EXPO Q2 Financials are amazing.

https://cdn.cse.lk/cmt/upload_report_file/1066_1635479452072.pdf

151 Billion Quarterly Revenue is a Massive Number.

GP % for Q2 again reporting as 15% and it is equivalent to Q1.

PBT 14.4 Billion and PAT 12 Billion goes to equity holders of the company.

Further their Leisure sector is now improving and can expect more in coming quarters.

See the top 20 shareholders in the list. all are increasing their holdings. That's their faith of the company.

Q2 EPS hit 6.17, almost reporting double from the Q1 EPS of 3.22. This is massive growth of this company.

EXPO is now continuously growing. It is a Quarter on Quarter (QoQ) growing Company. This is Expecting by shareholders and its very important for them to Invest.

See How much improve their Cash Flows. 13 Billion in Hand Cash equivalents. Can Go for massive further acquisitions.

Very Interesting to read its ever massive largest massively improved Cash Flow Statement.

Net Asset Value improved Nice and hit 22.15 (This is a light Asset module running company)

What else need to expect more from EXPO ?

I believe, this may be the ever largest operational Profits reporting with in single quarter by a listed company in Sri Lanka. So, trading price should definitely react.

06 months ending Profits reports as 9.38 and many expectation global shipping crisis further continuing and next 02 quarters looks larger. Based on that, Q3 and Q4 can be reports further improved result and annual EPS looks now 20 plus.

I prefer personnel Valuation as = 20 EPS x 15 PER minimum (current),

or either = 20 EPS x 18 or 19 PER (based on Global average)

To me EXPO should bypass the Capital Trust Target Price of Rs.307 during next Q3 (Nov-Dec21 period).

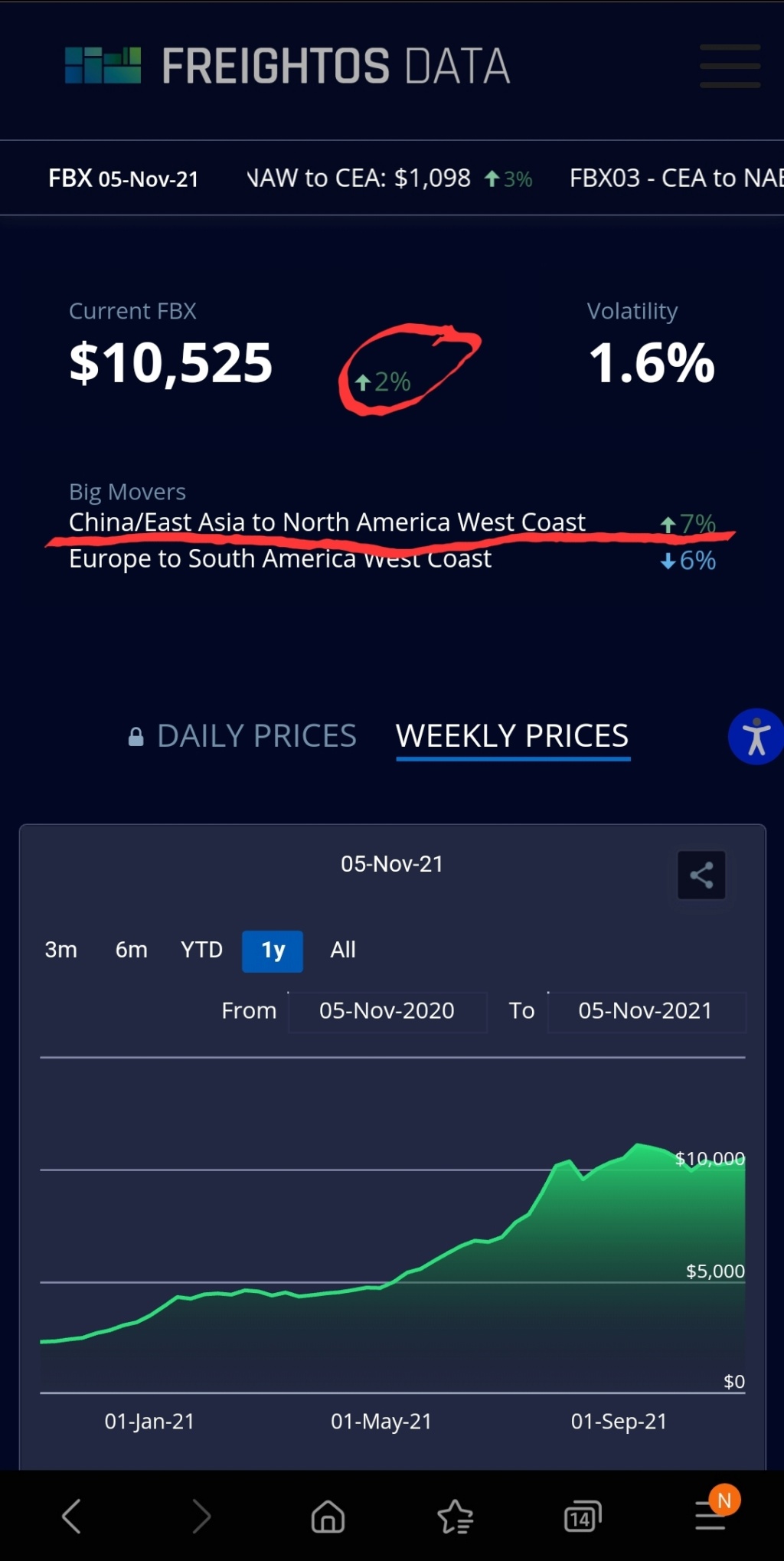

Further, EXPO's recent massive acquisitions (during recent months in Q2) - exact full quarter earnings will consolidating to its financial statement at the end of Q3. Specifically, USA's domestic trucking business will earn more and more during supply chain crisis period.

