Sri Lankan government plans to revamp the property tax system and introduce a wealth transfer tax by 2025. The aim of these measures is to make Sri Lanka’s tax system more progressive and gradually shift the focus of taxation from indirect to direct sources. These reforms are part of the government’s plan to enhance fiscal transparency and improve tax compliance in a country where the informal sector is relatively large.

According to the International Monetary Fund (IMF) Country Report No. 23/116, the government’s objective is to reach a primary fiscal surplus of 2.3% of GDP by 2025. To achieve this goal, the government is planning to introduce a nationwide real property tax and adjust the system of transfers between the central and provincial governments. The government also plans to introduce a gift and inheritance tax with a tax-free allowance and minimal exemptions.

“The economic reform program implemented by the Sri Lankan authorities is yielding the first signs of recovery. Real GDP recorded positive growth of 1.6 percent year-on-year in the third quarter of 2023, the first expansion in six consecutive quarters. Shortages of essentials have eased, and inflation remains contained. Gross international reserves increased by USD 2.5 billion during 2023, and preliminary data point to improved fiscal revenue collections during the fourth quarter of 2023. However, challenges remain as these improvements need to translate into improved living conditions for Sri Lanka’s people.

“In this context, sustaining the reform momentum and ensuring timely implementation of all program commitments are critical to rebuilding confidence and putting the recovery on a firm footing that will benefit all people. Swift progress towards the introduction of a progressive property tax is key to ensuring fair burden sharing while sustaining the revenue-based consolidation. Tax policy measures need to be accompanied by strengthening tax administration, removing tax exemptions, and actively eliminating tax evasion to make the reforms more sustainable and to further build confidence among creditors to support Sri Lanka’s efforts to regain debt sustainability.

Preparatory work for these tax reforms will commence by mid-2023, supported by IMF technical assistance. The IMF’s Extended Fund Facility is designed to provide financial support to countries like Sri Lanka that face balance of payments difficulties resulting from structural problems. The IMF’s support will help Sri Lanka implement its fiscal consolidation plan and achieve sustainable economic growth.

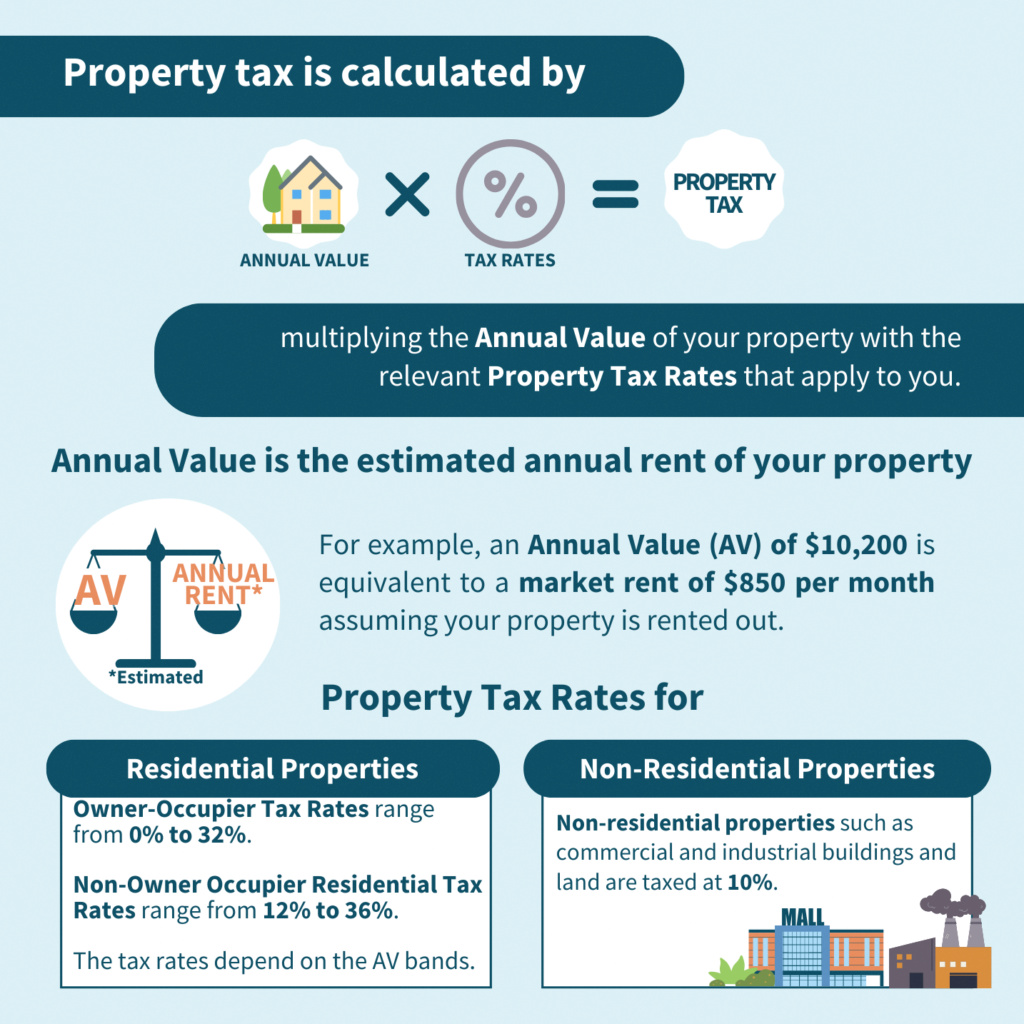

The introduction of a real property tax is a significant reform that will have far-reaching consequences. Currently, Sri Lanka’s property tax system is outdated and does not reflect the true value of properties. The government’s plan to introduce a nationwide real property tax will keep the system current and ensure that property owners pay their fair share of taxes. This will generate revenue for the government and reduce the burden on indirect taxes, such as Value Added Tax (VAT) and customs duties.

The introduction of a gift and inheritance tax is also a significant reform. Which is intended to reduce wealth inequality and ensure that wealth is distributed more evenly across society. The tax-free allowance and minimal exemptions ensure that the tax does not unduly burden middle-class Sri Lankans.

The government’s plan to document all tax expenditures provided under the Strategic Development Projects Act and the Board of Investment Act is an important step toward fiscal transparency. These acts provide tax incentives to businesses that invest in certain strategic sectors of the economy. By documenting all tax expenditures, the government will be able to monitor the effectiveness of these tax incentives and ensure that they are not abused.

The government’s plan to embark on revenue administration reforms is also a significant step toward improving tax compliance. Sri Lanka’s informal sector is relatively large, and many businesses operate outside the formal tax system. The government’s plan to strengthen tax compliance will ensure that these businesses pay their fair share of taxes and contribute to the country’s economic growth.

https://www.lankapropertyweb.com/property-news/the-sri-lankan-government-plans-to-implement-estate-duty-as-a-form-of-property-taxation-by-2025/

Last edited by God Father on Sun Jan 21, 2024 8:34 am; edited 2 times in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home