How Greece was able pay off its 260 billion Euro debt

* Three stage financial assistance from the EU, European Central Bank and International Monetary Fund known as the troika.

* Three successive bailout totalling some 260bn Euros between 2010 and 2018 prevented free from going bankrupt and exiting from the shared euro currency.

* Entire Timeline on the Debt Crisis of Greece -

https://www.cfr.org/timeline/greeces-debt-crisis-timeline

* In return, the EU required Greece to adopt austerity measures. These reforms were intended to strengthen the Greek government and financial structures.

The austerity plan included:

* 22% cut in minimum wage from 750 Euros to 585 Euros per month.

* Permanently cancel holiday wage bonuses (one extra month's pay each year)

* Pension cuts worth 300 million Euros in 2012.

* Changes in laws to make it easier to lay off workers.

* Health and defence spending cuts.

* Industry sectors are given the right to negotiate lower wages depending on economic development.

* Opening up closed professions to allow for more competition, particular in health, tourism, and real estate sectors.

* Privatisation worth 15 billion Euros by 2015, including Greek gas companies DEPA and DESFA. In the medium term, the goal remains at 50 billion Euros.

Source - http://www.thebalance.com/what-is-the-greece-debt-crisis-330525#toc-greece-crisis-explained

https://en.wikipedia.org/wiki/Greek_austerity_packages

Role of Troika/IMF

The origin of the European troika can be traced back to the Greek loan package in May 2010 and the EFSF. The work of the three members were distinct: the IMF co-financed the loans for Greece, the ECB focused its competences on the banking system and the Commission worked on economic reforms with the IMF. The troika solution brought controversy into the Euro crisis' solution following the Lisbon Treaty, where European institutions increased democratization among the institutional landscape of the European Union. At this time, the EU was more technocratic and emphasised the domination's feeling of the Troika mechanism. During the crisis period, Germany played also a predominant role and took power to rebalance its national interests and the European interests. The European strategy was implemented with the aim to reduce the Greek fiscal deficit from 15% to 5%. In 2015, the GDP of Greece remained stagnant compared to 2009, and the loans appeared as not sufficient to attempt the fiscal aims fixed by the troika; 90% of the amount paid interest. For Cyprus, Greece (thrice), Ireland and Portugal, the European Commission, the ECB and the IMF agreed Memoranda of Understanding with the relevant governments in a three-year financial aid programme on the condition of far-reaching austerity measures to be imposed on their societies in order to cut government expenditure.

The consequences of the decisions taken by the European Troika resulted in many critics both within the European institutions and at national levels. The European Parliament was excluded from negotiations and therefore decided to establish a special committee of inquiry led by the Austrian centre-right MEP Othmar Karas in order to analyse the level of the Troika's accountability. According to the findings of the committee, the Troika's members had totally asymmetric distribution of responsibilities. In addition, differing mandates together with varying negotiation and decision-making structures only led to more divisions and made it difficult to find a common approach. As said the British MEP Sharon Bowles, the response to the crisis lacked transparency and necessary credibility. In fact, the Troika did not have any legal basis at all because it was established as an emergency solution. However, a German politician Norbert Lammert stated that in his view it was incorrect to discuss the lack of democratic legitimacy of the Troika since the adjustment programmes had been approved by the parliaments of Ireland, Portugal, Cyprus and Greece. But when the parliaments approved those programmes, they did not know what implications it might bring.

The Troika interventions generated long-lasting political damage not only for the European Union but also for its member states themselves. Many European citizens claimed that the budget cuts resulted in the eurozone's longest recession since the creation of the single currency back in 1999. During that period, the efficiency of the Troika was another cause of concern but the ECB president Jean-Claude Trichet tried to reassure people and highlighted the fact that "if nothing had been done for Greece, the impact of the crisis would have been undeniably worse for this country". As it turned out, the Troika underestimated the impact of austerity policies on economic growth.

