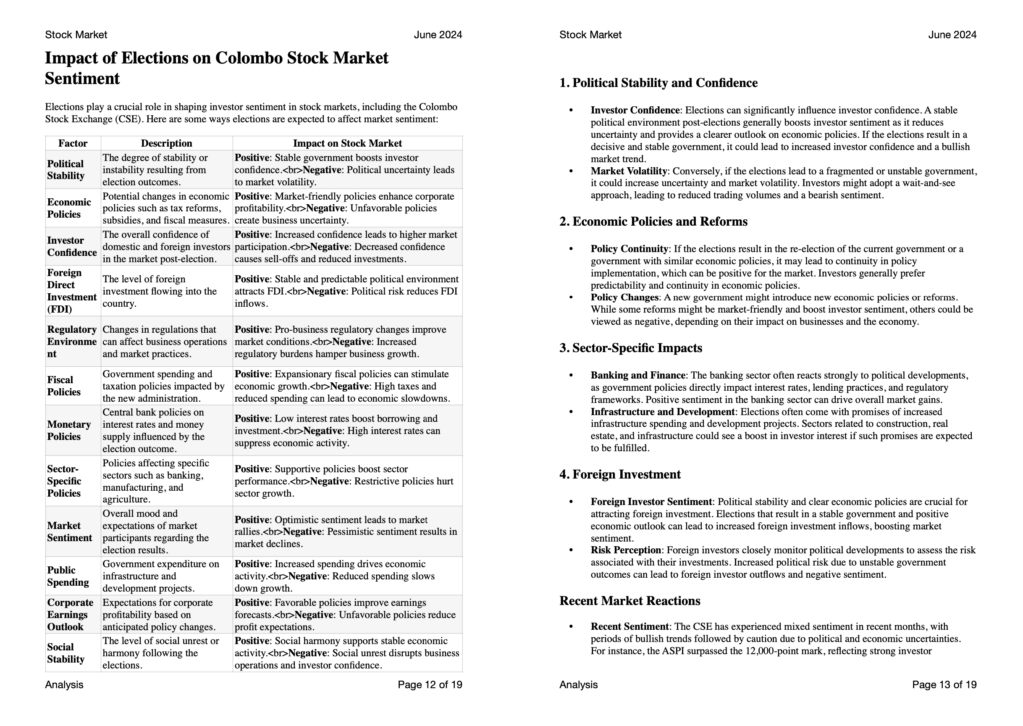

Elections play a crucial role in shaping investor sentiment in stock markets, including the Colombo Stock Exchange (CSE). Here are some ways elections are expected to affect market sentiment:

