PE Expectations are often depended on prevailing interest rates. Higher the interest rates fund will tend to shift towards debt instruments unless shares start trading at matching PE Ratios.

As a result of current TB rates being 33% p.a, stock market investors expect target buying companies to have PER of 3X or less. 100/33 = 3

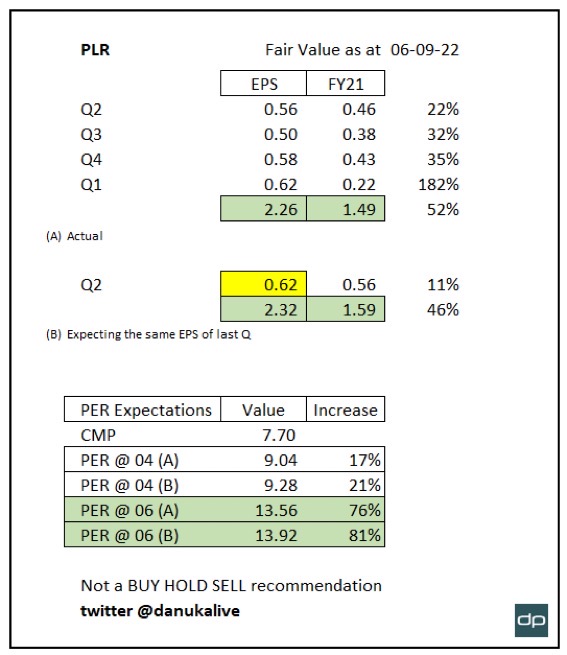

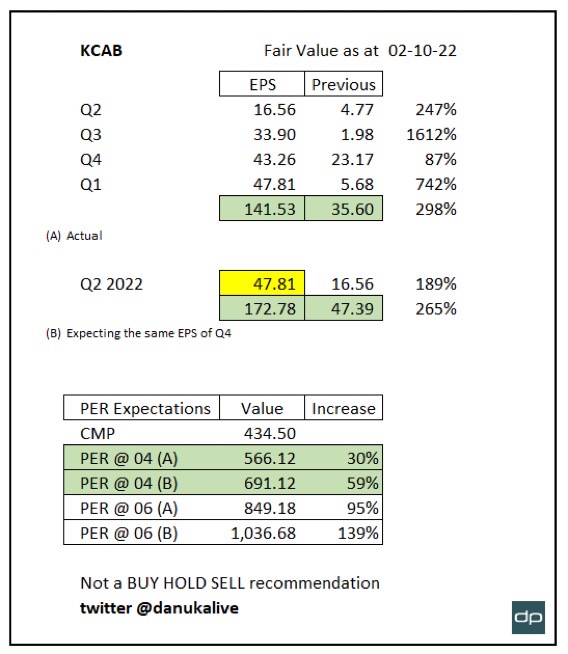

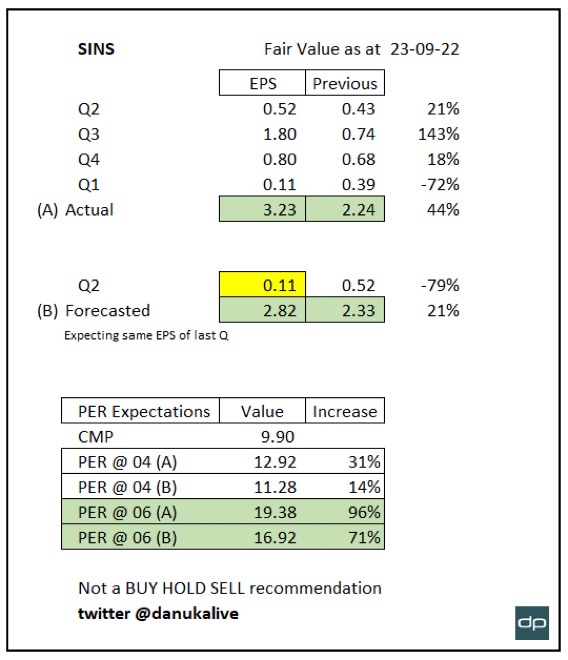

