Sri Lanka is in total Disarray

- Market is near its rock bottom. (Near ASI 8000)

- Rupee is heavily Depreciated (USD 1=LKR 365/-)

- Interest Rates are at its highest (TB Rates around 24% p.a)

- Hotel industry is struggling (Less than 30,000 Tourist Arrival in May)

- Inflation has Sky Rocketed. (Official 39%, Unofficial 133%)

- Agriculture industry in disarray due to shortage of Fertiliser.

- Restriction on import of all luxury items and some essentials.

- No Fuel, Gas and Electricity due to enegery crisis. Crude Oil hits US$ 120 per Barrel in June 2022.

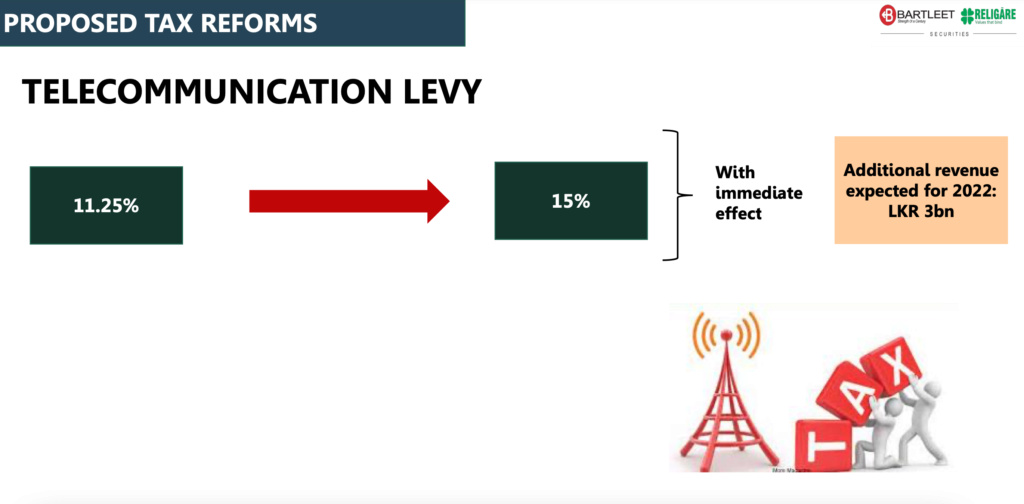

