It said that commodity prices at Sri Lankan auctions remained strong during 1QCY11 despite disturbances at global level with crisis in Libya and Japan.

In a sector update, JKSB said tea prices have remained robust whilst rubber after suffering a beating in March had shown signs of recovery. Here are excerpts from JKSB’s Update on the Plantation Sector:

All three elevations of tea recorded gains in Year to Date (YTD) prices with National Sales Averages (NSAs) having reached Rs. 394 per kg compared to Rs. 383 per kg during the comparative period in 2010.

Tea prices have been greatly supported by a reduction in output on the back of adverse weather with the latest statistics indicating a deficit of 9.3 million kgs up to February 2011. Production from the medium grown segment saw the highest decline of 26% while the low grown segment posted a deficit of 5 million kgs up to February 2011.

Tea production in Kenya too saw a decline of 9.8 million kgs up to February 2011, a decline of 13.5% along with India which showed a deficit of 6.2 million kgs in the month of January 2011.

In terms of rubber, RSS1 averaged Rs. 591 per kg during 1QCY11, 71% higher over the comparative period in 2010 while Latex crepe 1X averaged Rs. 623 per kg 79% higher than those recorded in 1QCY10. Rubber prices took a beating in the month of March 2011 consequent to the earthquake and tsunami that hit Japan with concerns arising due to closure of manufacturing plants; prices have subsequently recovered.

Commodity prices have been benefited by the increase in price of crude oil on the back of crisis in Libya. Rising crude oil prices has made synthetic rubber more expensive, thereby indicating a possible increase in demand for natural rubber (NR). Further, China – the largest consumer of NR has remained on the sidelines due to soaring rubber prices but is likely to return to the market soon due to a decline in NR inventories.

On the supply side, floods in Thailand, the world’s largest NR producer have disrupted output with production expected to drop by 50,000 tonnes according to the Thai Rubber Association. Seasonal wintering is also likely to dampen supply in the coming months which should further support prices.

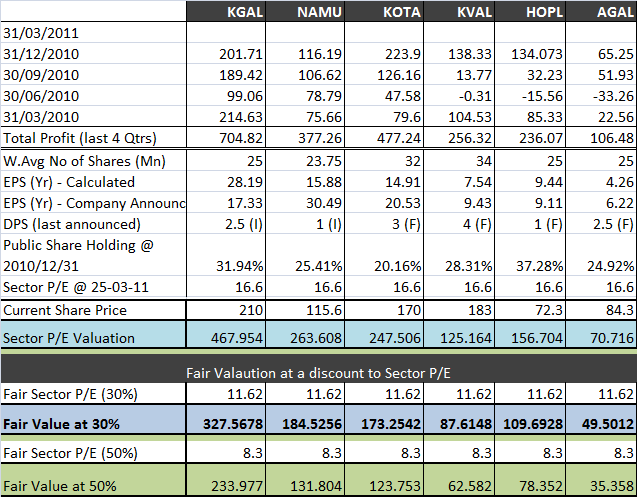

Quarterly performance of plantation companies

Strong commodity prices during the 4QFY10/3QFY11 saw the plantations segment posting a cumulative profit of Rs. 1,567 million, a growth of 95% over the comparative quarter in 2009.

Kotagala Plantations Plc (KOTA) and Kegalle Plantations Plc (KGAL) were the largest contributors to the segment’s earnings posting Rs. 239 million and Rs. 227 million respectively, thanks to a sharp increase in rubber prices despite a fall in production due to adverse weather conditions.

Earnings in most companies were supported by rising turnover and a decline in cost of production consequent to reduction in output as well as normalised cost of sales which excludes the one off adjustment that was seen in the comparative quarter in 2009 due to the previous wage hike.

Companies such as Horana Plantations Plc (HOPL), Malwatte Valley Plantations Plc, Namunukula Plantations Plc (NAMU), KGAL and KOTA with significant exposure to rubber were the largest beneficiaries of soaring rubber prices.

http://www.ft.lk/2011/04/13/plantation-firms-to-ride-on-strong-commodity-prices/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home