Another problem was in the different philosophies in relation to economic policy across the EC, the ECB and the IMF according to the European Commissioner in charge of economic and monetary affairs Olli Rehn. Whereas the IMF advocated for more robust debt relief, the EU insisted on more limited option. The European institutions prioritised the maintenance of the cohesion and protection of own rules. Apart from that, the members of Troika could not agree upon potential risk of financial spillovers across member states of the eurozone. For the European institutions this was a very sensitive topic this is why the objective was to avoid debt restructuring. If only the Troika paid more attention to cross-country spillovers and deteriorating conditions, the consequences could have been less harmful.

The academic community criticised the Troika just as other stakeholders accusing it of having an immense power and pursuing a fiscal conservatism approach. Based on the case studies, scholars as Kevin Featherstone and Judith Clifton together with Daniel Diaz-Fuentes and Ana Lara Gómez came to the conclusion that austerity policies in Greece were more brutal rather than in Ireland putting an emphasis again on the political and socio-economic consequences as administrative reforms, unemployment, emigration, serious deterioration of citizens' physical and mental health. Another prominent critics of the Troika are Yanis Varoufakis, a former Greek finance minister, and a German writer Fritz R. Glunk together with an American academic Noam Chomsky

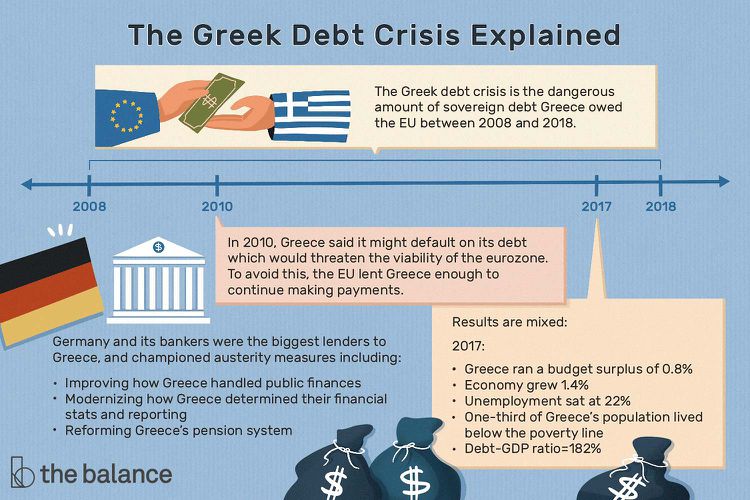

Greek Debt Crisis Explained

The Greek debt crisis is the dangerous amount of sovereign debt Greece owed the European Union between 2008 and 2018. In 2010, Greece said it might default on its debt, threatening the viability of the eurozone itself.

To avoid default, the EU loaned Greece enough to continue making payments.

- Since the debt crisis began in 2010, the various European authorities and private investors have loaned Greece nearly 320 billion euros.

- It was the biggest financial rescue of a bankrupt country in history.

- As of January 2019, Greece has only repaid 41.6 billion euros. It has scheduled debt payments beyond 2060.

In return for the loan, the EU required Greece to adopt austerity measures. These reforms were intended to strengthen the Greek government and financial structures. They did that, but they also mired Greece in a recession that didn’t end until 2017.

The crisis triggered the eurozone debt crisis, creating fears that it would spread into a global financial crisis. It warned of the fate of other heavily indebted EU members. This massive crisis was triggered by a country whose economic output is no bigger than the U.S. State of Connecticut.3

In 2009, Greece’s budget deficit exceeded 15% of its gross domestic product.2 Fear of default widened the 10-year bond spread and ultimately led to the collapse of Greece’s bond market. This would shut down Greece’s ability to finance further debt repayments. The chart below highlights in red the period when the 10-year government bond yield passed 35% until vast debt restructuring forced private bondholders to accept investment losses in exchange for less debt.

EU leaders struggled to agree on a solution. Greece wanted the EU to forgive some of the debt, but the EU didn’t want to let Greece off scot-free.

The biggest lenders were Germany and its bankers. They championed austerity measures. They believed the measures would improve Greece's comparative advantage in the global marketplace. The austerity measures required Greece to improve how it managed its public finances. It had to modernize its financial statistics and reporting. It lowered trade barriers, increasing exports.