Expect another Interim Dividend mostly during November, same as last year.

My EPS Predictions for 2021/22,

Q1 EPS = 3.22

Q2 EPS = 6.17

Q3 EPS expectation = 7 between can be go for until 9/10

Q4 EPS expectation = will keep minimum 5

So, Annual Prediction EPS = 23 (mostly it can be 20 plus EPS for 2021/22 FY)

Have anyone read CEO's statement given with Q2 report. Given more Hopes for its future.

EXPO's more than 93% of Businesses are located with overseas (mainly 68% in North USA). Only less than 7% contributing from SL - so nothing any major domestic/internal issues will impacting to its future earnings even tax issues. This is a international company and now Sri Lankan investors having a chance to invest in global Jaint company.

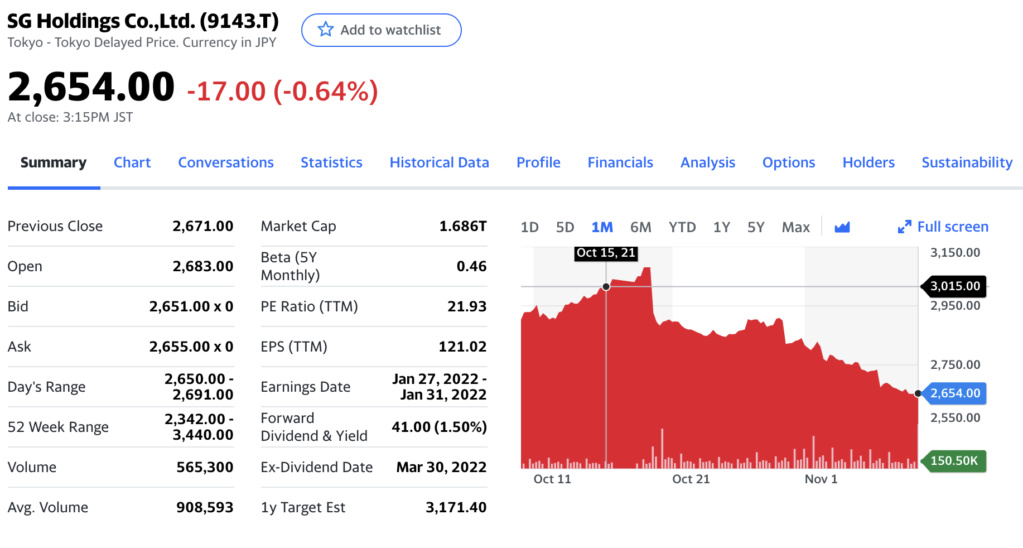

EXPO is manage by Japan based SG Holdings which is having 75% larger stake. As per their plans, more possible for EXPO to become as further leading logistic company during next coming few years.

Read below:

https://www.sg-hldgs.co.jp/en/ir/management/plan/

-----------------------------------------------------------------------------------------------------

Today just while ago EXPO's parent company has released (https://www.sg-hldgs.co.jp/en/ir/news/) its group financials to Japan Tokyo Stock exchange and please carefully refer below links - You can see their comments about EXPO and also they revised its future Forecast for 2021/22 full year.

This is a good news for all of us. https://ssl4.eir-parts.net/doc/9143/ir_material_for_fiscal_ym2/107732/00.pdf

(Page 12/13)

"Overview of Expolanka • Established: 1978 • Head office: Sri Lanka • Acquisition of shares by SG Holdings: June 2014 • Percentage held by SG Holdings: 75.6% (consolidated subsidiary) Based in South Asia where globally operating apparel manufacturers have factories, Expolanka has been growing in freight business to Europe and America. Marine transportation is also a core business now. Future business expansion • Steadily strengthen business foundation by gaining new customers, expanding business with existing customers and expanding business area • Aim for sustained growth by strengthening global lanes such as Europe, USA, South America and Africa"

-----------------------------------------------------------------------------------------------------

Further they increased its group Dividend payout :

https://www.sg-hldgs.co.jp/en/newsrelease/2021/1029_4846.html

https://ssl4.eir-parts.net/doc/9143/ir_material19/171172/00.pdf

https://ssl4.eir-parts.net/doc/9143/ir_material19/171173/00.pdf

-----------------------------------------------------------------------------------------------------

Group Results presentation :

https://ssl4.eir-parts.net/doc/9143/ir_material_for_fiscal_ym2/107733/00.pdf

https://ssl4.eir-parts.net/doc/9143/ir_material_for_fiscal_ym2/107732/00.pdf

-----------------------------------------------------------------------------------------------------

Forecast :

https://ssl4.eir-parts.net/doc/9143/ir_material_for_fiscal_ym3/107726/00.pdf

-----------------------------------------------------------------------------------------------------

EXPO is now golden gem. Future value will be higher and higher. It should 300-400 category stock now.

If you plan to invest with EXPO - Please carefully go thru with all of above SG holdings link and study more.

-----------------------------------------------------------------------------------------------------

Note :

Above is not for B/S/H recommendation - This is only my view, based on the released Q2 financials.

Welcome your comments.

(Please Understand the global shipping industry trend/earnings/supply chain crisis and do more study)

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home