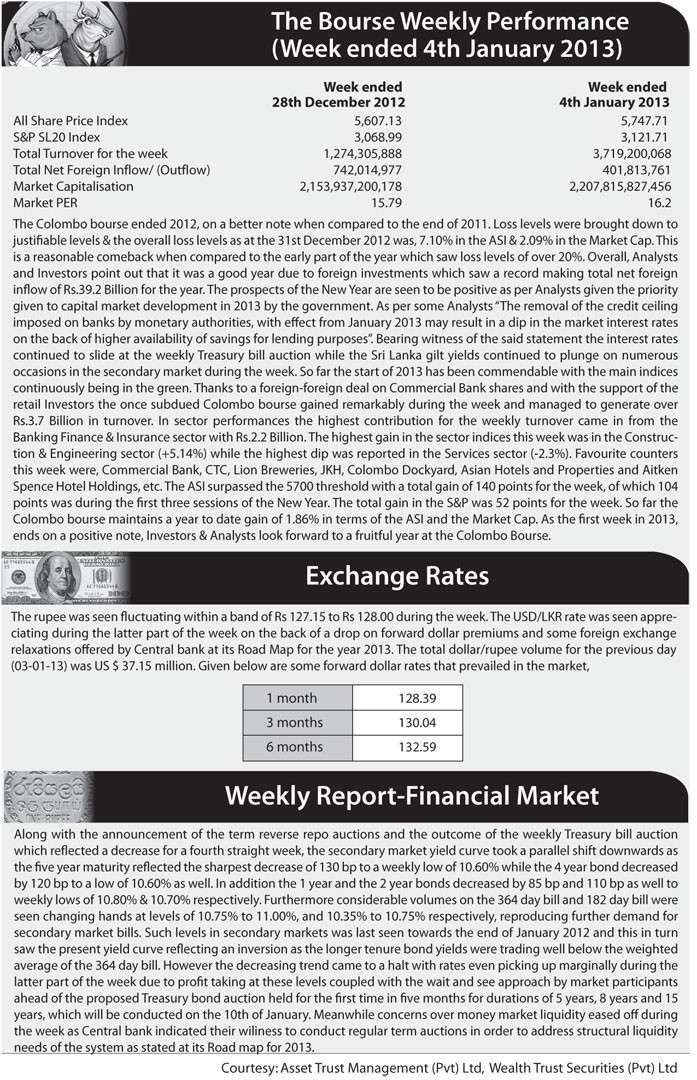

Noting that the market had built on the upward trend seen in the last week of 2012, the report said that the All Share Price Index had crossed 5,700 points for the first time in 12 weeks to record a week-on-week gain of 140.58 points.

Turnover levels too improved significantly over the 4-day trading week with large block trades in Commercial Bank and JKH helping to sustain volumes.

The daily average turnover hit Rs.0.9 billion last week against the previous week’s Rs.0.4 billion with foreign investor activity continuing to make positive strides and mid-week outflows last week offset by positive inflows of Rs.0.52 billion over the remainder of the week.

"Similar sentiment was likely to prevail in the week ahead," Acuity said.

Meanwhile the Central Bank which unveiled its 2013 Road Map setting out medium term monetary policy targets said its priority was to maintain inflation, particularly core inflation, at the mid single digits.

The bank estimated annual average inflation for 2012 at 7.4% with expectations of sustained declines in inflation coupled with continued fiscal consolidation which would imply lower rates.

It indicated that it would continue to systematically allocate EPF funds to the stock market, private equities and corporate debts.

The bank also highlighted its commitment to encourage equity and corporate debt markets to provide non-inflationary sources of funding to the economy.

The Central Bank had also relaxed several existing exchange control measures underscoring its commitment to maintain a stable but flexible rupee, Acuity said.

The bank had nevertheless indicated that intervention was possible in the event of sharp fluctuations.

The ASPI closed the week 2.51% (140.58 points) up while S&P SL20 gained 1.72% (52.72 points) last week.

Commercial Bank was the highest contributor to the week’s total turnover value accounting for Rs.1.44 billion or 38.75%. JKH contributed Rs.667.75 million or 17.95% while HNB accounted for 12.32% of the total market value contributing Rs.458.27 million.

Total turnover for the four-day trading week was Rs.3.72 billion against Rs.1.27 billion to the previous three-day week.’

John Keells Stockbrokers said in its Stock Market Weekly that the All Share Price Index trended higher during the first week of 2013 mainly on the back of gains on large caps with Commercial Bank, JKH and HNB accounting for 69% of the weekly turnover largely driven by crossings.

Foreign participation improved during the week resulting in a net inflow of Rs.401.8 million.

http://www.island.lk/index.php?page_cat=article-details&page=article-details&code_title=69720

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home