Most importantly, the measures required Greece to reform its pension system. Pension payments had absorbed 17.5% of GDP, higher than in any other EU country. Public pensions were 9% underfunded, compared to 3% for other nations. Austerity measures required Greece to cut pensions by 1% of GDP. It also required a higher pension contribution by employees and limited early retirement.4

Half of Greek households relied on pension income since one out of five Greeks were 65 or older.5 Workers weren’t thrilled paying contributions so seniors can receive higher pensions.

The austerity measures forced the government to cut spending and increase taxes. They cost 72 billion euros or 40% of GDP. As a result, the Greek economy shrank 25%. That reduced the tax revenues needed to repay the debt. Unemployment rose to 25%, while youth unemployment hit 50%.6 Rioting broke out in the streets. The political system was in upheaval as voters turned to anyone who promised a painless way out.

The results are mixed. In 2017, Greece ran a budget surplus of 0.8%.7 Its economy grew 1.4%, but unemployment was still 22%.8 One-third of the population lived below the poverty line. Its 2017 debt-to-GDP ratio was 182%.

Timeline

In 2009, Greece announced its budget deficit would be 12.9% of its GDP.2 That's more than four times the EU's 3% limit. Rating agencies Fitch, Moody's, and Standard & Poor's lowered Greece's credit ratings. That scared off investors and raised the cost of future loans.

In 2010, Greece announced a plan to lower its deficit to 3% of GDP in two years. Greece attempted to reassure the EU lenders it was fiscally responsible. Just four months later, Greece instead warned it might default.2

The EU and the International Monetary Fund provided 240 billion euros in emergency funds in return for austerity measures. The loans only gave Greece enough money to pay interest on its existing debt and keep banks capitalized. The EU had no choice but to stand behind its member by funding a bailout. Otherwise, it would face the consequences of Greece either leaving the Eurozone or defaulting.9 Austerity measures required Greece to increase the VAT tax and the corporate tax rate. It had to close tax loopholes. It created an independent tax collector to reduce tax evasion. It reduced incentives for early retirement. It raised worker contributions to the pension system. At the same time, it reduced wages to lower the cost of goods and boost exports. The measures required Greece to privatize many state-owned businesses such as electricity transmission. That limited the power of socialist parties and unions.

Why was the EU so harsh? EU leaders and bond rating agencies wanted to make sure Greece wouldn't use the new debt to pay off the old. Germany, Poland, Czech Republic, Portugal, Ireland, and Spain had already used austerity measures to strengthen their own economies. Since they were paying for the bailouts, they wanted Greece to follow their examples. Some EU countries like Slovakia and Lithuania refused to ask their taxpayers to dig into their pockets to let Greece off the hook.10 These countries had just endured their own austerity measures to avoid bankruptcy with no help from the EU.

In 2011, the European Financial Stability Facility added 190 billion euros to the bailout. Despite the name change, that money also came from EU countries.

By 2012, Bondholders finally agreed to a haircut, exchanging 77 billion euros in bonds for debt worth 75% less.

In 2014, Greece’s economy appeared to be recovering, as it grew 0.7%. The government successfully sold bonds and balanced the budget.

In January 2015, voters elected the Syriza party to fight the hated austerity measures. On June 27, Greek Prime Minister Alexis Tsipras announced a referendum on the measures. He falsely promised that a "no" vote would give Greece more leverage to negotiate a 30% debt relief with the EU. On June 30, 2015, Greece missed its scheduled 1.55 billion euros payment.11 Both sides called it a delay, not an official default. Two days later, the IMF warned that Greece needed 60 billion euros in new aid. It told creditors to take further write-downs on the more than 300 billion euros Greece owed them.

On July 5, Greek voters said "no" to austerity measures.12 The instability created a run on the banks. Greece sustained extensive economic damage during the two weeks surrounding the vote. Banks closed and restricted ATM withdrawals to 60 euros per day. It threatened the tourism industry at the height of the season, with 14 million tourists visiting the country. The European Central Bank agreed to recapitalize Greek banks with 10 billion euros to 25 billion euros, allowing them to reopen.13

Banks imposed a 420 euros weekly limit on withdrawals. That prevented depositors from draining their accounts and worsening the problem. It also helped reduce tax evasion. People turned to debit and credit cards for purchases. As a result, federal revenue increased by 1 billion euros a year.

