https://cdn.cse.lk/pdf/upcoming_listing/prime-pros6-23-04-2021.pdf

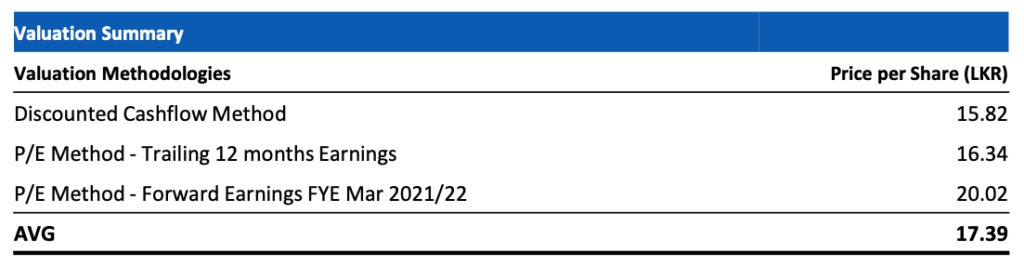

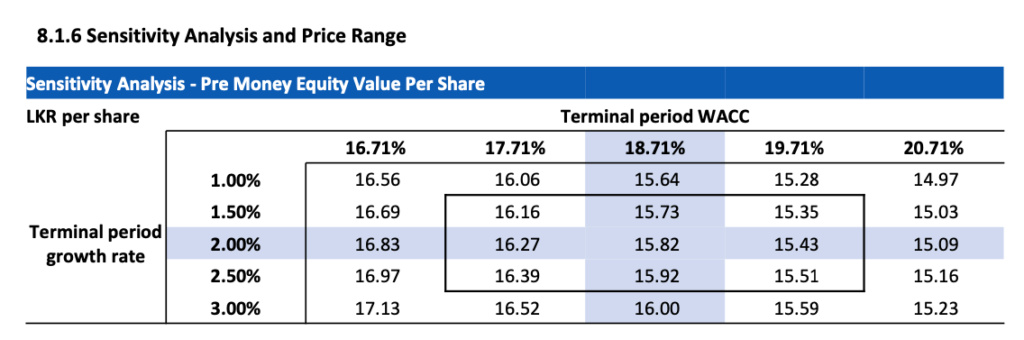

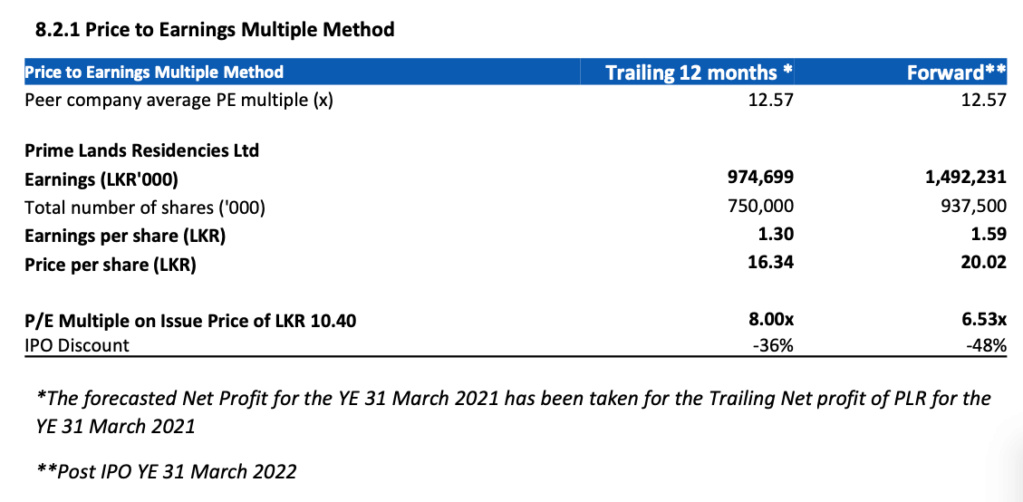

We have carried out a detailed analysis of the business operations of PLR to arrive at an average of the Discounted Cashflow based valuation method and P/E multiples based method on trailing 12 months’ earnings and forward earnings, and the results have been summarized below

We estimate the Ordinary Voting Shares of PLR to have an average fair value per share of LKR 17.39, given the Company’s operational and strategic dynamics and industry dynamics of the residential real estate industry in Sri Lanka.

