No of Shares 120,000,000

Public holding = 49%

Last edited by sriranga on Wed Jan 22, 2014 9:23 am; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

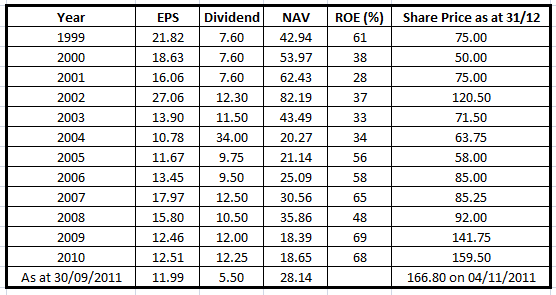

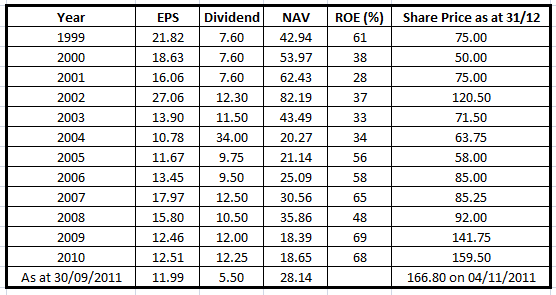

Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Nov 06, 2011 11:23 pm

Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Nov 06, 2011 11:23 pm

Last edited by sriranga on Wed Jan 22, 2014 9:23 am; edited 1 time in total

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Nov 06, 2011 11:40 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Nov 06, 2011 11:40 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Nov 06, 2011 11:54 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Nov 06, 2011 11:54 pm

Rajaraam wrote:According to the figures EPS is coming down and the share price is going up. Isn't it?

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 3:10 am

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 3:10 am

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 3:27 am

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 3:27 amThanks a lot for your feedback.slstock wrote:

Thanks Sriranga.

But is 2004 Dividend amount correct?

Also can you please let me know the references you used to find this data?

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 3:47 am

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 3:47 am

sriranga wrote:Thanks a lot for your feedback.slstock wrote:

Thanks Sriranga.

But is 2004 Dividend amount correct?

Also can you please let me know the references you used to find this data?

Really appreciate.

I found the info from their Annual report.

Please find below the snapshot from their annual report.

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 3:55 am

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 3:55 amslstock wrote:sriranga wrote:Thanks a lot for your feedback.slstock wrote:

Thanks Sriranga.

But is 2004 Dividend amount correct?

Also can you please let me know the references you used to find this data?

Really appreciate.

I found the info from their Annual report.

Please find below the snapshot from their annual report.

2004 Eps 10.78

2004 Dividend RS 34

Looks like they disposed some assert and paid a thumping dividend in 2004.

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 4:13 am

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 4:13 am

sriranga wrote:slstock wrote:sriranga wrote:Thanks a lot for your feedback.slstock wrote:

Thanks Sriranga.

But is 2004 Dividend amount correct?

Also can you please let me know the references you used to find this data?

Really appreciate.

I found the info from their Annual report.

Please find below the snapshot from their annual report.

2004 Eps 10.78

2004 Dividend RS 34

Looks like they disposed some assert and paid a thumping dividend in 2004.

If we notice their Balance Sheet year 2003 the reserve was 2,009,326,000.

In 2004 that was reduced to 616,123,000.

I'm not 100% sure, instaed of giving bonus share they gave cash dividend.

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 8:16 am

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 8:16 am

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 9:52 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 9:52 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 11:33 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Mon Nov 07, 2011 11:33 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Sep 02, 2012 5:45 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Sep 02, 2012 5:45 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Sep 02, 2012 6:22 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Sep 02, 2012 6:22 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Sep 02, 2012 9:29 pm

Re: Chevron Lubricants Lanka PLC - LLUB Dividend from 1999 Sun Sep 02, 2012 9:29 pm

FINANCIAL CHRONICLE™ » CORPORATE CHRONICLE™ » Chevron Lubricants Lanka PLC - LLUB Dividend from 1999

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum