SC Securities is advising the public that the time is right for investing in the Colombo stock market due to a host of fundamental reasons. This recommendation is contained in the SC Securities special report titled ‘Equity Focus: Sector roundup and stock recommendations’. Here are excerpts:

Sri Lanka economy

The Sri Lankan economy, which was battered by the three-decade long armed conflict, witnessed a solid resurgence in 2010 with a GDP growth of 8%. The favourable macroeconomic environment that was created after the end of the war resulted in increased economic activity levels among corporates as well as individuals resulting in a higher GDP growth of 8.3% in 2011, the best performance post-independence.

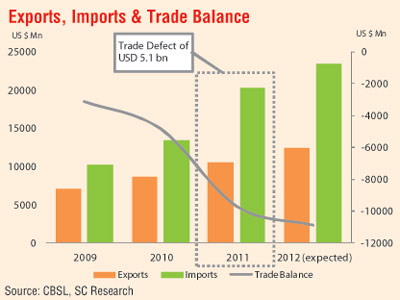

The country’s economy depends heavily on imports thus the rise in economic activity levels resulted in a substantial rise in the import bill which was further worsened by the sharp increase in global crude oil prices.

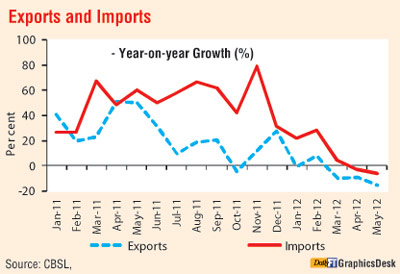

Exports, which witnessed a steady growth of 22.4% in 2011 (21.7% growth in 2010), however was insufficient to counter the adverse effects caused by the sharp rise in imports in 2011, which ballooned by 50.68% resulting in an abrasive situation with the balance of payments of the country. The dollar peg that the Government was maintaining, which was a highly unsustainable action too resulted in severe drains in the country’s foreign reserves.

The Government however took a few bold but imperative decisions in order to address the economic concerns that were threatening to cause detrimental effects to the country. We believe it would take at least six to 12 months to witness the positive impact of the corrective measures that the government has taken in order to address the economic concerns that arose in the latter part of 2011.

The low interest regime witnessed during 2011 was a conducive factor for economic activity levels to rise in the country. This propelled the appetite for credit especially by the private sector to high levels in 2011. Private sector credit growth reached close to 34%, over and above the anticipated level.

Trading activity based on imported goods witnessed a steep increase during the year which included motor vehicle imports and consumer goods. Total imports in 2011 grew by 50.68% to US$ 20.27 b as opposed to a growth of 31.78% in 2010. The countries export earnings recorded a steady growth of 22.4% to US$ 10.56 b but could not avoid the depreciation pressure on the rupee as the trade deficit surged to US$ 9.7 b by the end of 2011.

The government depreciated the rupee by 3% in November 2011 in trying to combat the high demand for imported goods but the adjustment fell short of any material change to the situation where the rupee continued to face severe pressure from the unwarranted import expenditure.

The Government in early 2012 took a few bold but vital policy decisions to counter the unfolding adverse economic situation. The corrective measures were imperative and focused primarily on reducing the excessive credit growth which propelled unwarranted import expenditure.

The central bank also limited their intervention in the forex market thus allowing a flexible exchange rate instead of the dollar peg which helped the official reserves to improve. The corrective measures taken were

* Increasing the vehicle importation tax by a large degree

* Adopting a flexible exchange rate

* Increasing the Government’s policy rates,

* Increasing fuel prices,

* Imposing a ceiling on the loan growth of commercial banks

* Directing commercial banks to limit their credit exposure on loans for vehicle purchases

* Increasing electricity charges to allow the State-run Electricity Board to reduce its losses.

We believe the actions taken by the Government will address the economic concerns but would take at least a further six to 12 months to counter the adverse impacts that caused an abrasive situation in the economy in late 2011/early 2012.

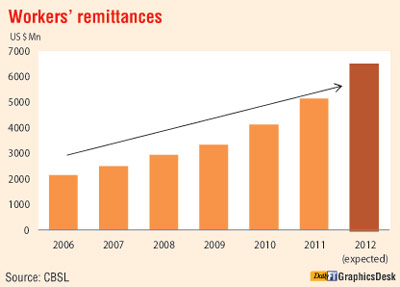

Worker remittances in 2012 which is expected to grow by 25% to US$ 6.5 b will assist to sustain the trade deficit to the levels recorded in 2011 without allowing it to balloon up sharply while increased earnings from the tourism sector too will help the situation further.

Interest rates remained low during most part of 2011 with the benchmark hitting a low of 6.98% in March 2011. However during the latter part of 2011 interest rates witnessed a gradual rise while from the beginning of 2012 the rates saw a steep climb as the Central Bank revised its policy rates twice during a period of two months to 7.75% (Repo) and 9.75% (Reverse repo) in order to curtail the unwarranted credit growth to meet its targets set for the end of 2012. We believe the rise in interest rates could continue with a further upward revision in the policy rates being a probability.

However the 2nd quarter of 2012 will be a key indicator in deciding the requirement for a further revision in the policy rates.

The rupee after being free floated in February 2012 depreciated by 18% since November 2011 (after the rupee was depreciated by 3% according to a 2012 Budget proposal) as the country’s import bill put the rupee under severe pressure. However the rupee witnessed a recovery in July 2012 backed by a US$ 1 billion sovereign bond issue which was oversubscribed. We believe the rupee will stabilise between Rs. 127.00 to Rs. 132.00 against the US$.

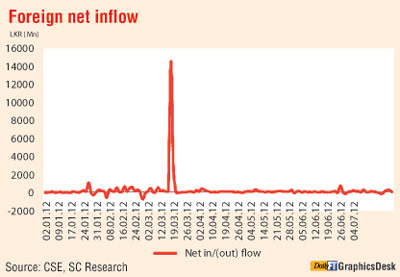

The stock market operations are a vital avenue for dollar inflows. The Central Bank expects net foreign inflows to be around US$ 500 m in 2012. Foreign net inflows had reached US$ 190 m by the end of July 2012.

We believe foreign inflows will continue to be dominant during the reaming five months of 2012 as the Sri Lankan equities will be able to attract foreign interest since the pricing of most of the fundamentally sound company shares are attractive.

We believe the Hotel, Banking, Food & Beverage, Diversified & Manufacturing sectors will continue to denote solid performance & will be in the forefront in enhancing net foreign inflows in the Colombo Stock Exchange.

Sri Lanka Equities – Colombo Stock Exchange

The Colombo Stock Exchange (CSE) has been experiencing an uninspiring run lately after two memorable years which saw the Colombo Stock Exchange (CSE) end among the top two performing exchanges in the world for two consecutive years. The CSE recorded unprecedented growths of 125% and 96% in 2009 and 2010 respectively. The CSE ended year 2011 on a totally different pitch, recording a negative growth of 8.5%. Activity levels too suffered considerably as investor sentiment eroded as the year progressed.

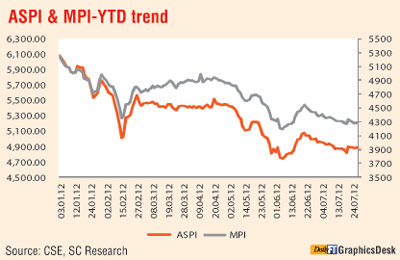

Year 2012 too has not brought a change to the dull sentiment although a few strategic deals took place in blue chip counters. The benchmark index, All Share Price Index (ASPI) which is currently at 4900 levels, has witnessed a notable correction of 37% from its peak of 7800 points in mid February 2011.

The market entered a reasonable valuation platform as the earnings multiple (PER) dropped to 12x as opposite to +28x PER recorded during the peak.