On July 15, the Greek parliament passed the austerity measures despite the referendum.14 Otherwise, it would not receive the EU loan of 86 billion euros. The ECB agreed with the IMF to reduce Greece’s debt. It lengthened the terms, thus reducing net present value. Greece would still owe the same amount. It could just pay it over a longer time period.

On July 20, Greece made its payment to the ECB, thanks to a loan of 7 billion euros from the EU emergency fund. The United Kingdom demanded the other EU members guarantee its contribution to the bailout.

On September 20, Tsipras and the Syriza party won a snap election.15 It gave them the mandate to continue to press for debt relief in negotiations with the EU. However, they also had to continue with the unpopular reforms promised to the EU.

In November, Greece's four biggest banks privately raised 14.4 euros billion as required by the ECB.16 The funds covered bad loans and returned the banks to full functionality. Almost half of the loans banks had on their books were in danger of default. Bank investors contributed this amount in exchange for the 86 billion euros in bailout loans. The economy contracted 0.2%.

In March 2016, the Bank of Greece predicted the economy would return to growth by the summer. It only shrank 0.2% in 2015, but the Greek banks were still losing money. They were reluctant to call in bad debt, believing that their borrowers would repay once the economy improved. That tied up funds they could have lent to new ventures.

On June 17, the EU's European Stability Mechanism disbursed 7.5 billion euros to Greece.17 It planned to use the funds to pay interest on its debt. Greece continued with austerity measures. It passed legislation to modernize the pension and income tax systems. It promised to privatize more companies, and sell off nonperforming loans.

In May 2017, Tsipras agreed to cut pensions and broaden the tax base. In return, the EU loaned Greece another 86 billion euros.13 Greece used it to make more debt payments. Tsipras hoped that his conciliatory tone would help him reduce the 293.2 billion euros in outstanding debt. But the German government wouldn't concede much before its September presidential elections.

In July, Greece was able to issue bonds for the first time since 2014. It planned to swap notes issued in the restructuring with the new notes as a move to regain investors' trust.

On January 15, 2018, the Greek parliament agreed on new austerity measures to qualify for the next round of bailouts. On January 22, the eurozone finance ministers approved 6 billion to 7 billion euros.13 The new measures made it more difficult for union strikes to paralyze the country. They helped banks reduce bad debt, opened up the energy and pharmacy markets, and recalculated child benefits.

On August 20, 2018, the bailout program ended.2 Most of the outstanding debt is owed to the EU emergency funding entities. These are primarily funded by German banks.

- European Financial Stability Mechanism and European Stability

- Mechanism: 168 billion euros

- Eurozone governments: 53 billion euros.

- Private investors: 34 billion euros.

- Greek government bond holders: 15 billion euros.

- European Central Bank: 13 billion euros.

- IMF: 12 billion euros.

Until the debt is repaid, European creditors will informally supervise adherence to existing austerity measures. The deal means that no new measures would be created.

Causes

How did Greece and the EU get into this mess in the first place? The seeds were sown back in 2001 when Greece adopted the euro as its currency. Greece had been an EU member since 1981 but couldn't enter the eurozone. Its budget deficit had been too high for the eurozone's Maastricht Criteria.3

All went well for the first several years. Like other eurozone countries, Greece benefited from the power of the euro. It lowered interest rates and brought in investment capital and loans.

In 2004, Greece announced it had lied to get around the Maastricht Criteria.18 The EU imposed no sanctions. Why not? There were three reasons.

France and Germany were also spending above the limit at the time. They'd be hypocritical to sanction Greece until they imposed their own austerity measures first.

There was uncertainty on exactly what sanctions to apply. They could expel Greece, but that would be disruptive and weaken the euro.

The EU wanted to strengthen the power of the euro in international currency markets. A strong euro would convince other EU countries, like the United Kingdom, Denmark, and Sweden, to adopt the euro.

