would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

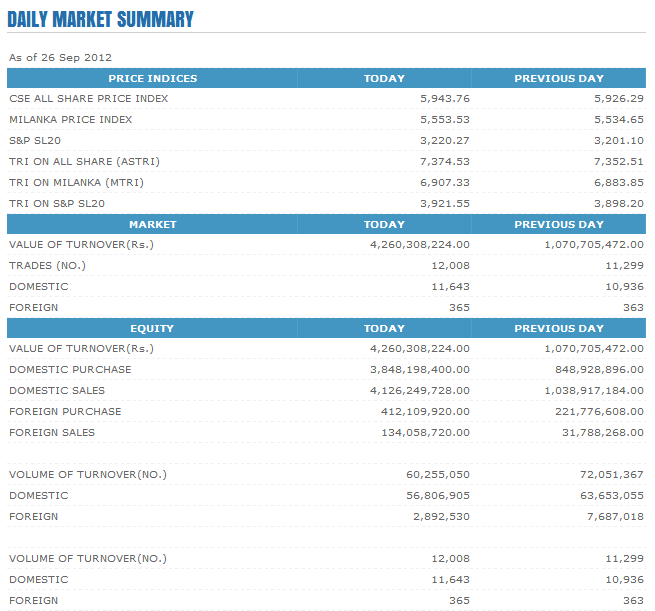

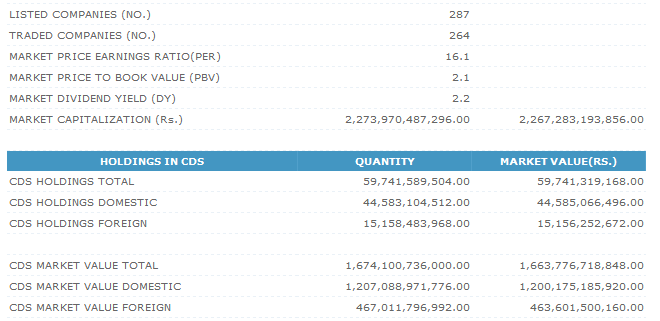

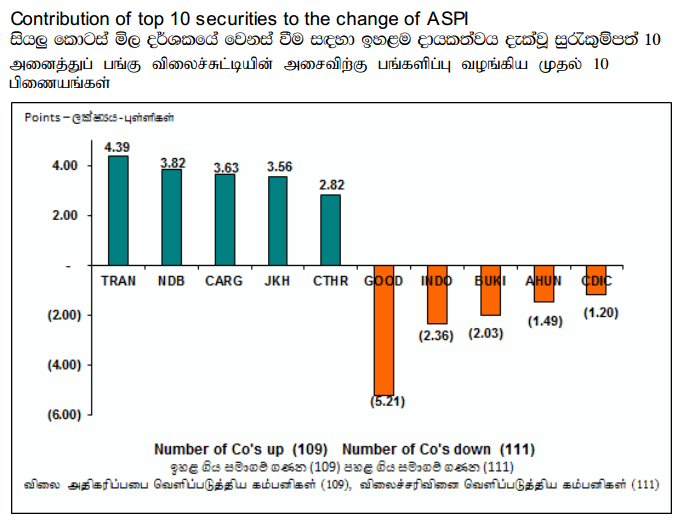

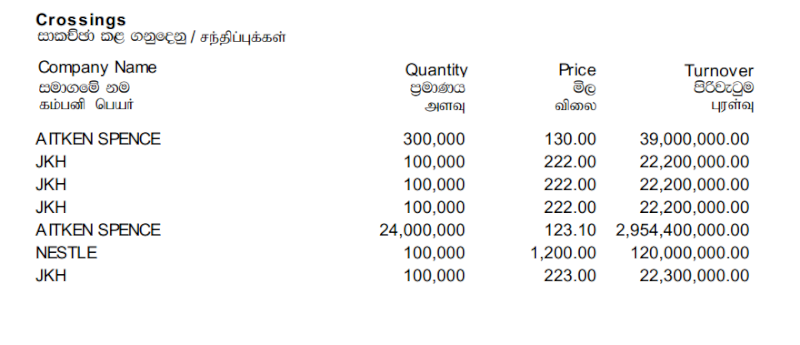

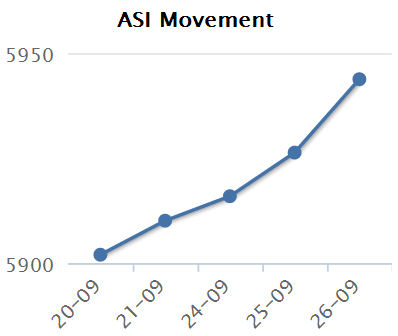

Crossings - 26/09/2012 and Top 10 Contributors to Change ASPI Wed Sep 26, 2012 4:45 pm

Crossings - 26/09/2012 and Top 10 Contributors to Change ASPI Wed Sep 26, 2012 4:45 pm

LBT:Market Wednesday Wed Sep 26, 2012 5:25 pm

LBT:Market Wednesday Wed Sep 26, 2012 5:25 pm

Big Spence crossing help sustain upward run Thu Sep 27, 2012 4:21 am

Big Spence crossing help sustain upward run Thu Sep 27, 2012 4:21 am

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum