would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

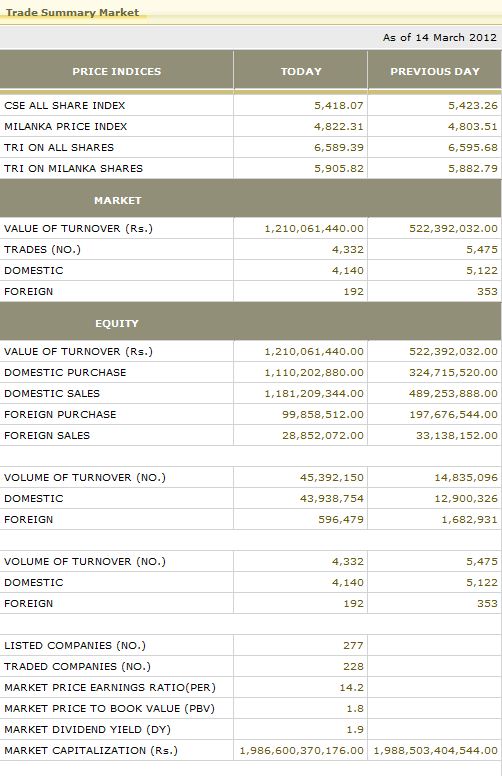

Re: Trade Summary Market 14/03/2012 Wed 14 Mar 2012 - 14:23

Re: Trade Summary Market 14/03/2012 Wed 14 Mar 2012 - 14:23 Re: Trade Summary Market 14/03/2012 Wed 14 Mar 2012 - 14:40

Re: Trade Summary Market 14/03/2012 Wed 14 Mar 2012 - 14:40

Re: Trade Summary Market 14/03/2012 Wed 14 Mar 2012 - 14:44

Re: Trade Summary Market 14/03/2012 Wed 14 Mar 2012 - 14:44

wiser wrote:Continuously Foreigners are net buyers. May be due to USA announced 5 years recession has finished. USA Markets already given buy signal. Good sign for us as well.

Re: Trade Summary Market 14/03/2012 Wed 14 Mar 2012 - 14:54

Re: Trade Summary Market 14/03/2012 Wed 14 Mar 2012 - 14:54 Trading Wednesday - Sri Lanka stocks close flat, rupee weaker Wed 14 Mar 2012 - 15:07

Trading Wednesday - Sri Lanka stocks close flat, rupee weaker Wed 14 Mar 2012 - 15:07

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum