would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

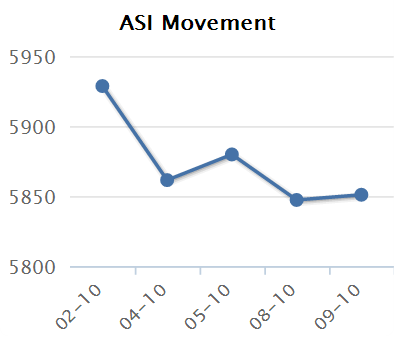

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 4:13 pm

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 4:13 pm

Crossings - 09/10/2012 and Top 10 Contributors to Change ASPI Tue Oct 09, 2012 4:15 pm

Crossings - 09/10/2012 and Top 10 Contributors to Change ASPI Tue Oct 09, 2012 4:15 pm

LBT : Market Tuesday Tue Oct 09, 2012 4:19 pm

LBT : Market Tuesday Tue Oct 09, 2012 4:19 pm

Last edited by sriranga on Tue Oct 09, 2012 7:07 pm; edited 1 time in total

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 4:32 pm

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 4:32 pm

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 4:36 pm

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 4:36 pm

K.Haputantri wrote:Foreigners selling. An out come of relaxation of rules being considered by them as damaging or any other plausiable reason unknown to us?

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 4:49 pm

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 4:49 pmslstock wrote:K.Haputantri wrote:Foreigners selling. An out come of relaxation of rules being considered by them as damaging or any other plausiable reason unknown to us?

GREG sold by foreigners is it? Bit too early to worry about outflow as it is marginal today.

Trading Tuesday - Sri Lanka stocks close down 0.24 pct Tue Oct 09, 2012 5:07 pm

Trading Tuesday - Sri Lanka stocks close down 0.24 pct Tue Oct 09, 2012 5:07 pm

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 9:05 pm

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 9:05 pm

slstock wrote:K.Haputantri wrote:Foreigners selling. An out come of relaxation of rules being considered by them as damaging or any other plausiable reason unknown to us?

GREG sold by foreigners is it? Bit too early to worry about outflow as it is marginal today.

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 9:44 pm

Re: Trade Summary Market - 09/10/2012 Tue Oct 09, 2012 9:44 pm

Whitebull wrote:slstock wrote:K.Haputantri wrote:Foreigners selling. An out come of relaxation of rules being considered by them as damaging or any other plausiable reason unknown to us?

GREG sold by foreigners is it? Bit too early to worry about outflow as it is marginal today.

Yes we should not rush in to conclusions.

Re: Trade Summary Market - 09/10/2012 Wed Oct 10, 2012 4:33 am

Re: Trade Summary Market - 09/10/2012 Wed Oct 10, 2012 4:33 amSimilar topics

Permissions in this forum:

You cannot reply to topics in this forum