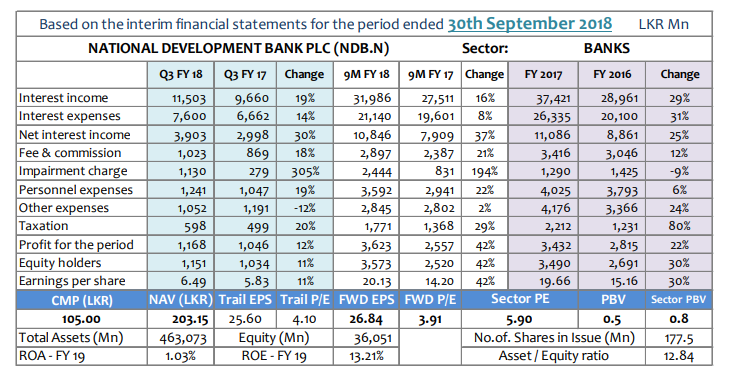

For me it is correct time to buy now based on following reasons,

1. NAPS - Rs. 185/-

2. Last Qtr Group EPS - Rs. 4.48 (Amualised Rs 18/-) and Bank EPS Rs 7.72 (Annualised Rs 31/-)

3. Dividend Declaration most likely to happen in the month of February. (Possible to between Rs. 10/- to 12 /- based on passed)

4. Based on Chart it should move up now.

Expert Please advice on this share, Specially with regard to government future policy on interest rate.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home