I like to highlighted few bank 9 months EPS comparing 2019

2020 2019

NDB 19.24 15.11

HNB 15.12 15.72

SAMP 13.35 20.06

COMB 10.52 11.09

SEYB 4.30 6.10

considering above 9 months figures, everyone easily identify who is best performer within covid19 period. NDB is most all rounder in 2020.

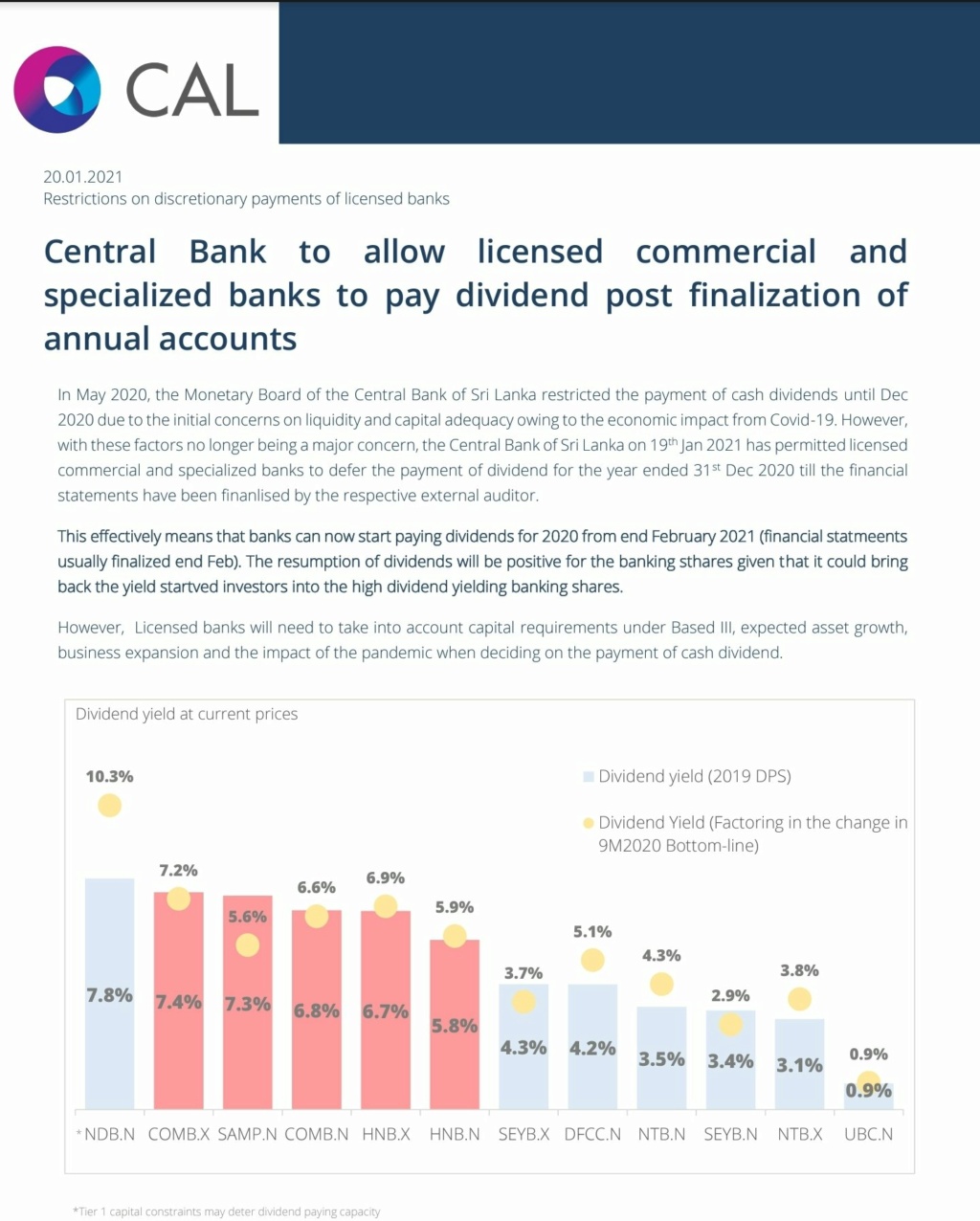

considering their dividend policy, most of dividend paid company SHOULD be NDB. it's Dividend yield so higher than others. another one is NDB , 2.6 times undervalued in market.

If you get right stock easily able to earn higher capital gain + dividend income. this time, NDB will distribute both scrip and cash dividend like earlier. NDB technically shows, strong price appreciation.

HURRY UP join with NDB long journey. it will touch Rs.180 as soon as. please keep your attention following research report. CAL also highlighted NDB super performance comparing with others. choice in your hand.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home