Super Gain Tax =LKR 27bn

Market PER= 20 PER

Impact to Market Capitalisation:

LKR 27Bn X 20 PER

LKR 540 billion

You can also calculate the expected fall:

Current market cap = LKR 3,000 Billion

Impact: LKR 540 Billion

% Impact = 540/3000

18%

Market should fall By 18%

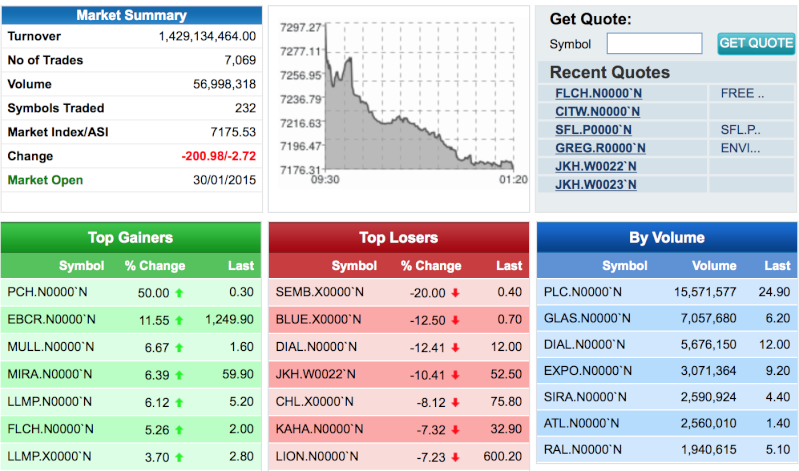

Current Market ASI : 7200

Expected Fall: 1296 Points

Final ASI after adjustment : 6000

If we take a market PER of 10, then the market should fall 648 Points (ASI 6728) as a result of this tax.

(This is a theoretical calculation and therefore please do not find fault with me if it does not fall to 6000)

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home