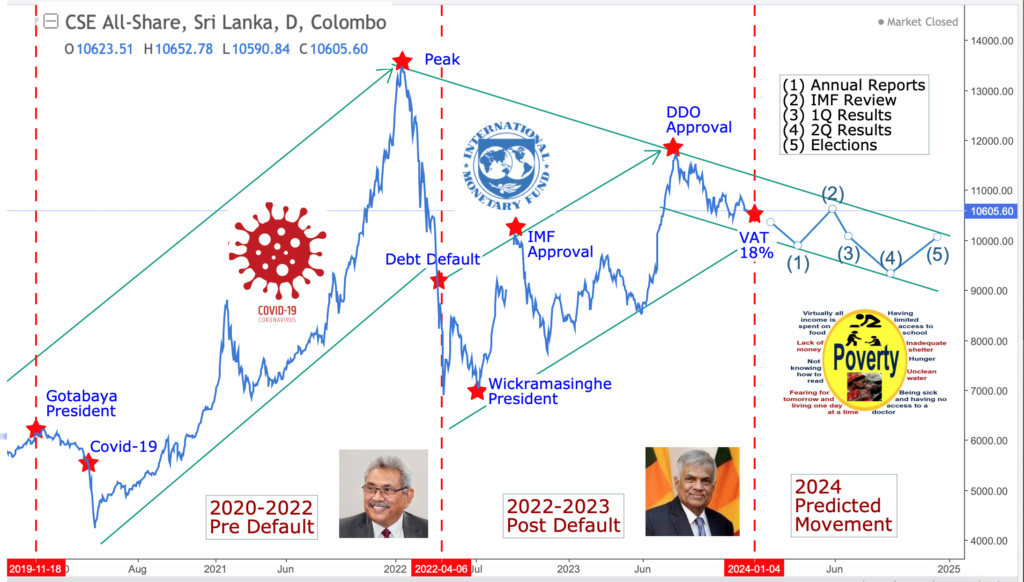

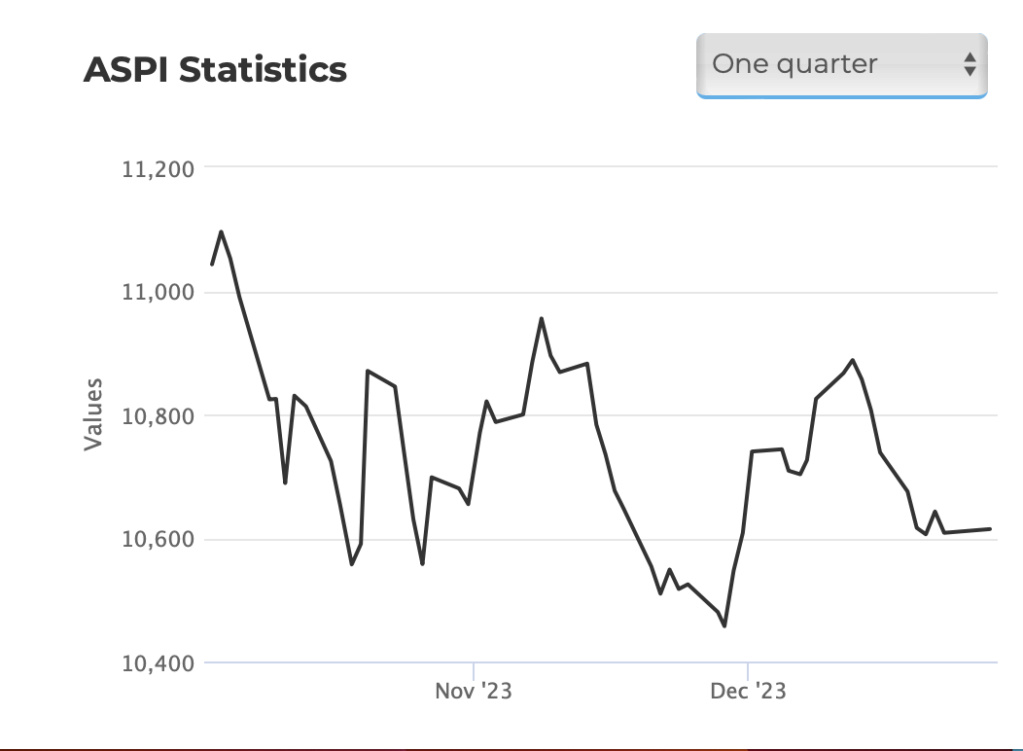

According to latest trend analysis, Colombo Stock Market All Share Price Index (ASPI) expected to trade between ASPI 10600-9400 during 2024.

Key Events - 2024

(1) Annual Reports/3Q Results (Feb/March/April)

(2) IMF 2nd Review/4Q Results (May/June)

(3) 1Q Results (July/August)

(4) 2Q Results (October/November)

(5) Elections (November/December)

Sri Lanka's cabinet approved a hike in Value Added Tax (VAT) up to 18% from the current 15% with effect from Jan. 1, 2024. Further Sri Lanka will remove “almost all” exemptions from value added tax keeping health, education and some foods, President Ranil Wickremesinghe said in presenting a budget for 2024.

The second review of Sri Lanka's $2.9 billion bailout with the IMF expected to be completed in the first half of 2024, provided it manages to meet debt restructuring and revenue targets set under the programme.

It’s certain now that 2024 will be a year of election in Sri Lanka with both the presidential and parliamentary polls slated for next year. Coincidentally there are several other countries including India where parliamentary elections will be held next year while the US presidential election is scheduled for November 2024.

https://invst.ly/12sl52

Last edited by God Father on Thu Dec 28, 2023 8:50 am; edited 2 times in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home