Further, 1Q/4QFY12 corporate earnings moderately enhanced market valuations. However, we anticipate 2Q12/1QFY13 earnings to get affected by recent policy changes to a certain extent.

The attractive market valuations along with steeply discounted share prices (to their fundamental value) have attracted foreign investor interest. Foreign buying has augmented considerably during this year to Rs. 40.82 b against YTD foreign sales of Rs. 16.25 b resulting in YTD net inflow of Rs. 24.58 b. This is a definite plus factor for Sri Lanka equities.

However domestic investors remain on the sidelines, presumably being jittery about the current situation of the economy.

Recent policy changes could affect short to medium term projections

As discussed under economy, the Government has taken few bold measures to avoid a fresh BoP crisis. As a consequence of this, the economy growth is expected to slow down during 2012. The steep rise in interest rates along with the rise in the US Dollar against the Rupee has painted a negative picture in the minds of the investors apart from other concerns over the situation of the economy.

Further, the rising interest rates are likely to result in retail investors shifting their assets from equity investments to less risky and risk free investments (fixed deposits, short term Treasury Bills) in the short to medium term.

The above facts are likely to affect the short term outlook of the equity market as they have caused a negative sentiment among the domestic investors. Further the expected slowdown in corporate earnings also could affect the short term outlook of the Sri Lankan equity market.

Healthy long term outlook

The current situation has resulted in the CSE to underperform although certain shares are trading at a steep discount to their fundamental value, thus creating an ideal situation for long term investors to accumulate value stocks.

We believe the economic situation would improve during the next six to 12 month period with the Government’s bold measures paving way to a more stable and solid growth phase which we believe would result in the CSE performing better. Investing in the CSE at a time like this would enhance one’s return on investment since certain shares that are backed with fundamentals and have the potential to beat the average market returns are trading at an attractive price.

We anticipate companies will relook their future strategy to maximise the medium to long term profitability, hence we foresee corporate earnings to improve in late FY13E-early FY14E. We also expect corporate profits to grow at 10-15% on average during the same period.

It’s also noteworthy that some of these fundamentally sound shares that have the potential to

improve their financial performance in the medium to long term are trading at near or below their book value per share.

Further investing now when the market is down and dull would also give an investor that extra advantage of exiting when the market is performing well and when there are copious buyers for the particular value stocks. ‘Buying when there’s blood in the streets’ and also ‘avoiding the herd’ strategies could enhance the return on investments greatly, thus we believe buying before hand of a potential upturn could be a worthy action.

Sector performance

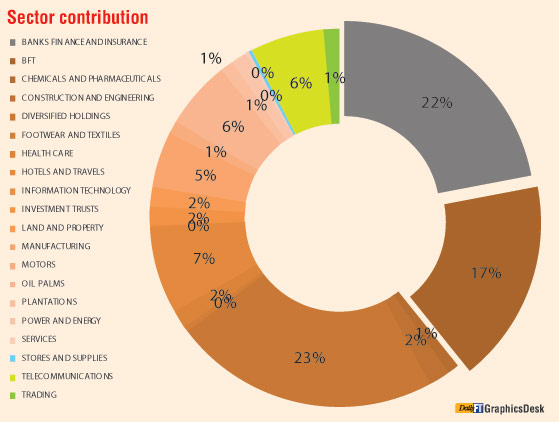

The CSE, with a total of 285 companies listed across 21 sectors, had a total market capitalisation of Rs. 1877.0 b (US$ 14.3 b) as at 16 August 2012. The All Share Price Index (ASPI) acts as the benchmark index of the Colombo Bourse, which has witnessed a 19% YTD drop. The Milanka Price Index (MPI), which tracks 25 liquid counters, has dipped 18% YTD. The newly introduced S&P SL20 index also tracks 20 liquid stocks in the CSE. The CSE is trading at a PER of 13.36x and operates at a PBV of 1.74x. The Dividend Yield of the market is 2.57%.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home