Sri Lanka NPLs seen peaking around 13-pct, some sectors hit up to 30-pct

Friday December 1, 2023 1:17 pm

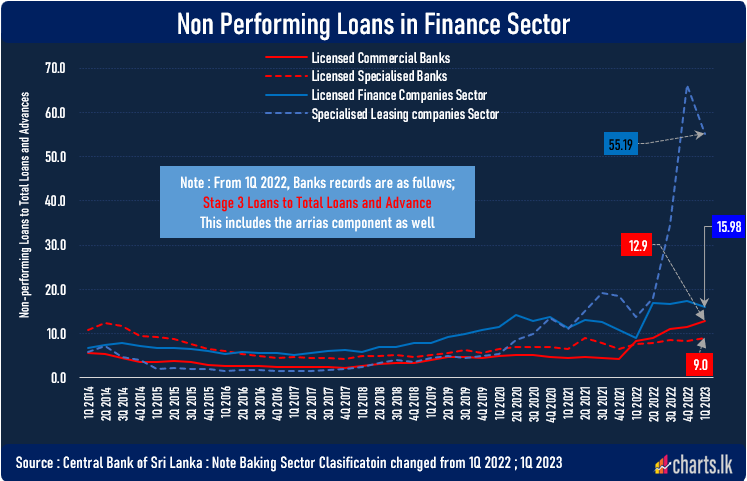

ECONOMYNEXT – Sri Lanka’s non-performing loans after the latest currency crisis is showing signs of having peaked but some sectors are hit worse than others with problem loans dating back from Coronavirus moratoria, a banking official said.

Hotels, transport and arts and entertainment sectors had bad loans of 30 to 20 percent, while the overall level was lower.

There is a marginal set of borrowers whose loans had been re-structured at high rates, whose loans could turn bad if no action is taken.

“The good news is that our NPLs have now kind of slowed down,” Bingumal Thewarathanthri, who is chairman of Sri Lanka Banks’ Association, told the Sri Lanka Economic Summit 2023.

“It was 13.6 percent. Now it is hovering around 13.1, 13.2 percent. The net is down to 7.2 from 7.8 percent. Very clearly we have come to the end of this process.”

Thewarathanthri said Sri Lanka’s NPLs were low around 2.5 percent in 2017.

“NPLs came down but suddenly went up in 2018 and 2019 because credit to private sector was double digit when the economy was growing at low single digits,” he said.

Sri Lanka’s NPLs started to inch up from before the Coronavirus crisis amid money printed to mist-target rates, which tend to drive mal-investments, analysts have said.

The inevitable currency collapse which follows, destroys purchasing power, on top of stabilization measures to stop the external drain, making businesses fail and drive up bad loans.

Some Sectors More Affected

Meanwhile, Thewarathanthri said, Sri Lanka’s bad loans hit 15.8 percent in 1999, and that level was not reached in the current crisis.

But some sectors are more badly affected than others

“In terms of sectors, tourism NPLs are 33 percent,” he said. “Very clearly some of the tourism sector enterprises will not recover. You can clearly see the stress in that sector.

“Transport and logistics is 30 percent. Disposable incomes have come down, less consumption, the sector is impacted. Some of our clients who went down during covid will never recover, sadly.

“Interestingly arts and entertainment is also close to 20 percent. Again, when disposable income goes down there is an impact to arts and entertainment. You first eat.”