As a result, Greek debt continued to rise until the crisis erupted in 2008.

https://www.thebalancemoney.com/what-is-the-greece-debt-crisis-3305525

Greece repays IMF debt two years ahead of schedule, says finance minister

Greece has paid off its entire debt from the financial crisis to the International Monetary Fund (IMF), two years ahead of schedule.

Finance Minister Christos Staikouras said the repayment "closes the chapter" that was opened in May 2010.

"[This is] “a very positive development,” Staikouras stated, adding that the country could save around €230 million in interest.

Greece’s European Union bailout lenders gave the formal go-ahead last week for the early repayment of the outstanding loans worth €1.86 billion.

Their approval was needed as the initial requirement was for early IMF repayments to be made in parallel with those made to European lenders.

https://www.euronews.com/2022/04/05/greece-repays-imf-debt-two-years-ahead-of-schedule-says-finance-minister[/b]

Does failed IMF prescription for Greece work for Sri Lanka?

We preach that Sri Lanka is a Democratic Socialist Republic and practice social-market economy. One of the measures to see the role of government in the social sector is to look at the total tax collection from the rich and the subsidies afforded to the less privileged people in society.

The rich countries’ tax collection is around 45 percent to 50 percent of gross domestic product (GDP) and they in turn invest 12 percent to 18 percent on health and education, whereas in Sri Lanka, our tax revenue is around 13 percent and how much do we spend on education and health?

Last year, the government spent only 3.6 percent on health and education, where more than 25 percent of our people live below the poverty line. In fact, there has been a reduction in the capital expenditure on health in 2016 compared to the previous year. Our health and education services are fast deteriorating to a level where we could end up in having unhealthy and less educated children similar to the population living in least developed countries.

Growing civil unrest due to poor health and education facilities

The growing tax collection has enabled the developed countries (the US, Britain, France and Sweden) to take on social welfare functions. A major portion goes to health and education. Spending on education and health accounts for 12 percent to 18 percent of national income in all the developed countries today.

Primary and secondary education are almost entirely free for everyone in all the rich countries but higher education can be quite expensive, especially in the United States. In all the developed countries, public spending covers much of the cost of education and health services. The goal is to give equal access to these basic goods: every child should have access to education, regardless of his or her parents’ income and everyone should have access to healthcare.

In Sri Lanka, the situation is totally different. Public spending on education and health services is totally inadequate. One of the fundamental problems in Sri Lanka is that we have very low national savings resulting a gap between investments and savings. Our economy is stagnating and foreign and local investments are at a very low level. (Average foreign direct investments (FDIs) during the last five years is around US $ 800 per annum whereas our debt servicing alone is around US $ 4,600 per annum).

As a result, the government is compelled to curtail investment in people. The successive governments have failed in bringing social justice and much-needed economic welfare to the people. Consequently, the income inequality and social unrest are fast spreading across the regions, sub-districts and cities. Most of the top business leaders and professionals are of the view that the quality of life of not only poor, even the middle class is drastically reducing.

As per the Central Bank report 2016, the economy has been stagnating around US $ 82 billion in terms of GDP and the external debt outstanding as at end-December 2016 has increased to US $ 46.6 billion. In fact, the per capita GDP income has come down from US $ 3,843 to US $ 3,839 in 2016.

The external account performance is fast deteriorating. Despite continuous borrowings, our foreign reserves are declining and debt servicing is ever increasing. As can be seen from Table 1, there is a persistent balance of payment (BOP) deficit, which had been financed through high-cost borrowings.

Export earnings are declining for the first time in the last two decades and except tourism income all other exports such as tea, rubber products, textile and garments, gems and jewellery, etc. are stagnating if not declining. There has been a substantial savings on fuel bill during the last two years, yet the trade deficit widens as we continue to spend foreign exchange to import dairy products, sugar and even rice, wheat, maize, etc.

Persistent BOP deficits financed by heavy borrowings

These statistics are not sufficient to explain the real downturn. Basically, the countries’ external account has been in deficit of US $ 2 billion per annum before debt amortization/servicing.

