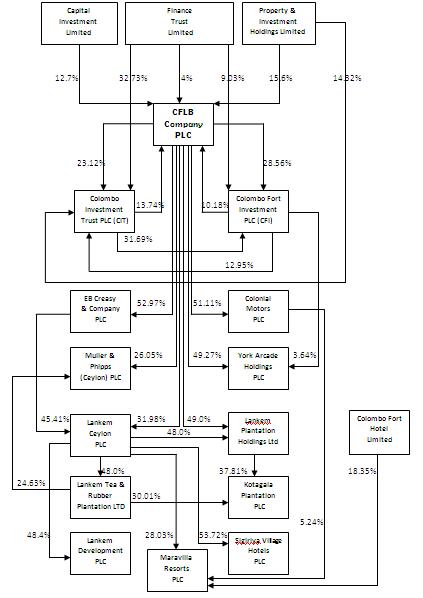

CFLB prices have gone up so much, there is a rumor in the market that there is a rights issue or split. Is it true? do you think it is worth buying this company at this price. Also what do you think of lankem and cw mackie.

Last edited by CHRONICLE™ on Sat Jun 05, 2021 3:00 pm; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home