and to ensure an unbiased consideration of the shareholders in transferring the shares to LOCH the ratio needs to be same among all three....if not the people who transferred the shares need to give proper reasons

Considering the LOFC’s ratio (5.03)

Market price of LOFC should be 37.2

Market price of CLC should be 23034*5.03/6308876426=18.36

Market price of NIFL should be 1667*5.03/132189572=63.43

Considering the CLC’s ratio (21.5)

Market price of LOFC should be 21.5*17403/2351313562=159.13

Market price of CLC should be 78.5

Market price of NIFL should be 21.5*1667/132189572=271.13

Considering the NIFL’s ratio (39.65)

Market price of LOFC should be 39.65*17403/2351313562=293.46

Market price of CLC should be 39.65*23034/6308876426=144.76

Market price of NIFL should be 500

LOFC

Carrying amount of LOFC....17403 million

Number of carrying shares of LOFC....2351313562

Carrying value of LOFC per share....17403/2351313562=7.4

Reported NAV of LOFC per share....7.4

Ratio between the market amount and carrying amount.....87469/17403=5.03

The market amount is @ 37.2 per share

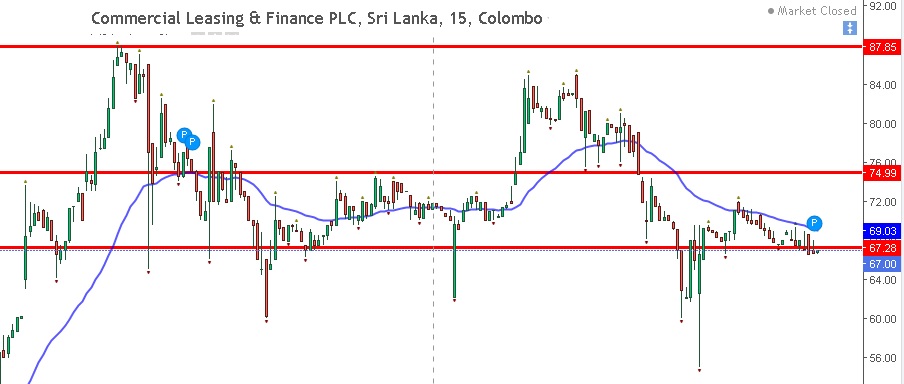

CLC

Carrying amount of CLC......23034 million

Number of carrying shares of CLC.......6308876426

Carrying value of CLC per share....23034/6308876426=3.65

Reported NAV of CLC per share....3.65

Ratio between the market amount and carrying amount.....495247/23034=21.5

The market amount is @ 78.5 per share

NIFL

Carrying amount of NIFL.....1667 million

Number of carrying shares of NIFL.....132180572

Carrying value of NIFL per share....1667/132189572=12.61

Reported NAV of NIFL per share....12.61

Ratio between the market amount and carrying amount.....66090/1667=39.65

The market amount is @ 500 per share

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home