The government is now compelled to borrow external debt on non-concessionary, commercial terms in order to finance the deficit. The current government continues to borrow foreign funds at relatively higher interest rates in order to retire previously obtained low-cost borrowings. According to the auditor general’s findings, the government debt as a percent of GDP has increased to 83 percent by end-2016, which includes US $ 27.8 billion foreign loans obtained by the government.

However, if we take into account the overall external debts obtained by the country, it works up to US $ 46. 6 billion. If we add the overall external debt of Rs.6,785 billion (equivalent of US $ 46.6 billion) to the o/s domestic debt, then the total debt works out to Rs.12,600 billion. This, as a percent of GDP of Rs.11,839 billion was 106 percent of GDP, which is excessive.

Is IMF loan similar to bailout package given to Greece?

Unfortunately, the country’s gross official reserves are fluctuating around US $ 6 billion, which is sufficient only for four months of imports. However, we are now under the International Monetary Fund (IMF) programme Extended Fund Facility (EFF) where a total sum of US $ 1.5 billion is due to be disbursed during the’ three-year period. (Already two tranches have been received)

It is in this context only we need to assess the current scenario to ascertain whether Sri Lanka could come out from the present economic crisis without burdening the poor anymore. It may be relevant to compare and contrast the economic situation faced by Greece today, where the IMF came with a recipe similar to one that prescribed to Sri Lanka when Greece had to face a serious financial crisis somewhere in 2008.

Greece had experienced strong economic growth till 2006 where GDP was around 4-6 percent and the budget deficit was around 5-7 percent with relatively higher per capita income. During the financial crisis in 2008, the budget deficit of Greece has exceeded 15 percent and the economy was stagnating. They were forced to accept a bailout package from the IMF and EU banks but those came with conditions. As in the case of Sri Lankan present situation, lenders imposed harsh austerity terms, requiring deep budget cuts and steep tax increases.

Greece announced in October 2009 that it had been understating its deficit figures for years, raising alarms about the soundness of Greek finances. (The Sri Lankan auditor general has recently given a ‘disclaimer’ to the Finance Ministry 2016 accounts claiming the ‘public debt’ figures in the accounts have been understated).

Suddenly, Greece was shut out from borrowing in the financial markets. To avert calamity, the so-called troika — the IMF, European Central Bank and European Commission — issued the first of two international bailouts for Greece, which would be 240 billion euros. The money was supposed to buy Greece time to stabilize its finances. Measures ranging from the overhaul of the pension system to increase in indirect taxes (VAT) are cited by Greeks now reneging on loan repayments, property taxes and energy bills.

The IMF has insisted that Greece cannot meet its budget goals without easing its debts, while Germany remains sceptical of cutting Athens spending. Germany and its bankers want Greece to reform its financial structure. International lenders have struggled for seven years to agree on its resolution. New York Times on June 17 explaining the debt crisis of Greece noted that the IMF and Germany were lining up on opposite sides.

During the period from 2010 up to now, the Greek economy has shrunk 25 percent because of spending cuts and tax increases demanded by creditors. As a matter of fact, Greece became the first developed country to fail to make the IMF loan repayment.

Greek economy from bad to worse?

Last year was meant to be a year of recovery – instead, uncertainty has prompted the Central Bank to revise its growth projection downwards following the economy’s contraction in the fourth quarter last year. The economy has shrunk by a quarter (25 percent) in six years and unemployment is about 24 percent. The bailout money mainly goes toward paying off Greece’s international loans, rather than making its way into the economy.

It is evident that despite the IMF bailouts, Greece’s economic problems have not gone away. Consumption is also down. “The 37 percent of Greeks at risk of poverty and social exclusion really cannot make ends meet,” said Aliki Mouriki, a leading Greek sociologist.

“They no longer have the means to meet the basic needs, with consumption of milk and bread right down and payment of electricity bills at an all-time low.”

According to foreign media, the farmers who travelled to Athens have clashed with riot police outside the agriculture ministry, in the latest unrest on the streets of the Greek capital, prompted by the government’s austerity policies.

