RENU has always been in my dream to collect and failed several attempts..

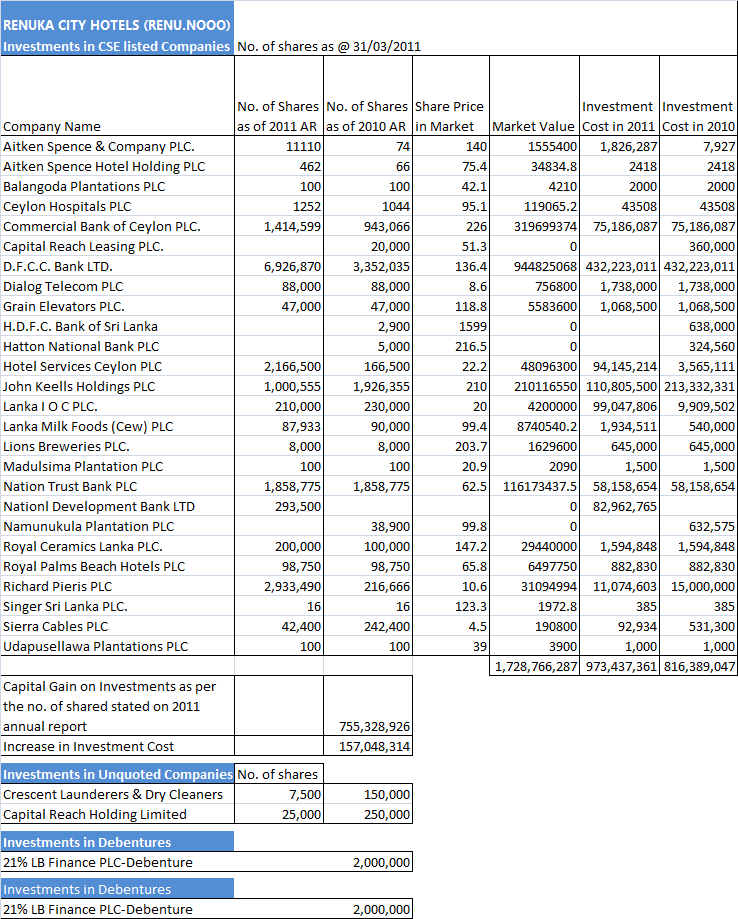

This is not a comprehensive analysis, just a briefing on their investments..

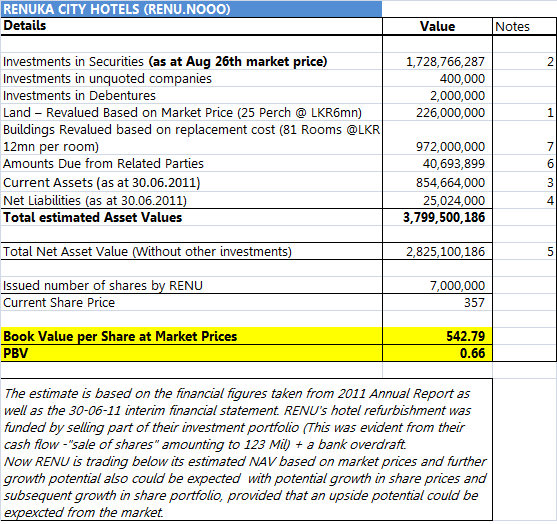

Now we're coming to the interesting part, if my calculations are correct this is now trading below its modest NAV (adjusted to their investment portfolio value)

Note;

1) As per the independent valuation conducted by a professionally qualified independent valuer Mr. T. Hilmy Farook on 19th June 2010 the fair market value of property bearing assessment no. 326, Galle Road, Colombo 3 is Rs. 226,000,000. However the the Company policy is to record its Property, Plant and Equipment at Cost. Therefore; this value has not been recorded in the Financial Statements.

2) Investments at Market value are based on the major investments as per 2011 AR. It was evident that RENU has sold some of its shares for the renovation of Hotel and also added NDB and few others during 2011. The hotel refurbishment cost was 125 Mn and was 80% funded by investments + a bank overdraft (42 Mn). However this portion has not been taken into account as I beleive their AR highlights the shares outstanding a post refurbishment portfolio.

Further to get a more accurate figure the market price of shares has been revalued to 26th August 2011 market value.

However the the Company policy is to record its investments @ cost.

3) Current Assets were taken from the 3th June 2011 Interim financial report. It includes Trade & Other recievables + Cash + Inventories + Pre-Payments.

4) Net Liabilities include Non-Current Liabilities of 7.9Mn + Current Liabilities of 17.1 Mn as @ 30 June 2011 Interim financial report.

5) NAV (without other investments) - This means NAV without (Investments in unquoted companies + Investments in Debentures).

6) Amount due from Related Parties - Company has granted a loan amounting Rs. 325,551,194 (AUD 2,911,386) during the year to REN Pty Limited which is incorporated in Australia. Interest rate on this loan is 5% to 7% per annum. This loan is totally repayable by 30 th March 2019. A first ranking fixed and floating debenture charge over all of the undertakings of the borrower is the security to this loan.

Only a part of this value was taken into consideration due to the time period of settlement being 8 long years. (325,551,194 / 8 = 40,693,899.25)

7) Building re-valuation was taken from Asia Securities Valuation Document in May 2010. It is to be noted that the building could go under depreciataion but the land value could appreciate.

source - http://www.asiacapital.lk/pdf/TourismSectorReport.pdf

Based on the above calculations, RENU to me is trading at a significant discounted price to the NAV based on market value of assets as of 30 June 2011.

P.S. I've got some RENU shares which I collected a week back.

Last edited by smallville on Thu Sep 01, 2011 9:28 am; edited 4 times in total (Reason for editing : Updated the calculations as per the 2011 AR. Revaluation of Assets have also been done accordingly.)

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home