Many people think trading is the simplest way of making money in the stock market. Far from it; I believe it is the easiest way of losing money. There is an old Wall Street adage, that “the easiest way of making a small fortune in the markets is having a large fortune.”

I discuss below 7 ways of undisciplined trading which lead to losses. Guard against them, or the market will wipe you out. I am qualified to speak on this subject because I was myself an undisciplined trader for a CONSIDERABLE time and the market hammered me into line and forced me to change my approach...

1. Trading during the first half-hour of the session

The first half-hour of the trading day is driven by emotion, affected by overnight movements in the global markets, and hangover of the previous day’s trading. Also, this is the period used by the market to entice novice traders into taking a position which might be contrary to the real trend which emerges only later in the day.

Most experienced traders simply watch the markets for the first half of the day for intraday patterns and any subsequent trading breakouts.

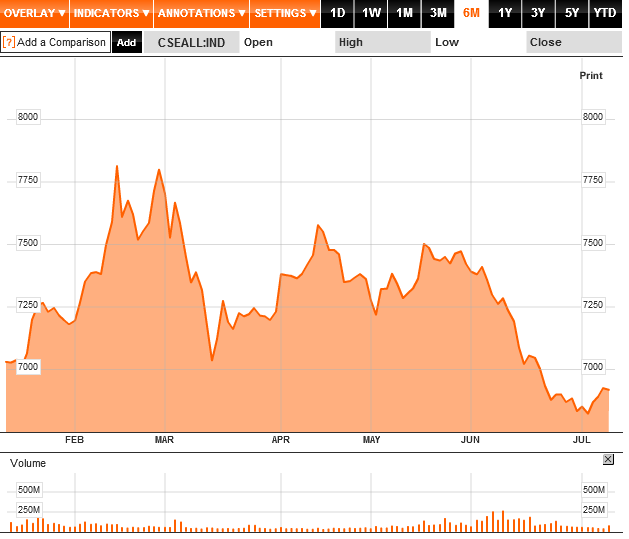

2. Ignoring which phase the market is in

It is important to know what phase the market is in — whether it’s in a trending or a trading phase. In a trending phase, you go and buy/sell breakouts, but in a trading phase you buy weakness and sell strength.

Traders who do not understand the mood of the market often end up using the wrong indicators in the wrong market conditions. This is an area where humility comes in. Trading in the market is like blind man walking with the help of a stick.

You need to be extremely flexible in changing positions and in trying to develop a feel for the market. This feel is then backed by the various technical indicators in confirming the phase of the market. Undisciplined traders, driven by their ego, often ignore the phase the market is in.

3. Failing to reduce position size when warranted

Traders should be flexible in reducing their position size whenever the market is not giving clear signals. For example, if you take an average position of 3,000 shares in Nifty futures, you should be ready to reduce it to 1,000 shares.

This can happen either when trading counter trend or when the market is not displaying a strong trend. Your exposure to the market should depend on the market’s mood at any given point in the market. You should book partial profits as soon as the trade starts earning two to three times the average risk taken.

4. Failing to treat every trade as just another trade

Undisciplined traders often think that a particular situation is sure to give profits and sometimes take risk several times their normal level. This can lead to a heavy drawdown as such situations often do not work out.

Every trade is just another trade and only normal profits should be expected every time. Supernormal profits are a bonus when they — rarely! — occur but should not be expected. The risk should not be increased unless your account equity grows enough to service that risk.

5. Over-eagerness in booking profits

Profits in any trading account are often skewed to only a few trades. Traders should not be over-eager to book profits so long the market is acting right. Most traders tend to book profits too early in order to enjoy the winning feeling, thereby letting go substantial trends even when they have got a good entry into the market.

If at all, profit booking should be done in stages, always keeping some position open to take advantage of the rest of the move. Remember trading should consist of small profits, small losses, and big profits. Big losses are what must be avoided. The purpose of trading should be to get a position substantially into money, and then maintain trailing stop losses to protect profits.

Most trading is breakeven trading. Accounts sizes and income from trading are enhanced only when you make eight to ten times your risk. If you can make this happens once a month or even once in two months, you would be fine. The important point here is to not get shaken by the daily noise of the market and to see the market through to its logical target.

Remember, most money is made not by brilliant entries but by sitting on profitable positions long enough. It’s boring to do nothing once a position is taken but the maturity of a trader is known not by the number of trades he makes but the amount of time he sits on profitable trades and hence the quantum of profits that he generates.

6. Trading for emotional highs

Trading is an expensive place to get emotional excitement or to be treated as an adventure sport. Traders need to keep a high degree of emotional balance to trade successfully. If you are stressed because of some unrelated events, there is no need to add trading stress to it. Trading should be avoided in periods of high emotional stress.

7. Failing to realise that trading decisions are not about consensus building

Our training since childhood often hampers the behaviour necessary for successful trading. We are always taught that whenever we take a decision, we should consult a number of people, and then do what the majority thinks is right. The truth of this market is that it never does what the majority thinks it will do.

Trading is a loner’s job. Traders should not talk to a lot of people during trading hours. They can talk to experienced traders after market hours but more on methodology than on what the other trader thinks about the market.

If a trader has to ask someone else about his trade then he should not be in it. Traders should constantly try to improve their trading skills and by trading skills I mean not only charting skills but also position sizing and money management skills. Successful traders recognise that money cannot be made equally easily all the time in the market. They back off for a while if the market is too volatile or choppy.

Excerpt from: How to Make Money Trading Derivatives by Ashwani Gujral.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home