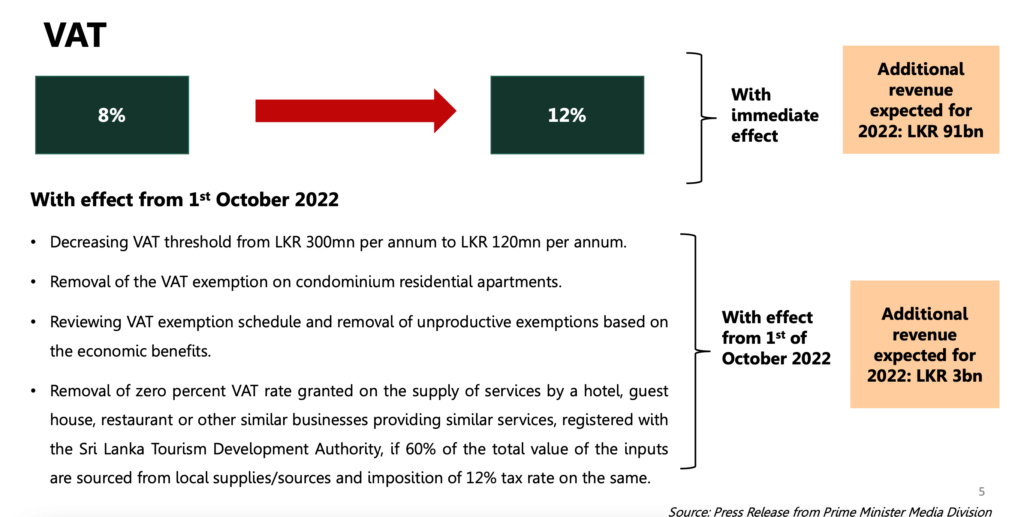

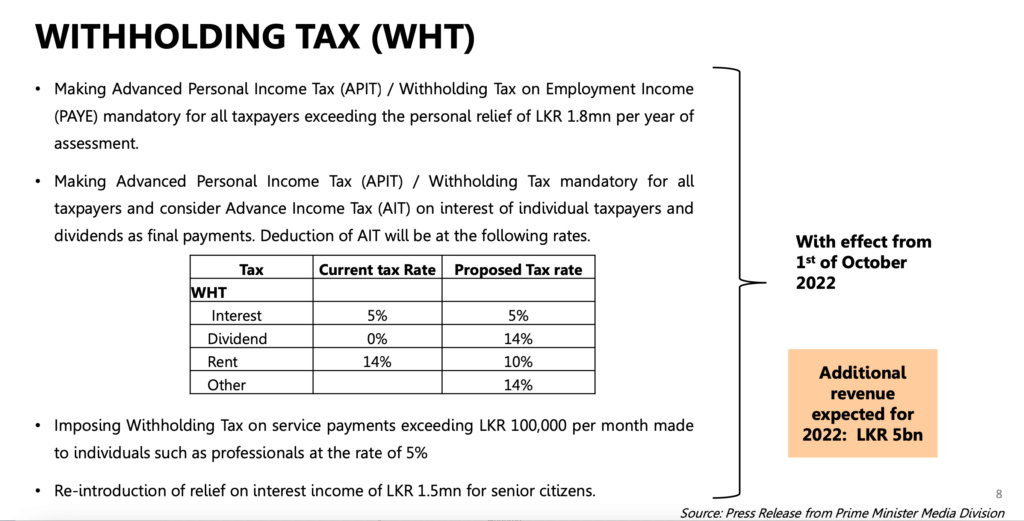

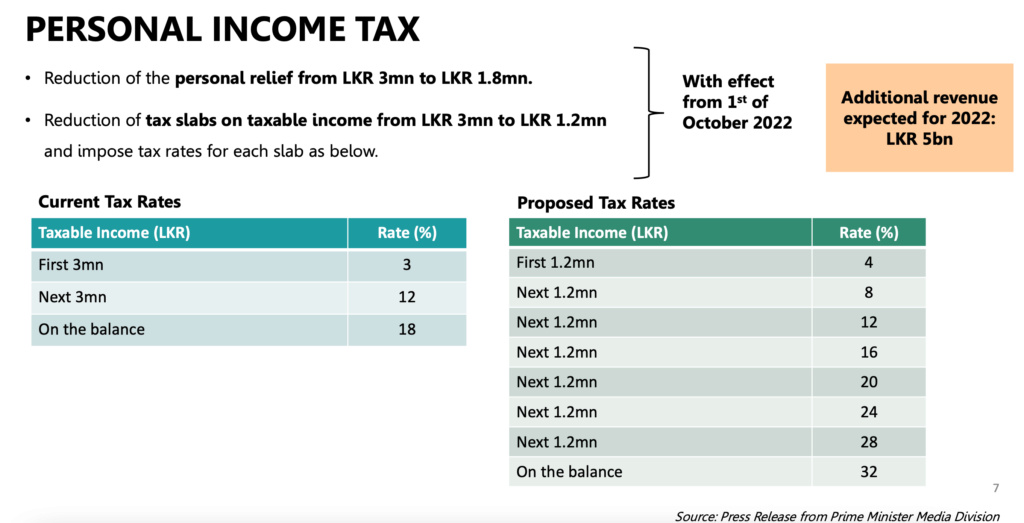

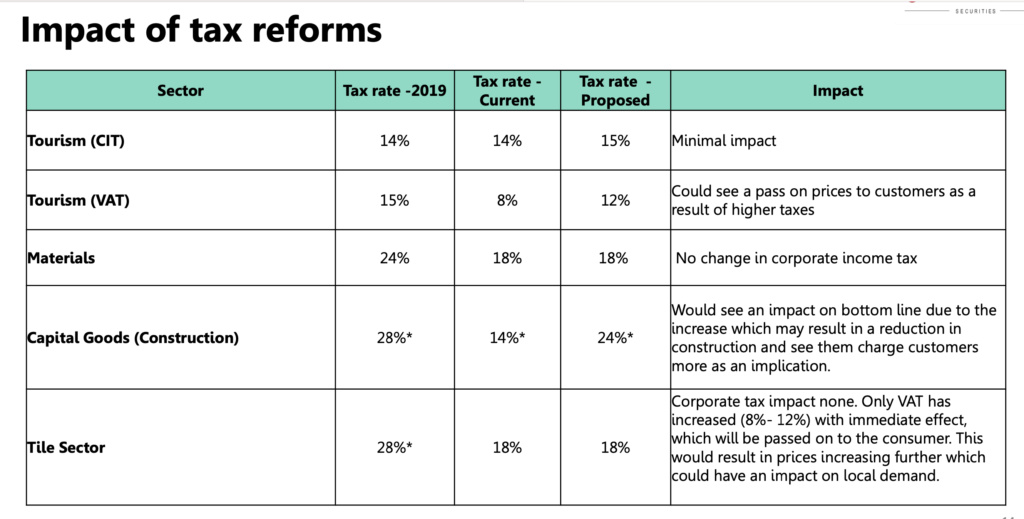

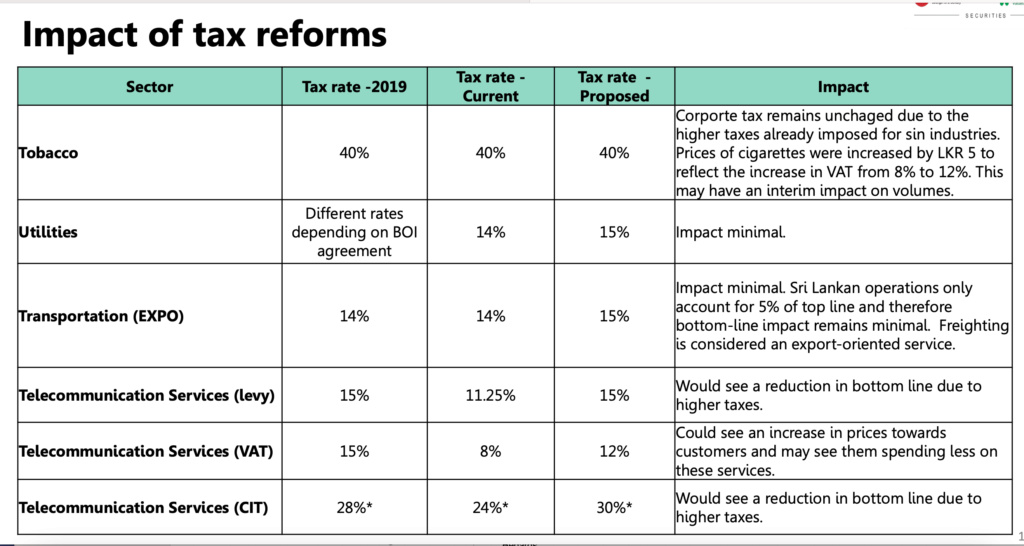

- Taxes to be increased. VAT, Corporate/Income Tax. VAT likely be increased to 18% and Corporate Tax to 35%

- Country is likely to face a food crisis in September 2022.

- Debt Default by Sri Lanka in year 2022, first time ever to happen since independence. Worst ever Credit rating in history.

- Foreign Currency Reserves near zero (US$ 50mn in May 2022).

- No notable Foreign Direct Investments.

- Foreign Inward Remittances at its lowest. Official remittances in January 2022 were down 61.6 percent from a year earlier to US 259.2 million

- Significant reduction in output of tea, rubber and other export crops. Production of finished tea fell by 4 million kilograms in the first quarter of this year.

- Industrial Production in Sri Lanka is at its lowest. Decreased by 13.61 percent in March of 2022 over the same month in the previous year.

Feel Free to add more and justify as to why investors should invest in the Colombo Stock Market at these level?

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home