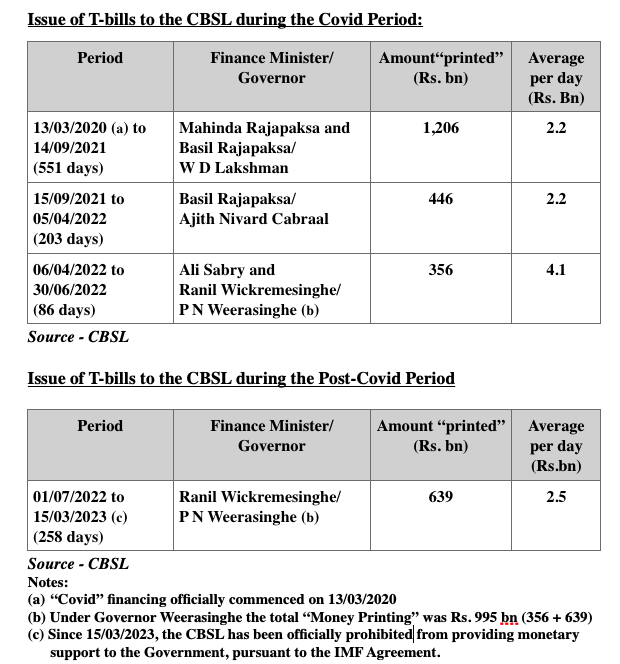

Contrary to popular belief, “money printing” by the CBSL was at its highest under Governor P N Weerasinghe, even while the IMF was closely involved with Sri Lanka since mid April 2022. Above table would be helpful to understand the context

With the new IMF arrangement whereby CBSL’s “money printing” is discontinued, it will only be a matter of time before the Government will find it impossible to face the huge challenge of meeting its commitments without recourse to the CBSL’s support. Consequently, it would lead to a further spike in interest rates (as in Argentina) at best, or the Government being compelled to default on its local currency debt, at worst. Both such occurrences could also easily lead to the collapse of the fragile IMF Agreement.

https://www.srilankachronicle.com/t62974-sri-lanka-sovereign-debt-default-1st-year-anniversary#407542

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.