Latest Accounts of CDIC

http://www.cse.lk/cmt/upload_report_file/365_1298633958.pdf

CDIC owns total 41.56% of AVIVA NDB Insurance Company (CTCE). As given above the book value of the said investment to CDIC is only Rs 741mn (Please see the accounts above under the investment in Associate Companies). The current market capitalization of AVIAV NDB is approximately Rs 10bn. Therefore 41.56% owned by CDIC should be worth approximately Rs 4.15bn.

Lets consider mark to market method to value CDIC

Total Asset Value of CDIC without Associate Company = Rs 4.5bn - Rs 0.74bn = Rs 3.76bn.

Value of 41.56% Stake AVIVA NDB = Rs 10bn x 41.56% = 4.15 bn

Total Asset Value of CDIC = Rs 7.91bn

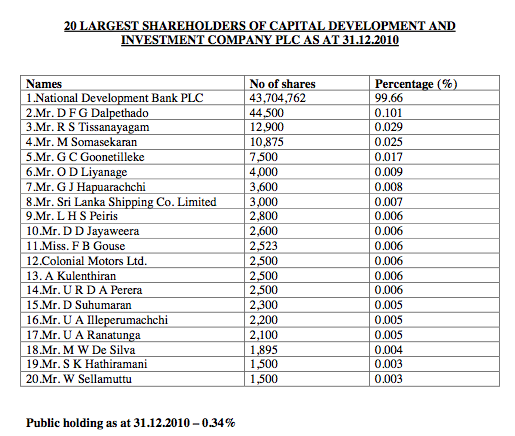

Total issued capital of CDIC is only 43.8mn shares

99.9% is owned by NDB and free float is only 150,000 shares.

CDIC also own and control the AVIVA NADB Fund Management Company which manages the AVIVA NDB Funds.

This makes CDIC very interesting proposition?

Last edited by Quibit on Thu May 12, 2011 6:29 pm; edited 5 times in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home