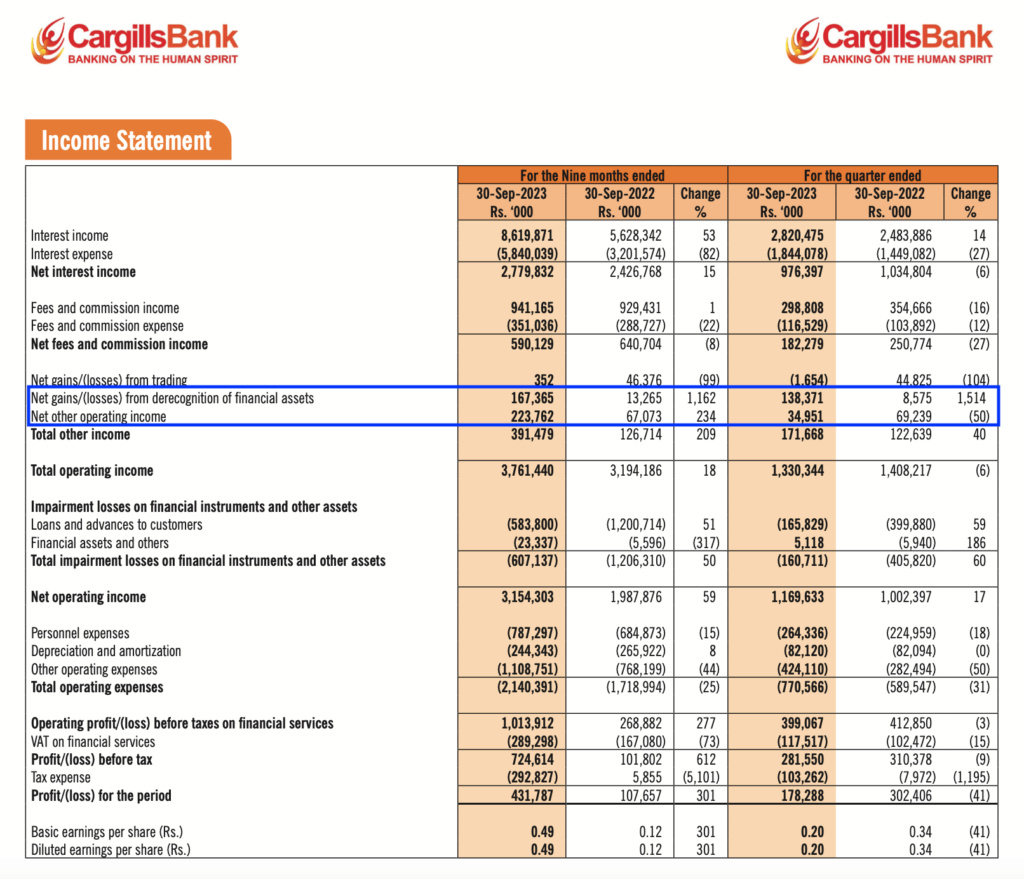

Cargills Bank reported an EPS of LKR 0.49 per share for the 9 months ended 30th Sep 2023 compared to LKR 0.12 per share in 2022 (More than 300% increase) ahead of Initial Public Offering (IPO) mainly due to capital gains from derecognition of financial assets and other operating Income.

https://cdn.cse.lk/cmt/upload_report_file/3118_1704772352765.pdf

Accounting Ratios of Cargills Bank

Historical Earnings per Share (EPS), Return on Equity (ROE) and Price to Earnings Ratio (P/E) of Cargills Bank are given below.

As can be seen above, the Earnings per Share (EPS), Return on Equity (ROE) and Price to Earnings Ratio (P/E) of Cargills Bank has turned positive just prior to the IPO.

Accounting Ratios of other Banks

What is derecognition of financial assets?

Derecognition is the removal of a previously recognized financial asset or financial liability from an entity's balance sheet. A financial asset should be derecognized if either the entity's contractual rights to the asset's cash flows have expired or the asset has been transferred to a third party (along with the risks and rewards of ownership). If the risks and rewards of ownership have not passed to the buyer, then the selling entity must still recognize the entire financial asset and treat any consideration received as a liability.

Part of the year-end closing procedure may include a step to review all fixed assets currently on the books to see if any should be derecognized. Otherwise, an excessive amount of accumulated depreciation may clutter the balance sheet.

On de-recognition of a financial asset in its entirety, the difference between: (a) the carrying amount (measured at the date of de-recognition) and (b) the consideration received (including any new asset obtained less any new liability assumed) shall be recognised in profit or loss.

http://www.slaasc.lk/files/Communication-%20Insights%20into%20SLFRS%209%20Financial%20Instruments_IInsights%20on%20SLFRS%209%20Financial%20Instruments.pdf[/b]

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home