Considering your intention to offer an upside to potential investors and the healthy marketability of shares, we recommend an Issue Price of LKR 10.40 per share at an Earnings Multiple of 8.01x, 34% discount to the DCF based value, 36% discount to the trailing P/E based method and 48% discount to the forward P/E based method

8.0 VALUATION RESULTS

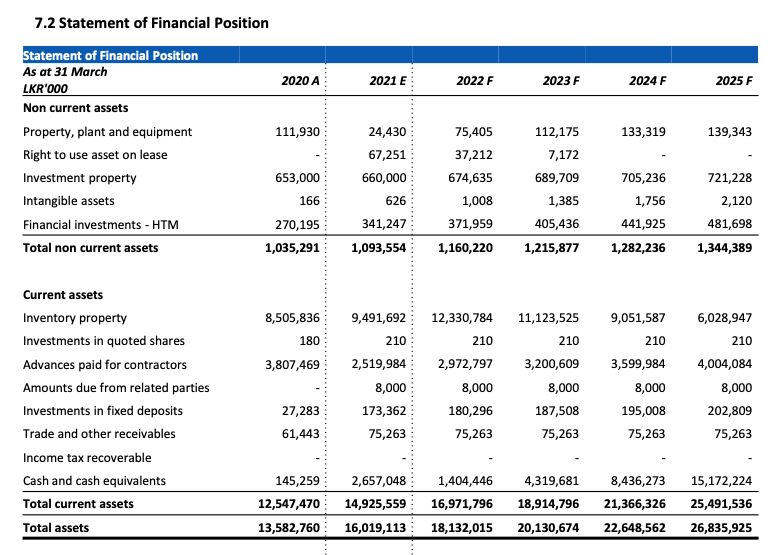

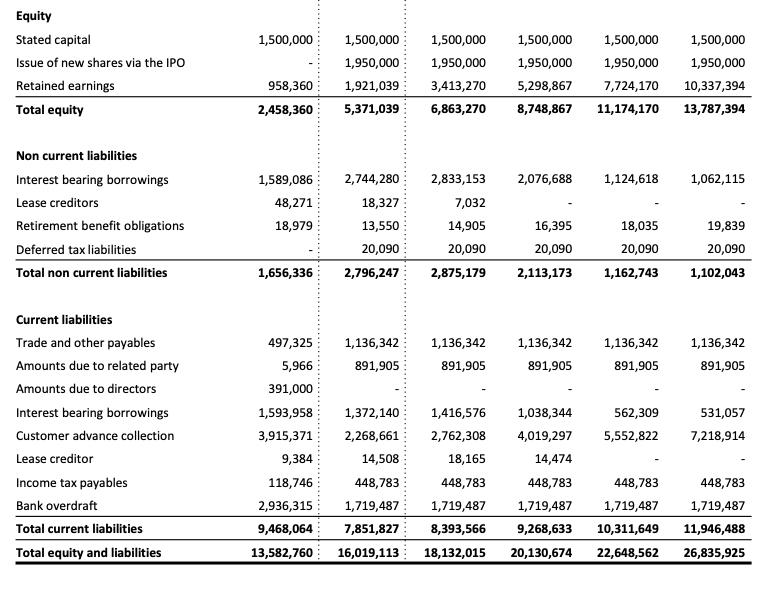

The following section illustrates key valuation assumptions and the resultant equity valuations as at 31 January 2021 for the Company based on the methods discussed in this Research Report.

8.1 Discounted Cash Flow Methodology

Free Cash Flow to Firm formula has been used in calculating the fair value of Ordinary Voting Shares of Prime Lands Residencies Ltd.

8.1.1 Cost of Equity

valuation.

8.1.2 Cost of Debt

8.1.3 Capital Structure and Weighted Average Cost of Capital (WACC)

A variable gearing ratio methodology over the explicit forecast period and a optimal gearing ratio of 11.80% in the terminal period have been used in arriving at the weighted average cost of capital for the Company.

8.1.4 Terminal Growth Rate

A terminal growth rate of 2% has been used in arriving at the terminal value of the Company.

Unrealistic Assumptions and forecasts to justify over pricing.

