LankaBIZZ helps you find answers and to be knowledgeable about the Stock Market Rules and Regulations through AI. Listing & Trading Rules, CDS & Clearing House Rules, Dispute resolution Rules. Ask many questions as you like. www.lankabizz.net

Example Questions & Answers

__________________________________________________________

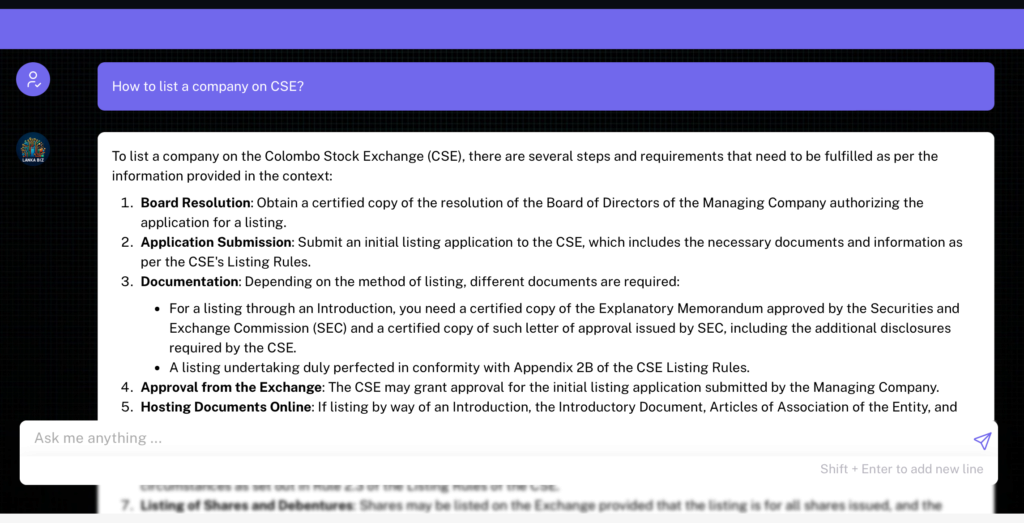

How to list a company on CSE?

To list a company on the Colombo Stock Exchange (CSE), there are several steps and requirements that need to be fulfilled as per the information provided in the context:

1. Board Resolution: Obtain a certified copy of the resolution of the Board of Directors of the Managing Company authorizing the application for a listing.

2. Application Submission: Submit an initial listing application to the CSE, which includes the necessary documents and information as per the CSE's Listing Rules.

3. Documentation: Depending on the method of listing, different documents are required:

- For a listing through an Introduction, you need a certified copy of the Explanatory Memorandum approved by the Securities and Exchange Commission (SEC) and a certified copy of such letter of approval issued by SEC, including the additional disclosures required by the CSE.

- A listing undertaking duly perfected in conformity with Appendix 2B of the CSE Listing Rules.

4. Approval from the Exchange: The CSE may grant approval for the initial listing application submitted by the Managing Company.

5. Hosting Documents Online: If listing by way of an Introduction, the Introductory Document, Articles of Association of the Entity, and Trust Deed should be hosted on the Entity’s website and the CSE’s website at least seven (7) Market Days prior to the submission of the Declaration referred to in Appendix 2D until the date of maturity of the Debt Security.

6. CSE's Right to Withdraw Approval: It is important to note that the CSE reserves the right to withdraw approval for a listing in certain circumstances as set out in Rule 2.3 of the Listing Rules of the CSE.

7. Listing of Shares and Debentures: Shares may be listed on the Exchange provided that the listing is for all shares issued, and the Entity complies with the Rules and Circulars of the Exchange and the Central Depository Systems (Pvt.) Limited.

8. Declaration Receipt: The Entity shall be listed on the Exchange on or before the third (03rd) Market Day from the date of receipt of the Declaration by the Exchange.

9. Further Listing of Units: If applicable, the procedure relating to the further issue and listing of units shall be determined by the Managing Company in consultation with the SEC and CSE.

10. Compliance with Ongoing Requirements: The Board of Directors of the Entity must ensure that all the listing requirements are met on a continuing basis as long as its Securities remain listed on the Exchange.

These steps are a high-level overview, and it is advisable for the company seeking to list to consult with the CSE or a professional advisor for detailed guidance and to ensure compliance with all the necessary rules and regulations.

_______________________________________________________

CSE Disclosure requirements?