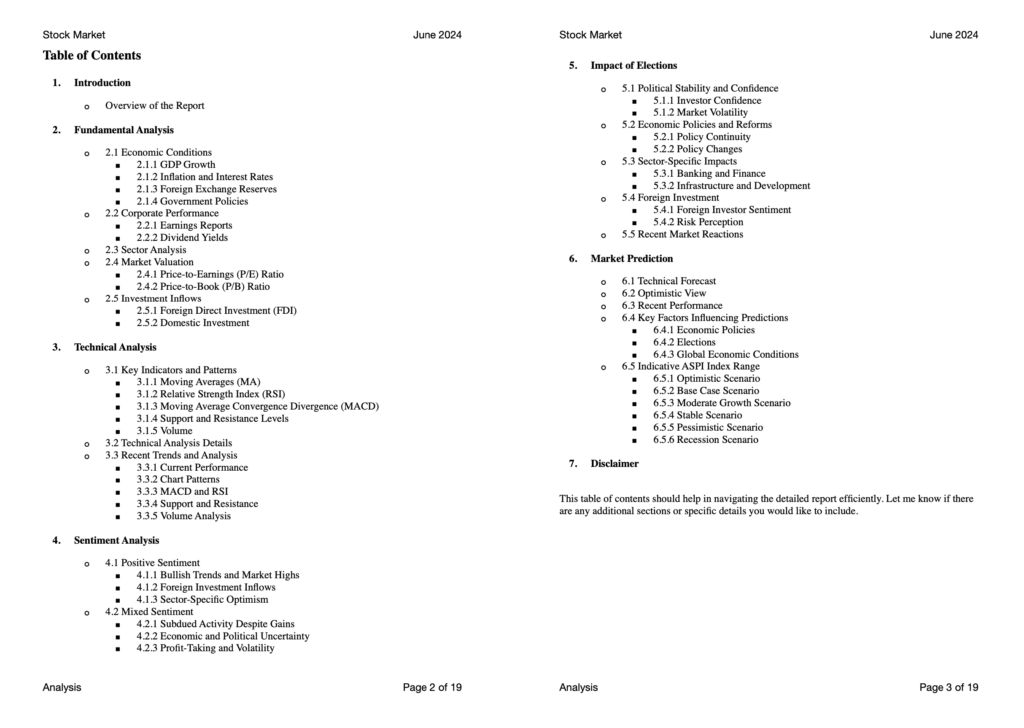

Download Full Report on Stock Market Outlook for 2024, which highlights the key factors that determines the direction of the market in 2024.

Key Content:

Analysis of the Colombo Stock Market

– Fundamental Analysis

– Technical Analysis

– Sentiment Analysis

– Impact of Elections

– Market Forecast

https://lankabizz.net/product/stock-market-analysis/

1. Political Stability and Confidence

• Investor Confidence: Elections can significantly influence investor confidence. A stable political environment post-elections generally boosts investor sentiment as it reduces uncertainty and provides a clearer outlook on economic policies. If the elections result in a decisive and stable government, it could lead to increased investor confidence and a bullish market trend.

• Market Volatility: Conversely, if the elections lead to a fragmented or unstable government, it could increase uncertainty and market volatility. Investors might adopt a wait-and-see approach, leading to reduced trading volumes and a bearish sentiment.

2. Economic Policies and Reforms

• Policy Continuity: If the elections result in the re-election of the current government or a government with similar economic policies, it may lead to continuity in policy implementation, which can be positive for the market. Investors generally prefer predictability and continuity in economic policies.

• Policy Changes: A new government might introduce new economic policies or reforms. While some reforms might be market-friendly and boost investor sentiment, others could be viewed as negative, depending on their impact on businesses and the economy.

3. Sector-Specific Impacts

• Banking and Finance: The banking sector often reacts strongly to political developments, as government policies directly impact interest rates, lending practices, and regulatory frameworks. Positive sentiment in the banking sector can drive overall market gains.

• Infrastructure and Development: Elections often come with promises of increased infrastructure spending and development projects. Sectors related to construction, real estate, and infrastructure could see a boost in investor interest if such promises are expected to be fulfilled.

4. Foreign Investment

• Foreign Investor Sentiment: Political stability and clear economic policies are crucial for attracting foreign investment. Elections that result in a stable government and positive economic outlook can lead to increased foreign investment inflows, boosting market sentiment.

• Risk Perception: Foreign investors closely monitor political developments to assess the risk associated with their investments. Increased political risk due to unstable government outcomes can lead to foreign investor outflows and negative sentiment.

Recent Market Reactions

• Recent Sentiment: The CSE has experienced mixed sentiment in recent months, with periods of bullish trends followed by caution due to political and economic uncertainties. For instance, the ASPI surpassed the 12,000-point mark, reflecting strong investor

sentiment, but also faced sessions of subdued activity and profit-taking (Daily FT) (DailyFT) .

• Net Foreign Buying: There have been significant instances of net foreign buying, indicating

foreign investor confidence at times, though this has been interspersed with periods of net foreign selling, reflecting cautious sentiment (Daily FT) (Daily FT) .

Elections are expected to have a substantial impact on the sentiment of the Colombo Stock Market. The outcomes will shape investor confidence, influence market volatility, and affect foreign investment flows. Monitoring the political developments and the resulting economic policies will be crucial for understanding market sentiment in the post-election period.

Download Full Report Free (19 Pages):

https://lankabizz.net/product/stock-market-analysis/

ResearchHUB

ResearchHUB is a Digital Market Place to purchase AI generated Research & Analytical Reports of Sri Lankan Companies and Industries. Research HUB also provide Exclusive Research Reports on Colombo Stock Market and Listed companies on periodic basis.

Download More Research Reports and update visit ResearchHUB

https://lankabizz.net/shop/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home