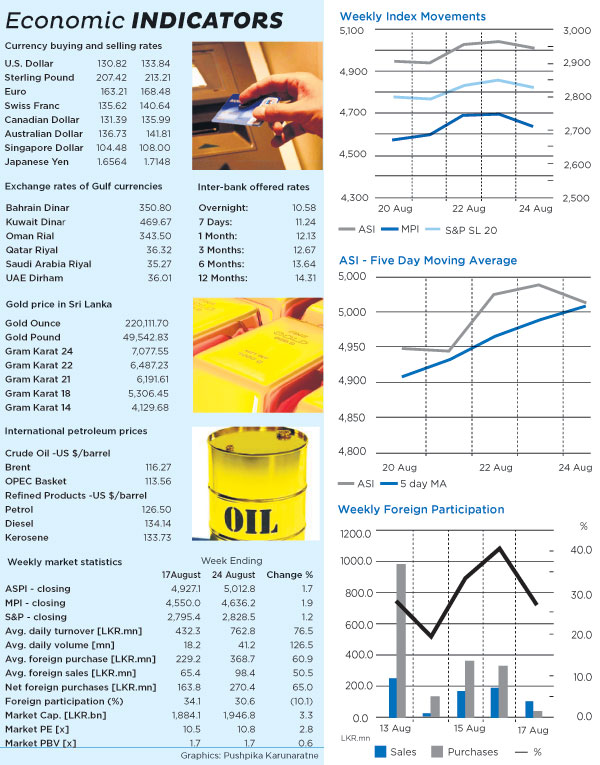

Market witnessed net foreign buying throughout the week with activity levels also picking up. John Keells Holdings provided the impetus to this weeks’ positive activity.

Market opened on Monday with large deals on Asiri Hospital Holdings and Asha Central. The positive momentum was seen continuing into this day. All indices closed higher with net foreign buying amounting to Rs. 980.2Mn with a formidable turnover of Rs. 1,763.4Mn.

The market saw mixed reactions on Tuesday but not before most counters showing active trading. Many fundamentally sound counters saw renewed investor interest. Foreign activity was lower on this day but foreigners remained net buyers.

Wednesday saw signs of a bull market with all indices gaining considerably. In the meantime, Treasury bill auction saw yields on the 6-month and 12-month bills rising. Foreigners remained net buyers on this day. Aitken Spence saw renewed activity at Rs. 110.00 levels.

John Keells Holdings dominated trading on Thursday with positive activity on the counter seemed to be rubbing off on other counters as well. The market lost steam towards the latter part of trading with indices closing in opposite directions. Foreign activity picked up on this day and foreigners remained net buyers.

The market took a breather on Friday with all indices closing in the red. John Keells failed to reach the Rs. 200.00 barrier and saw its shares trading at lower levels. Turnover was also lower Friday as only one private deal took place.

ASI dropped by 13.55 points (0.27%) to close at 5,024.60, MPI fell by 56.61 points (1.21%) to close at 4,636.21 and the S&P index dropped 16.62 points (0.58%) to close at 2,830.88. Turnover was Rs. 265.8Mn.

Notable contributors to turnover were John Keells Holdings with Rs. 73.9Mn, Distilleries with Rs. 25.7Mn and Commercial Bank with Rs. 21.9Mn. Most active counters for the day were Hydro Power Free Lanka, Distilleries and Browns Investments.

Notable gainers for Friday were Ceylinco Insurance up by 6.7% to close at Rs. 800.00, Hydro Power Free Lanka up by 4.8% to close at Rs. 6.50 and Vidullanka up by 2.8% to close at Rs. 3.70. Notable losers for the

day were Tess Agro down by 3.9% to close at Rs. 2.50, The Finance up by 2.9% to close at Rs. 20.10 and

First Capital down by 2.4% to close at Rs. 12.00.

Cash map for Friday was 63.0%. Foreign participation was 27.9% of total market turnover and foreigners were net sellers of Rs. 63.7Mn.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home