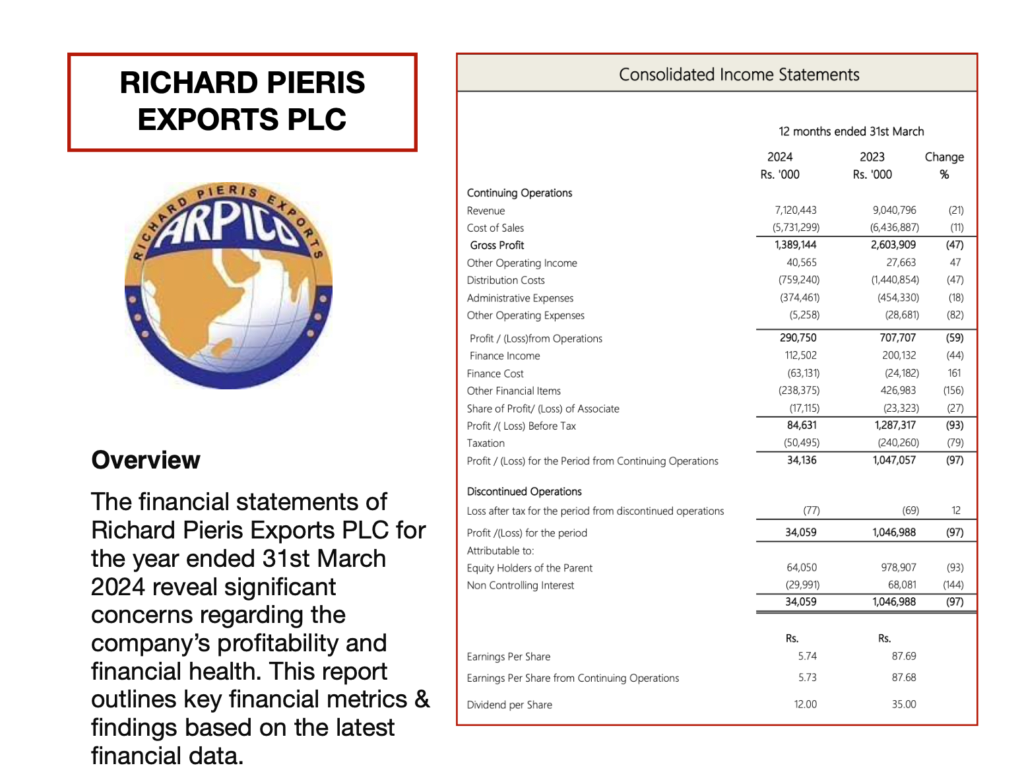

Net Profit Decline: Net profit attributable to equity holders of the parent company dropped drastically by 93%, from Rs. 978,907,000 in 2023 to Rs. 64,050,000 in 2024. This steep decline highlights the severe impact on the bottom line and raises concerns about the company's overall financial health and ability to generate profits..

Download Full Report: https://easyupload.io/uexmvn

Revenue Drop: The company experienced a significant drop in revenue, falling by 21% from Rs. 9,040,796,000 in 2023 to Rs. 7,120,443,000 in 2024. This decline reflects a substantial reduction in sales and indicates potential market challenges or operational inefficiencies impacting the company's ability to generate income.

Gross Profit Decline: Gross profit declined sharply by 47%, from Rs. 2,603,909,000 in 2023 to Rs. 1,389,144,000 in 2024. This significant decrease highlights the company's challenges in controlling production costs relative to revenue, indicating possible inefficiencies in the cost structure.

Operating Profits Plummeted: Operating profit plummeted by 59%, from Rs. 707,707,000 in 2023 to Rs. 290,750,000 in 2024. The substantial decrease in operating profit underscores the company's struggle to maintain profitability from its core operations, further pointing to inefficiencies and higher operating expenses.

Increased Finance Costs: Increased Finance Costs

Finance costs surged by 161%, from Rs. 24,182,000 in 2023 to Rs. 63,131,000 in 2024. This increase in finance costs reflects a higher burden of interest expenses, which could be due to increased borrowing or higher interest rates, further straining the company's profitability.

The financial position and profitability of Richard Pieris Exports PLC have significantly deteriorated over the fiscal year ending March 31, 2024. The substantial increase in liabilities, coupled with declining revenues, gross profit, operating profit, and net profit, indicates severe financial challenges. The sharp decline in EPS and increased finance costs further exacerbate the company's financial distress, raising critical concerns about its future sustainability and financial stability.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home