Market closed marginally lower on Monday although premier blue chip John Keells Holdings gained around 1.3%. Losses on Bukit Darah, Hatton National Bank, Commercial Bank saw the indices driven lower whilst foreign investor favourites Nestle, Chevron Lubricants and Lion Brewery gained further ground. Blue-chips continued to dominate turnover with retail activity slowing down.

Power and energy sector gained 1.3% to reflect the improved hydro electricity generation currently taking place in the country. Chemicals & pharmaceuticals sector lost most ground with CIC Holdings closing lower at Rs. 64.00.

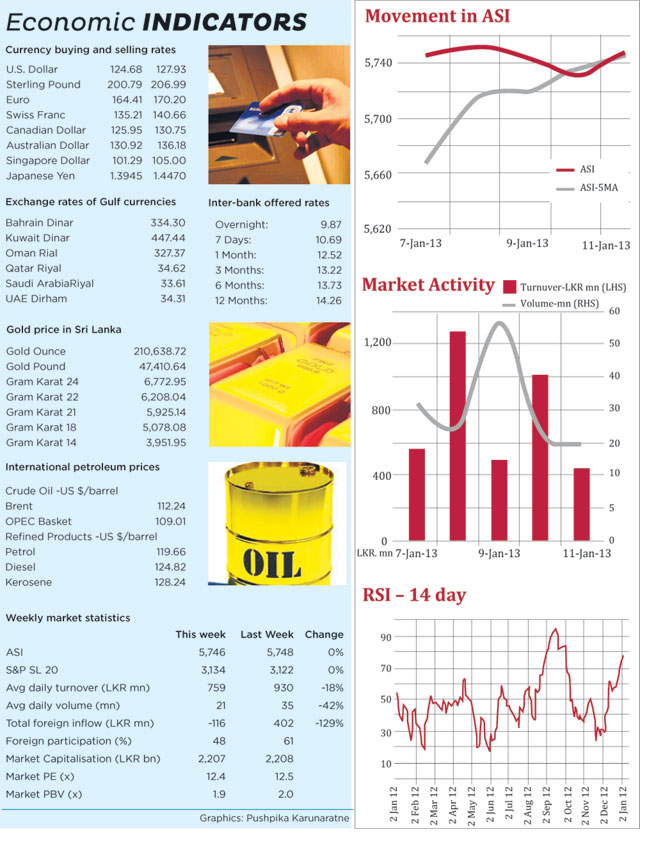

ASI dipped 1.62 points (0.03%) to close at 5,746.09 and the S&P SL20 index dipped 1.67 points (0.05%) to close at 3,120.04. Turnover was Rs. 557.5Mn.

Indices closed higher on Tuesday as Ceylon Tobacco Company dropped from its all-time high price and John Keells Holdings gained more than 0.6% whilst LOLC also gained more than 7% during a late rally. Asiri Central dominated turnover with a negotiated deal which accounted to almost 50% of the day’s turnover. Apart from that deal, blue-chips continued to dominate proceedings with plenty of private deals.

ASI gained 5.84 points (0.10%) to close at 5,751.93 and the S&P SL20 index gained 3.93 points (0.13%) to close at 3,123.97. Turnover was Rs. 1,273.6Mn.

On Wednesday, profit taking on many blue-chips during late trading caused the indices to lose marginally. However, yields on treasury bills fell further in today’s auction which will help to improve the condition of the stock market. Private deals on Asiri Hospitals and related parties transacted today as well whilst a Dialog saw selling pressure towards the close of trading.

ASI dropped 6.83 points (0.12%) to close at 5,745.10 and the S&P SL20 index lost 3.10 points (0.10%) to close at 2,120.87. Turnover was Rs. 497.2Mn.

Profit taking on John Keells Holdings and Banking sector stocks sent the broader index into negative territory on Thursday but Distilleries saw continued interest from retail and as well as institutional investors. Retail participation continued to be muted whilst private deals on blue-chips helped to bolster turnover.

ASI lost 12.89 points (0.22%) to close at 5,732.21 and the S&P SL20 index gained 0.66 points (0.02%) to close at 3,121.53 Turnover was Rs. 1,013.1Mn.

Indices managed to close higher on Friday helped by gains on Sri Lanka Telecom, Distilleries and few banking sector counters. Profit taking was evident on John Keells Holdings which has consistently gained ground during the past few weeks. Retail interest was seen picking up today as accumulation was seen on many

mid-capped counters.

ASI gained 14.28 points (0.25%) to close at 5,746.49 and the S&P SL20 index gained 12.34 points (0.40%) to close at 3,133.87. Turnover was Rs. 454.2Mn.

Top contributors to turnover were John Keells Holdings with Rs. 79.3Mn, Distilleries with Rs. 56.3Mn and Commercial Bank with Rs. 33.6Mn. Most active counters for the day were Environment Resource Investments, Distilleries and Environment Resource Investments warrant-6.

Notable gainers for the day were Hayleys Exports up by 8.6% to close at Rs. 34.00, Lanka Milk Foods up by 8.0% to close at Rs. 100.00 and Panasian Power up by 3.5% to close at Rs. 3.00. Notable losers for the day

were Dipped Products down by 3.7% to close at Rs. 105.00, Central Industries down by 2.1% to close at Rs. 67.00 and Royal Ceramics down by 1.9% to close at Rs. 96.10.

Cash map for today was 56.15% which is slight drop from yesterday. Foreign participation was 30% of total market turnover whilst net foreign selling was Rs. 14Mn.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home