Based on the provided context, the disclosure requirements for entities listed on the Colombo Stock Exchange (CSE) are as follows:

1. Compliance with Corporate Governance Rules:

- Listed entities are required to disclose their compliance with the Corporate Governance rules applicable to their sector. This includes affirming compliance with the relevant sections under the Corporate Governance Rules of the CSE for the period under review.

2. Disclosure in Annual Reports:

- Listed entities must comply with the applicable Rules and Circulars of the CSE and the Central Depository Systems (Pvt) Limited.

- As per the Guidance Note issued by the CSE on ‘Annual Report Disclosures relating to Section 7 and Section 9 of the CSE Listing Rules’, entities must comply with the Corporate Governance Requirements as set out in the note during the transitional period until 01 October 2024.

3. Minimum Public Holding Requirements:

- Entities must disclose their plans and timeframe to comply with the Minimum Public Holding Requirements if they do not meet these requirements.

- Details and justification for the proposed method to achieve compliance must be disclosed if the entity decides to adopt a method specified in Section 5 of the CSE Listing Rules.

4. General Meeting Outcomes:

- The outcome of matters taken up at the General Meeting related to compliance with the Minimum Public Holding Requirement must be disclosed to the CSE and investors within the Market Day immediately following the General Meeting.

5. Specific Disclosures in Annual Reports:

- Entities must disclose information as per Section 7.6 of the Listing Rules of the CSE regarding the content of the Annual Report and Financial Statements.

- This includes a complete list of disclosure requirements such as the names and profiles of Directors, principal activities of the entity and any changes therein, and compliance with other specific sections of the Listing Rules.

6. Compliance with Other Regulations:

- Entities from specific sectors, such as banking or insurance, must also disclose compliance with sector-specific regulations, such as the Banking Act or the regulation of the Insurance Industry Act.

7. Related Party Transactions:

- Compliance with the Code of Best Practice on Related Party Transactions as advocated by the Securities and Exchange Commission of Sri Lanka (SEC) must be disclosed.

These disclosures are mandatory and are aimed at ensuring transparency and maintaining investor confidence in the market. Entities are required to make these disclosures in their Annual Reports and other relevant documents as per the CSE Listing Rules and other applicable regulations.

____________________________________________________

Dissemination of market sensitive information?

The dissemination of market-sensitive information by listed entities is governed by the rules outlined in the provided context. Here's a detailed explanation based on the context:

1. Immediate Disclosure of Price Sensitive Information (Section 8.1):

- Listed entities must immediately disclose price-sensitive information to the Exchange to maintain a fair and orderly securities market.

- Price-sensitive information refers to specifics concerning the entity that is not widely known to potential investors or traders but would likely influence the price of the entity's securities if it were known.

2. Content of Announcement (Section 8.1):

- Announcements must be balanced, fair, factual, clear, concise, and understandable to the layman.

- They should contain sufficient quantitative information for investors to evaluate its importance.

- Announcements should avoid omitting significant unfavorable facts, presenting favorable possibilities as certain, using promotional jargon, or making negative statements with a positive implication.

3. Procedure for Announcements (Section 8.2):

- Disclosure should be made through an announcement uploaded to the Exchange's website by authorized personnel.

- The announcement must be in writing and signed by an authorized officer of the entity.

- To facilitate dissemination, copies of the announcement may be simultaneously made to the news media.

4. Withholding of Information (Section 8.3):

- In certain circumstances, immediate disclosure may be withheld, such as when it could prejudice the entity's objectives or when facts are in flux.

- Strict confidentiality must be maintained when price-sensitive information is withheld, and trading by insiders with access to such information is prohibited.

- The entity must be prepared to make an immediate public announcement if required by the Exchange.

5. Insider Trading Regulations (Business Regulations 2024, Pages 1125-1126):

- Insiders are prohibited from trading based on information that is not generally available and has a material effect on the price or value of securities.

- Communication of such information to others is also prohibited if the insider knows or could reasonably be expected to know that the information is not generally available.

6. Monitoring and Disclosure (Corporate Performance - 31 Dec 2023 Vol 1B, Page 709):

- Entities like the Bank have in place a Board-approved Disclosure Policy to ensure prompt identification and reporting of material and price-sensitive information.

- A Group Securities Trading Policy restricts trading during specified blackout periods to prevent trading based on price-sensitive information.

Entities must adhere to these rules to ensure transparency and fairness in the market, and to comply with the regulations set by the Colombo Stock Exchange and the Securities and Exchange Commission of Sri Lanka.

_____________________________________________________

www.lankabizz.net

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.