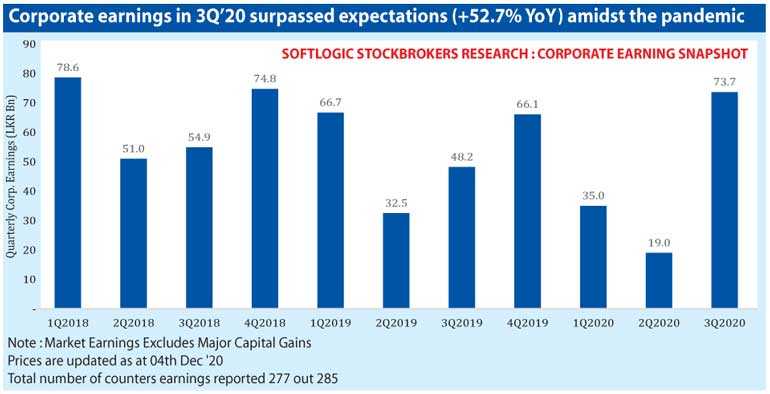

- Combined earnings of listed companies up 53% to Rs. 73.7 b in 3Q of 2020 from a year ago

- Three month period between July-September produces best earnings since late 2018

- Massive 287% rise as against quarter ended June which was impacted by first wave shutdown

- Performance reflects quick rebound and private sector resilience

Earnings of listed companies in the third quarter of 2020 have swelled to Rs. 73.7 billion, the highest for a three month period since late 2018, and reflect significant recovery after the resumption of the economy following the COVID-19 first wave-induced shutdown.

Softlogic Stockbrokers Research which released its analysis of results of 277 companies (out of 285 listed) described the corporate earnings in 3Q2020 as having “surpassed expectations” amidst the pandemic.

The Rs. 73.7 billion combined earnings reflected a robust 53% gain year-on-year and a massive 287% jump in comparison to the 2Q figure of Rs. 19 billion, and more than double the 1Q of 2020.

The previous highest for a quarter was Rs. 74.8 billion achieved in the 4Q of 2018.

From 2018 to date the 3Q of 2020 is also among the three best performing quarters.

“Capital goods (Rs. 8.47 billion, up 106%), Materials (Rs. 7.1 billion, up 155%), and Food, Beverage and Tobacco (Rs. 17.1 billion, up 95%), largely contributed to earnings improvement while Banks (Rs. 13.1 billion, down 17%), Real Estate (Rs. 1 billion, down 52%) and Consumer Services (loss of Rs. 5.5 billion as against loss of Rs. 22 billion), dragged down earnings growth in 3Q’20,” Softlogic Stockbrokers Research said.

It said the banking sector earnings fell amidst higher impairment provisioning and margin contraction, however the sector’s cumulative 4Q earnings were Rs. 58.5 billion, up 6% Y-o-Y.

Capital Goods sector earnings were up 106% on the back of import protectionism and pent-up demand following the April-May lockdown, Softlogic Stockbrokers Research said.

Consumer Durables and Apparels earnings improved 32% Y-o-Y to Rs. 1.1 billion, reflecting resilient performance in 3Q’20 amidst the pandemic.

The 95% increase in Food, Beverage and Tobacco earnings was due to the inelastic nature of the products despite lower consumer spending ability.

Softlogic Stockbrokers Research also said Materials sector earnings improved significantly due to the surge in demand for construction materials and exported materials.

It said the Retailing sector witnessed a turnaround in 3Q’20, with the sector turning profitable to Rs. 1.8 billion compared to a loss of Rs. 24 million in the corresponding quarter of the previous year.

Telecommunication sector earnings surged 134% Y-o-Y in 3Q’20 to Rs. 6.96 billion on the back of improved data consumption, rupee appreciation and reduced operational expenditure.

Transportation sector earnings spiked 578% Y-o-Y to Rs. 4.8 billion on the back of the extraordinary earnings boost witnessed by Expolanka Holdings PLC, which reported earnings of Rs. 4.5 billion as against a loss of Rs. 830 million.

Utilities earnings grew 70% Y-o-Y in 3Q’20 to Rs. 817 million amidst favourable weather conditions resulting in better than expected power generation, Softlogic Stockbrokers Research said.

http://www.ft.lk/top-story/Corporate-earnings-swell-post-COVID-first-wave/26-709887?fbclid=IwAR3CelNn0nGLNr_1JhQH7dpjaMQI-b7qFHIefIkf8X_-BRyvnlB_9u846gY

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.