“No economy can withstand endless recession and stagnation, it’s anyone’s bet what will happen if the economy doesn’t [exhibit] a strong recovery in 2017,” says George Pagoulatos, Professor of European Politics and Economy at Athens University.

Ancient Greece and Anuradhapura kingdom similarities

During the ancient period, there were similarities between ancient Greece and the Anuradhapura kingdom. The emergence of the entire western philosophical tradition can be traced back to the golden era of ancient Greek philosophy. As in the case for Sri Lanka, agriculture was the foundation of the ancient Greek economy.

Aristotle (384 BC-322 BC) is truly a key figure in the ancient Greek philosophy and he is considered as Athenian philosopher Plato’s (pupil of Socrates) most famous student. His main works were on ‘prior analytics’ in which he described the ‘rule of logic’. During this time period only, the Anuradhapura kingdom was first established in Sri Lanka formed by King Pandukabhaya in 377 BC.

It was during King Devanampiyatissa’s time (307 BC) that Arahat Mahinda, son of Emperor Asoka of India, arrived and officially established Buddhism in the island. He wanted to preach dhamma to the king and his minors but was not sure how intelligent the king and the followers were. Therefore, he wanted to test ‘logic’ where the king successfully answered to the questions posed by Arahat Mahinda. (Famous questions and answers on mango tree in Mihintala).

The Sri Lankan agriculture sector and paddy cultivation flourished under Devanampiyatissa, who is considered as a true national leader. (During this period Sri Lanka earned the nick name ‘Granary of the East’). Alexander the Great, king of Macedonia, considered as one of the greatest military geniuses of all times, was his contemporary and was educated by the great philosopher Aristotle (3564 BC-322 BC). It is a pity that both countries are now faced with serious economic crises mainly due to the absence true national leadership in order to improve the social and economic welfare of the people on a sustainable basis.

Will Sri Lankan BOP situation deteriorate further?

The Central Bank in its latest report stated that Sri Lanka’s attractiveness for FDIs has remained low and a reversal of this is urgently required. It goes without saying that the political stability is the most important and necessary prerequisite in creating an enabling environment for FDIs.

The government must also facilitate and encourage businesses to improve competitiveness and enhance performance in order to stimulate economic growth. Only then the businesses thrive so that the inland’s revenue department could collect higher taxes on progressive basis without increasing indirect taxes arbitrarily.

Fiscal consolidation must be achieved through increased revenue and cut on unnecessary government expenditure and waste. Instead, if the government tries to increase VAT, NBT, etc. then both the rich and poor have to pay taxes equally, negating the very basis of progressive tax system. The result would be that social unrest will accelerate with widespread of income inequality.

One of the major drawbacks during the last two-year period is in the delays in execution of policies and projects. Getting policy implementation right is critically important for ‘governance’ purposes. The government must continue on the on-going infrastructure development projects using FDIs so that the government could provide sufficient funds for improvements in health and education. My own view is this must receive highest priority of the policy makers.

There are serious mismatches between the needs of the economy and output of the higher education system. There are major epidemic issues in the current healthcare services as there is a major inequality in the healthcare availability across the country.

Conclusion

It goes without saying that improving economic growth in terms of GDP has become a necessary prerequisite to enhance the quality of life of our people. The business community has been emphasizing the need to have political stability and consistency in government policymaking to spur much-needed economic growth.

The country must adopt an ‘investment-led’ growth strategy as the ‘export development’ has just become a buzz word only. However, if the above-mentioned deep-rooted structural issues in the economy are not addressed urgently, there is a greater probability that the Sri Lankan ‘BOP’ situation will further deteriorate.

In the medium term, both the income inequality as well as the unemployment rate will further widen. This will lead to further unrest among the people. The popular belief is that the successive governments have failed in bringing social justice and much-needed economic welfare to the people. It seems that the real crisis confronted with the country’s governance is a lack of a people-oriented visionary leadership.

(Jayampathy Molligoda can be reached via jayampathy@bpl.lk)

Compiled by: FINANCIAL CHRONICLE

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.