Fundamental,

Annual EPS 1.6-1.8

NAVPS 9.17

Intrinsic value 19.27

Number of shares held by others apart from 20 major share holders 47 mil

Good dividend too.

Technical,

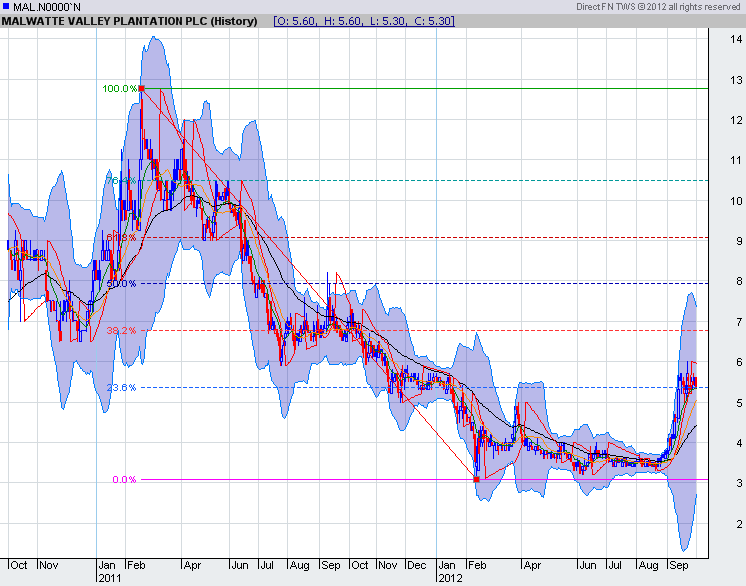

MAL is collecting at 5.30-5.40 range which is 23.6% fib level,next level is 6.70-6.80 (38.2%),more than 20% gain.

Sentiment analysis,

*MAL mainly depend on tea and rubber which prices are on the rise.

*MAL is diversified and in to tea export as well,exports will be benifited with currancy gain too.

*Many traders/investers have identified MAL's potential.

*Plantation rally is yet to start.

*Board had planned a right issue at 6.75 in Aug which was cancelled.

P.S I have many of this gem and still collecting.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home