The study, which was based on the Dubai Multi-Commodity Centre (DMCC) report, said gold traded through the Dubai Gold and Commodities Exchange (DGCX) had experienced healthy volumes in May 2011 the number of contracts increased 39 per cent year-on-year to 60,638.

According to the DGCX report, gold contracts in April increased 49 per cent year-on-year to 46,295, while in March they rose 51 per cent year-on-year.

More than 1,100 jewellery companies are active in the gold trade, the Dubai Chamber's database shows, including seven gold and precious metal manufacturing companies, three gold refineries and four gold and precious metal testing labs.

Article continues below

Gerhard Schubert, head of precious metals at Emirates NBD, told Gulf News: "The UAE has experienced healthy growth in the gold trade as Dubai alone represents 16 per cent of world gold trading volumes. Net local demand for gold increased by 3 per cent."

Convenient position

He pointed out that geographically and historically, Dubai is in a significant position as far as gold is concerned as its years of expertise have developed the emirate into an important hub for precious metal trading.

"Dubai is the most important logistics market for the gold trade and has no competitor regionally. It is the perfect platform for the gold trade."

Despite the volatility in which gold prices touched $1,593.60 (Dh5,853) per ounce recently, Schubert believes gold will continue to be in increasing demand amid global uncertainty relating to Europe's debt crisis and political tensions in the Middle East.

"Global uncertainty continues to maintain gold demand as a hedge against the unforeseen," Schubert said.

He attributed the rise in gold prices to investor demand for a safe haven among concerns about fiscal imbalances and the current political tensions.

"Not only [a move] toward wealth preservation, but also because investors with gold in their portfolios will be more comfortable with a return to risk assets."

Gold demand and supply has witnessed a unique balance in the face of economic volatility and uncertainty, allowing gold to move more independently from other assets.

While Schubert said political unrest in Libya and Syria had a direct impact on oil prices, the European debt crisis was the most influential aspect behind the hike in gold prices.

"Moreover, gold's crucial cycle will continue to have a dominant investment role for the next two years at least," he said.

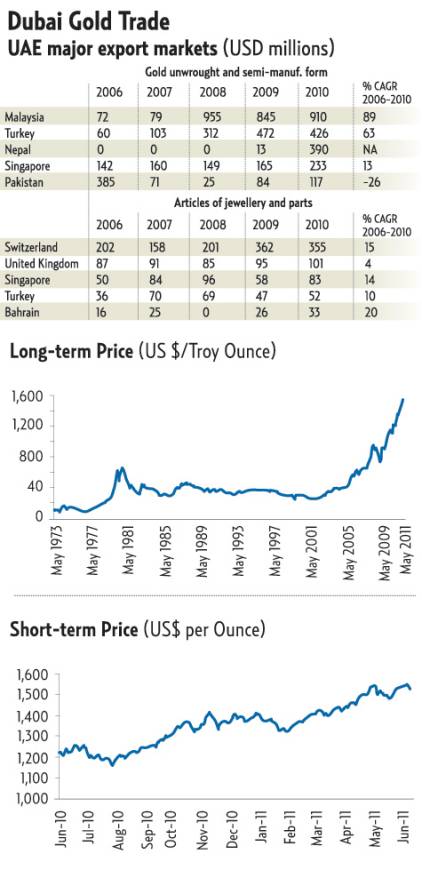

The study also indicates that in 2010, the UAE's most important export markets for raw and semi-manufactured gold were Malaysia, Turkey and Nepal.

Switzerland, the United Kingdom and Singapore were also among the UAE's major export markets for gold jewellery.

Malaysia, Turkey and Bahrain were among the fastest growing export markets with compound annual growth rates in the 2006-2010 period of 89 per cent, 63 per cent and 20 per cent respectively.

Source: http://gulfnews.com/business/surging-gold-prices-reflect-global-uncertainty-1.839691

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home