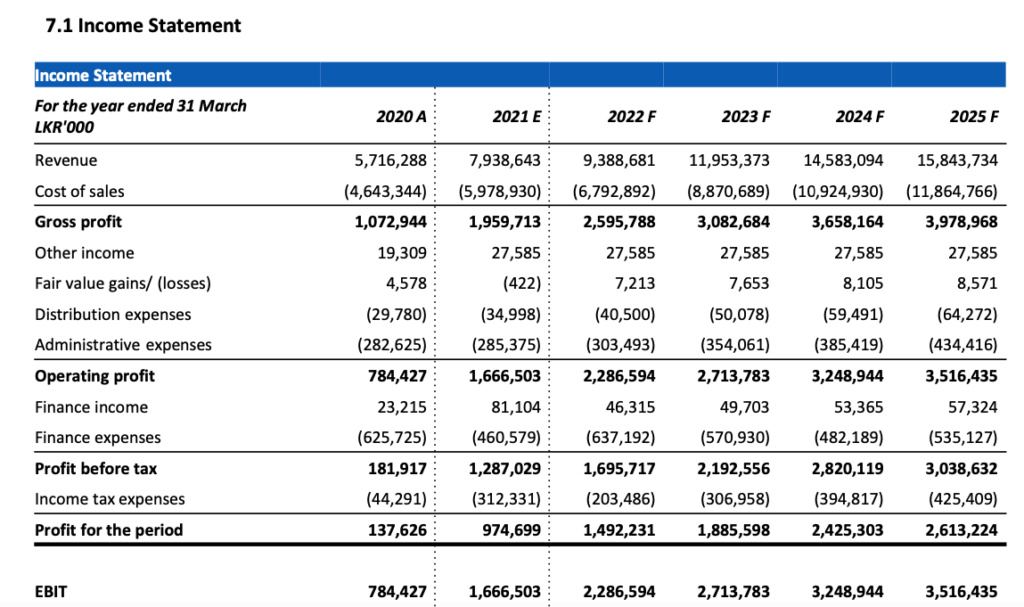

6.2 Cost of Sales

The average gross profit margin (excluding project finance expenses) of completed projects as at 30 September 2020 is 29.23%.

The average gross profit margin (excluding project finance expenses) of projects which are under construction as at 30 September 2020 is 26.25%.

Furthermore, the gross profit margin of future projects which are to be initiated during the explicit forecast period has been assumed as 25%.

In addition to the above, project overhead cost of 0.30% of the total net revenue and costs on repurchases of 0.50% of the total net revenue has been assumed under cost of sales of Prime Lands Residencies Ltd during the explicit forecast period.

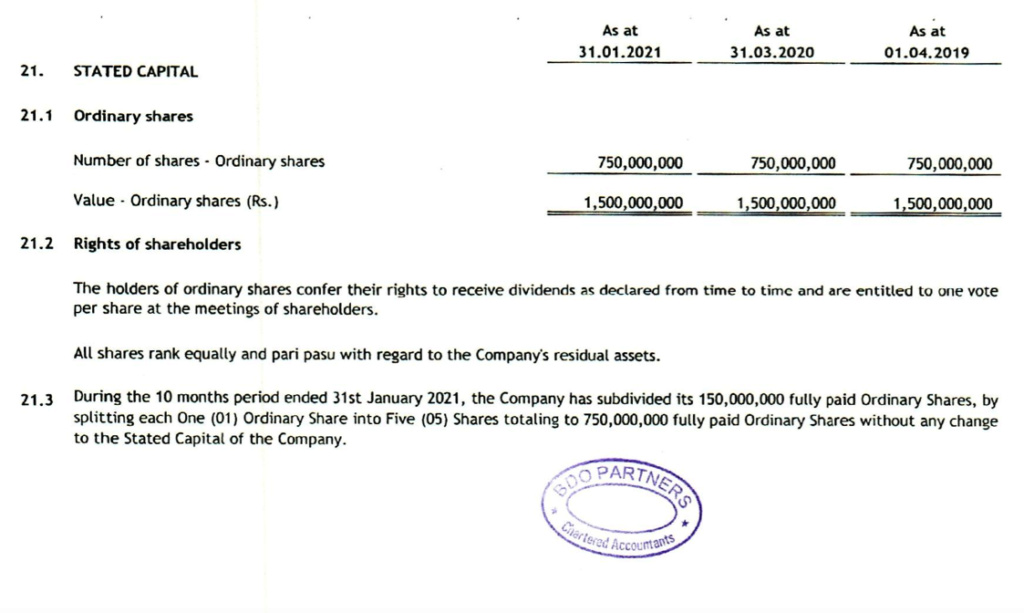

https://cdn.cse.lk/pdf/upcoming_listing/prime-pros6-23-04-2021.pdf

Last edited by God Father on Tue Jul 18, 2023 12:47 am; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home