Many of you are wondering what is happening in this market. And if you are new to cse with fresh capital, you will surely go wrong with decisions at times like this.

Therefore during these times do not get panic and do selling or buying. Wait until you see a clear direction of the ASI, right now ASI is volatile & misleading. Do not jump into conclusions. Also not only the market, take a look of the country's situation, the economic situations. If you think there is wonderful things happening in our country, you can buy.

CSE will surely reflect the true situation on its index.Sometimes it will take time. Then your decisions will payback.

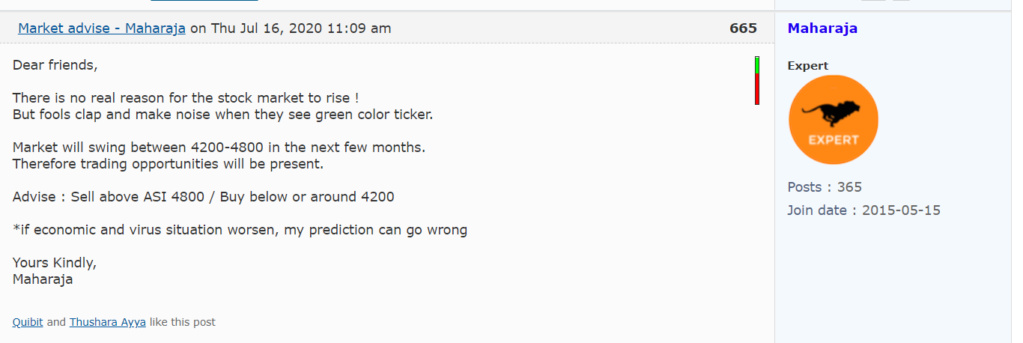

Maharaja's recommendation is a strong SELL for the whole market.

Other members also have different opinions and Maharaja respects those.

Maharaja

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home