkt. with my knwledge WAPO shd need many this kind of capital gains to justify with current mkt rate.

Pls point my mistake to correct me

Cheerz

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home