DS Wijesinghe wrote:ranferdi wrote:Maharaja wrote:Maharaja wroteranferdi wrote:Ranferdi WroteMaharaja wrote:Try to understand - Everyone who has big accounts are finding buyers to exit the portfolios.

Foreigners are struggling to clear accounts.

But no one wants to buy because 98% of company performance is declining. (except exporting companies). Country's economy is collapsing.

Whats the solution ? Putting epf money to this crashing stock market and loosing tax payer money.

It will not stop the market decline.

eg: JKH Main shareholder wants to sell stake. EPF not big even to buy 20% of that stake.

Maharaja

You are telling JKH main stake holder wants to sell and EPF is not enough to buy 20% of that...… This is a lie.

JKH total market capitalization is 195 Billion, Total EPF Fund value is 1281 Billion... Your sole intent is to lie deceive and drag the market down. To vandalize economy and then to bring back MARA.....

Its very hard when you dont have proper knowledge.

Each time like children you cry.

A fund cannot invest like retailers invest. There are rules and committee guidelines. Khazanah holds 10% + of jkh /19.5 Bn, epf cannot buy such big stake unless their portfolio rules change.

epf Fund value means - epf market cap. and not cash at hand. Learn the difference.

So as i said this is not a solution and will not stop ASI falling

Maharaja

I know EPF is not going to put all their monies into market. But As I know they have setup guidelines now.. I am not aware what is the cap for Share market investments. But this action will definitely bring life to market. My problem is you always not looking at the positive side but only negative side.

Ranferdi you proudly call others uneducated and imply that you are so educated. But when we read the above conversation between you and Maharaja it is evident your level of education/un-education

In fact Maharaja has exposed your level of education/un-education and your ability/inability to understand macro economic issues

What is proven in above communication is that Maharaja is misappropriating the JKH value and EPF net worth. even if epf allows 20% cap they can absorb JKH shares held for sale with the investor.

Do you think maharaja is so fool to tell EPF cannot

""You are telling JKH main stake holder wants to sell and EPF is not enough to buy 20% of that...… This is a lie.

JKH total market capitalization is 195 Billion, Total EPF Fund value is 1281 Billion...""

see below 20% of 1285 billion is 256 billion.. can easily absorb total JKH market cap.

Prove if this is wrong..

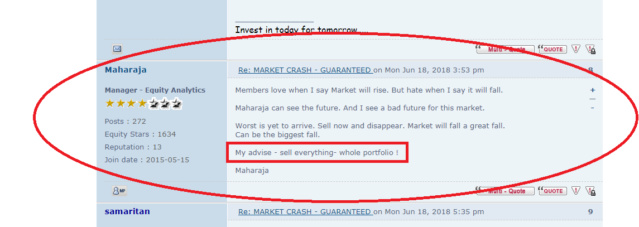

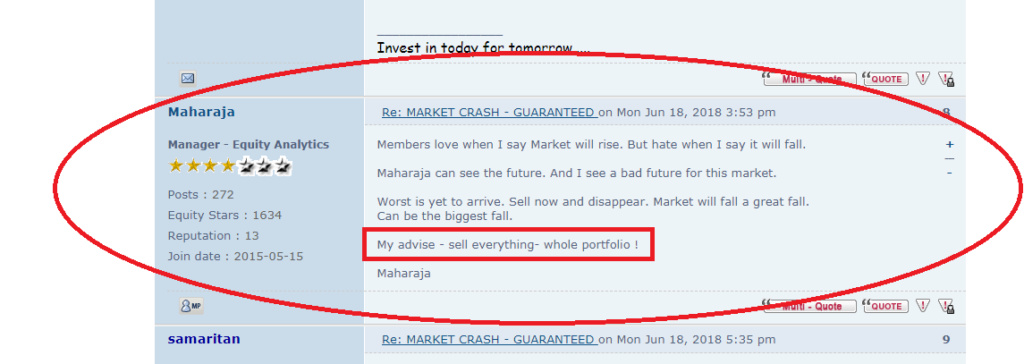

Maharaja is not fool but plays cunning tricks to bring markets down

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

The former SEC Chairman has not named the 17 companies that he placed under investigation. But he hinted at their identities by citing cases where prices had dramatically risen between the end of 2009 and end of 2010. Over that year, the share prices of Dankotuwa Porcelain, Blue Diamonds, Asian Alliance Insurance, Lanka Hospitals and HVA Foods stock increased by 226, 270, 177, 204 and 394 per cent respectively.

The former SEC Chairman has not named the 17 companies that he placed under investigation. But he hinted at their identities by citing cases where prices had dramatically risen between the end of 2009 and end of 2010. Over that year, the share prices of Dankotuwa Porcelain, Blue Diamonds, Asian Alliance Insurance, Lanka Hospitals and HVA Foods stock increased by 226, 270, 177, 204 and 394 per cent respectively. The UDA is central to the Government plans to develop Colombo as a major “commercial hub,” primarily through the eviction of some 70,000 shanty dwellers. The security forces have already forcibly removed hundreds of families.

The UDA is central to the Government plans to develop Colombo as a major “commercial hub,” primarily through the eviction of some 70,000 shanty dwellers. The security forces have already forcibly removed hundreds of families.