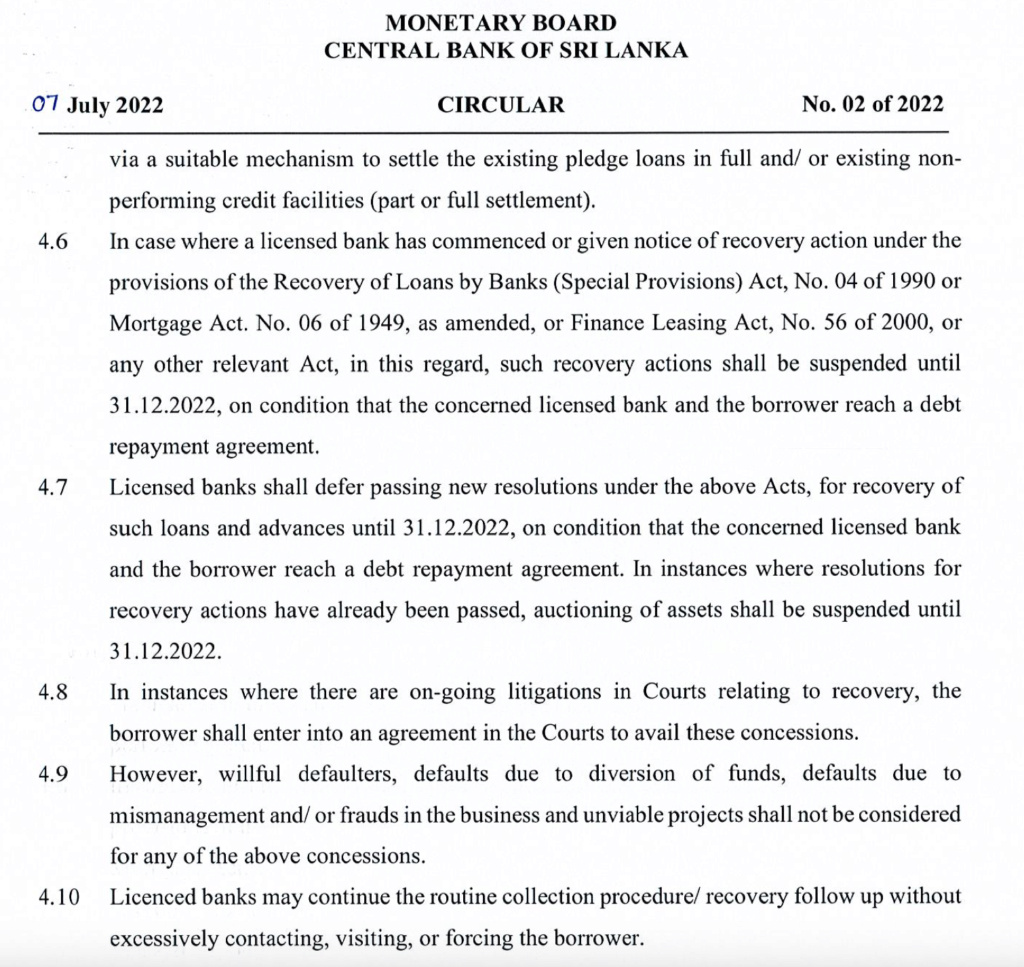

Moratorium

After the Easter Sunday blast, hotels were given relief. In 2020 more broad-based relief was given and extened.

“There are no standard moratoriums going forward,” Thewarathanthri said. “Banks are fully aware of who is in stress and there is a lot of restructuring happening as we speak.

There were three types of enterprises, that took moratoriums.

“Some took the moratoriums and somehow paid,” Thewarathanthri said. “They disposed some assets, they took cost action, they understood the size of the business what is possible, what is not possible.

“I would say close to half were actually have gone ahead and done that.”

“There is a good 20 percent I would say who had taken the moratorium and done other things.

They thought they can buy time and wait and they did not have to settle these loans. They are in stress. These firm with no cashflow are lobbying for more moratoriums.

There was a third sector which took moratoriums who were unable to settle due to due to inadequate cashflows.

Some hotels had recovered close to 80 percent of pre-Covid level but were not fully recovered, but were managing to service the debt.

Many loans of the loans were restructured in the recent past at “very high rates”, which the banks had to look at again.

“That component I think all of us in the banking community will have to take a look at that component and see what more can be done,” he said.

“If there is no cashflow there is no payment. Period. We can celebrate the NPLs have come to the bottom but you never know. If that portfolio goes bad, that’s a good portfolio going bad.

“The promoters are good, the business models are good. But sadly the cashflows are not supporting. So that individual banks are actively looking at them and supporting them.”

Global Picture

Several other countries which had currency troubles are also hit.

Ghana, a country which defaulted, amid a severe currency crisis, has about 20 percent bad loans.

Bad loans in Bangladesh, which is going through ‘external stress’ was 10 percent, Thewarathanthri who is also Chief Executive of Sri Lanka’s Standard Chartered Bank said.

“There is stress in the banking systems post-Covid,” he said. “Central banks have done moratoriums. There is stress in the banking systems coming out of the moratoriums as well.

“What we have seen is actually larger companies have taken market share … and grown.”

Similar trends were seen in Sri Lanka, he said.

“SME turnovers are down by 7 to 30 percent in Asia. Some of our SMEs have completely gone down.” (Colombo/Dec01/2023)

https://economynext.com/sri-lanka-npls-seen-peaking-around-13-pct-some-sectors-hit-up-to-30-pct-142097/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home