Download Report: https://www.imf.org/-/media/Files/Publications/CR/2023/English/1LKAEA2023001.ashx

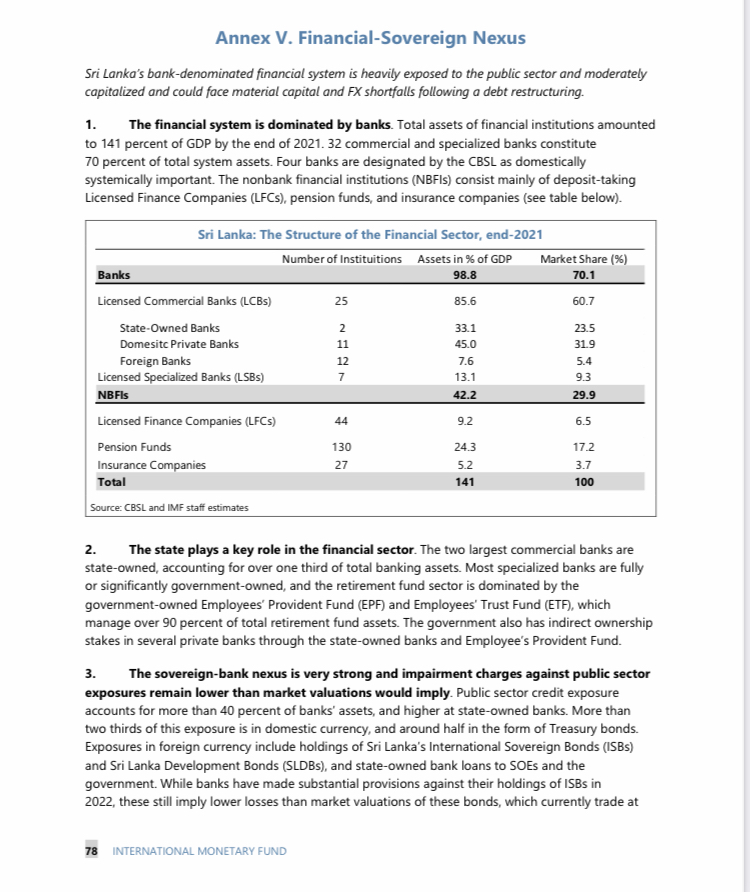

1. The financial system is dominated by banks. Total assets of financial institutions amounted to 141 percent of GDP by the end of 2021. 32 commercial and specialized banks constitute 70 percent of total system assets. Four banks are designated by the CBSL as domestically systemically important. The nonbank financial institutions (NBFIs) consist mainly of deposit-taking Licensed Finance Companies (LFCs), pension funds, and insurance companies (see table below).

2. The state plays a key role in the financial sector. The two largest commercial banks are state-owned, accounting for over one third of total banking assets. Most specialized banks are fully or significantly government-owned, and the retirement fund sector is dominated by the government-owned Employees’ Provident Fund (EPF) and Employees’ Trust Fund (ETF), which manage over 90 percent of total retirement fund assets. The government also has indirect ownership stakes in several private banks through the state-owned banks and Employee’s Provident Fund.

3. The sovereign-bank nexus is very strong and impairment charges against public sector exposures remain lower than market valuations would imply. Public sector credit exposure accounts for more than 40 percent of banks’ assets, and higher at state-owned banks. More than two thirds of this exposure is in domestic currency, and around half in the form of Treasury bonds. Exposures in foreign currency include holdings of Sri Lanka’s International Sovereign Bonds (ISBs) and Sri Lanka Development Bonds (SLDBs), and state-owned bank loans to SOEs and the government. While banks have made substantial provisions against their holdings of ISBs in 2022, these still imply lower losses than market valuations of these bonds, which currently trade at prices below 40 percent of par. Banks therefore remain vulnerable to losses arising from debt restructuring. In addition, most local currency government bonds are now accounted for on an amortized cost basis and are booked at well above their current market value, as 10-year T-bond yields have risen to around 28 percent from 12 percent at end-2021.

4. NBFIs are heavily exposed to sovereign risk through their investments in government bonds. Pension funds are one of the largest holders of local currency government debt. The EPF holds around 29 percent of total domestic local currency government debt, with 94 percent of its investments in government debt. Similarly, the ETF invested 80 percent of its portfolio in government debt by 2021. In addition, insurance companies are also highly exposed to government debt. Exposures of insurance companies to government debt accounted for 431⁄2 percent of their assets.

5. Banks could face significant capital and FX shortfalls as a result of a sovereign debt restructuring. A sovereign debt restructuring will crystalize both sovereign credit risk and FX risk facing the banks. Banks’ exposure to the public sector as of end-September 2022 amounts to 33 percent of projected 2022 GDP, more than 5 times their total capital of 61⁄2 percent of GDP. Staff’s analysis indicates that, the illustrative restructuring scenario considered in the public debt sustainability analysis (Annex II), combined with a severe asset quality shock consistent with the economic downturn, could result in capital shortfalls for some banks. Private sector capital may be difficult to secure until the economy has stabilized, especially for the state-owned banks. The authorities have therefore committed in the MEFP to a plan for potential bank recapitalization and the DSA includes a contingent liability to reflect this.

6. Moreover, banks’ net open foreign exchange position would deteriorate significantly as a result of a sovereign debt restructuring. The depreciation of the rupee has increased the share of FX assets from 16 percent at end-2021 to 25 percent of banks’ assets. Restructuring of public FX debt, or repayment in rupees could cause banks’ FX liabilities to significantly exceed their FX assets. These FX short positions could lead to more losses if the rupee depreciates further, if banks are unable to secure sufficient FX inflows. Thus, banks and the authorities will also require a plan to close the net open FX position in the banking sector.

Download Report: https://www.imf.org/-/media/Files/Publications/CR/2023/English/1LKAEA2023001.ashx

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home