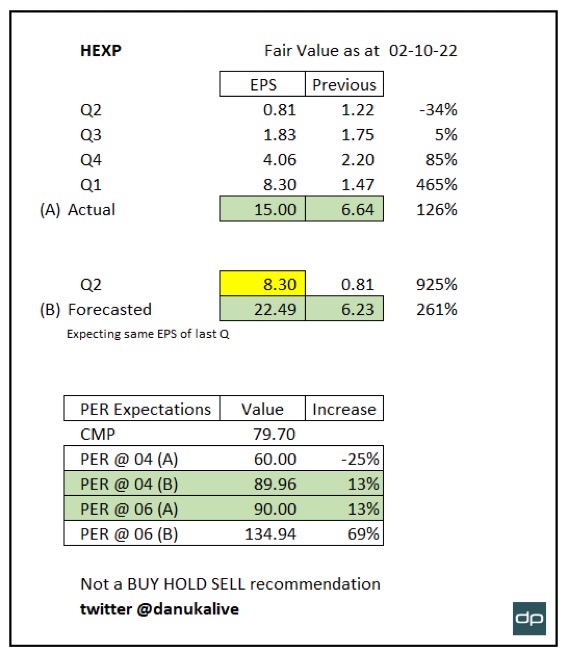

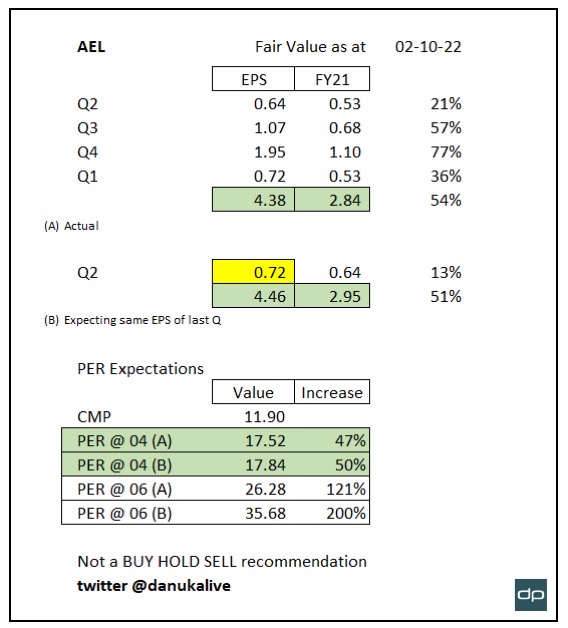

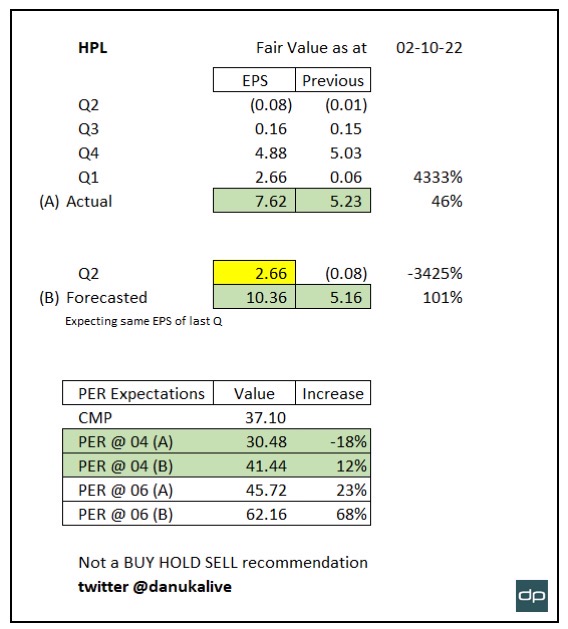

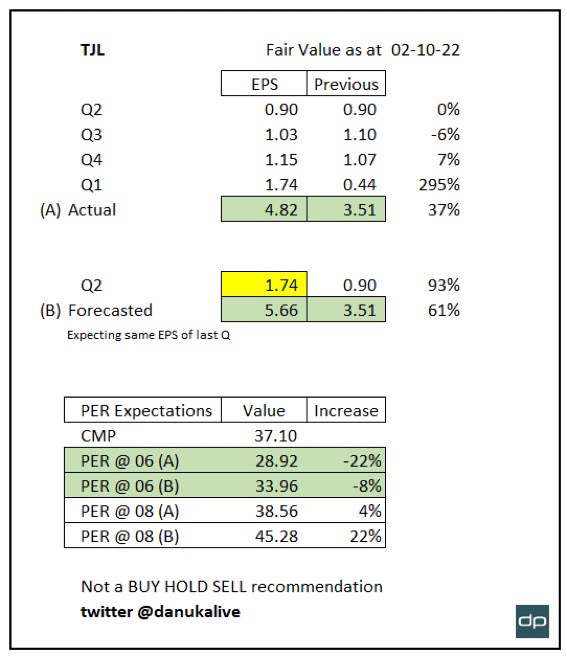

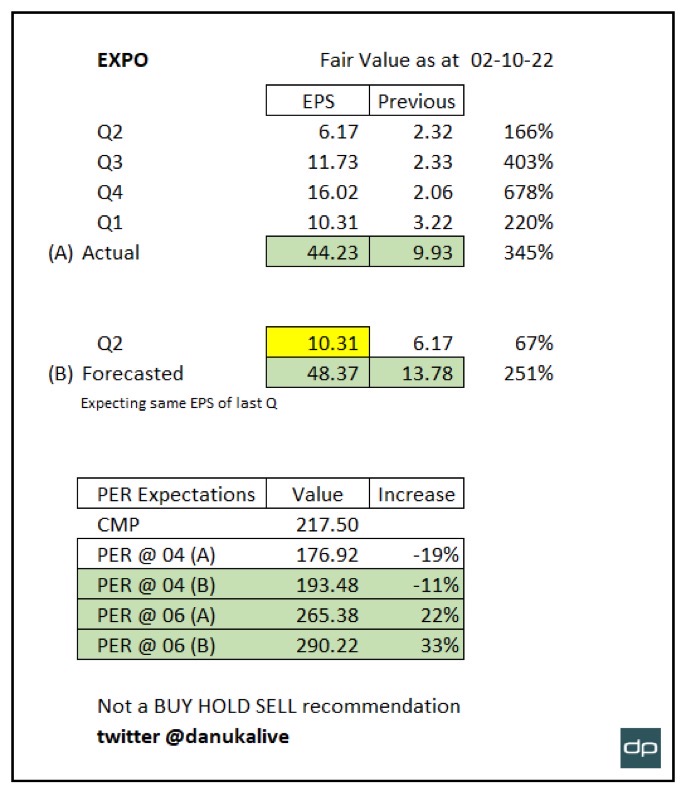

If the interest Rates were at 25%p.a then PER Expectation would be 4X or less. 100/25 = 4.

In case if TB Rates reach 50% then investors would be looking for companies with a PER of 2X or less. 100/50 = 2

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home