Many large-cap shares generally reach the maturity stage since the turnover and profits of large companies are already high in the context of that particular market. On the other hand, mid-cap shares are considered an attractive investment avenue because their growth rate will be comparably higher. Mid cap companies are generally in the growth momentum in their life cycles. Thus, they may or may not pay a dividend, often deciding to continue to reinvest in growing future operations and earnings ability. For investors looking for stock price appreciation, mid cap companies provide a fertile hunting ground. However on the flip side, mid-cap shares are of small companies where revenue and profits could be more volatile than large companies.

In a pioneering move, MBSL constructed a stock market Index: the MBSL Midcap Index, which measures the aggregate price level and price movements of medium size companies listed on the Colombo Stock Exchange (CSE). There was no index to measure the price movement of medium sized companies listed on the CSE.

The MBSL Midcap Index filled this vacuum.

The index which came into operation in 1999 is revised annually and looks at the middle range market capitalisation, liquidity and the profitability of the firms to be included in the Midcap Index.

MBSL Midcap Index can be used as the benchmark index by individual and institutional investors who prefer growth but are prepared to with stand only conservative levels of volatility in their equity investments.

The Midcap Index, together with the Milanka Price Index (MPI) generate valuable signals for portfolio managers for switching between larger-cap more sensitive stocks and the midcap less sensitive stocks with more growth potential in response to changing capital market conditions.

The Midcap Index focus in profitability helps to screen stocks with better future prospects that will cross to higher market capitalisation in the next year.

MBSL has included 14 new firms to the Year 2012 composition by excluding 14 existing firms from the index. The new inclusions are, Asian Alliance Insurance PLC, Seylan Bank PLC, Singer Finance ( Lanka) PLC, Union Bank of Colombo PLC, HVA Foods PLC, Expo Lanka Holdings PLC, Richard Pieris and Company PLC, Browns Investments PLC, The Lanka Hospital Corporation PLC, Nawaloka Hosptial PLC, PC House PLC, Environmental Resources Investments PLC, Ceylon Grain Elevators PLC and Laugfs Gas PLC.

Stocks are diversified over eleven sectors. The MBSL Midcap Index has the base as 1,000 as at 31 December 1998 (which is the same base year for Milanka Index). The range for market capitalisation for the year 2011 was Rs. 2.394 billion to Rs. 23.94 billion. With the stock market activity, this range is adjusted for the change in the ASPI annually. Accordingly the range of market capitalisation for 2012 is Rs. 1 billion to Rs. 15 billion.

MBSL has excluded firms such as LB Finance PLC, Nations Trust Bank PLC, Merchant Bank of Sri Lanka PLC, Bairaha Farms PLC, The Lion Brewery Ceylon PLC, Chemical Industries (Colombo) PLC, Colombo Dockyard PLC, Hemas Power PLC, Sunshine Holdings PLC, Asiri Hospital Holdings PLC, Renuka Holdings PLC, Tokyo Cement Company (Lanka) PLC, Chevron Lubricants Lanka PLC and C.W. Mackie PLC from the MidCap index composition of 2012.

The criteria for selecting the 25 stocks of the index remained unchanged and are: middle range market capitalisation, liquidity and profitability.

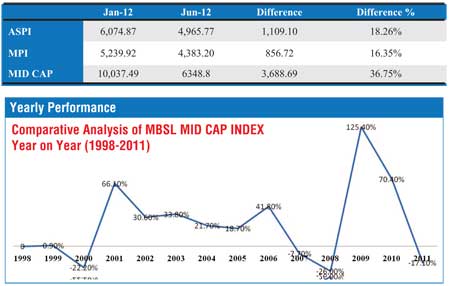

Yearly performance

The CSE performed exceptionally well in the two years following the end of the war: the benchmark All Share Price Index (ASPI) surged 96% to become Asia’s best performing market in 2010 and the world’s best performing market in 2009 with a gain of 125%. MBSL MIDCAP Index also surged 125.4% in 2009 and 70% in 2010. Although the indexes are declined for 2010 to 2011 and six months ended 30 June 2012, it is indicates that the index is at a good level for the medium to long term.

Comparative analysis of MBSL MID CAP INDEX, ASPI and MPI year to date

In absolute terms, market indices have declined year to date, reflecting the weak global outlook for equities and rising domestic interest rates. The Sri Lankan economy is not immune to global conditions and faces its own challenges in the near term. Larger than expected trade deficits, depleting foreign reserves, rising interest rates and weaker than expected FDIs are primary concerns. Policy makers have allowed the currency to depreciate and interest rates to rise in order to address structural imbalances in the economy in the short to medium term. The economy needs time to adjust to the new exchange and interest rate regimes. Nevertheless, the volatility is managed and dynamics of the economy will decide the outlook of Sri Lanka.

On a positive side, we have observed net foreign inflow into the market over Rs. 20 billion; this current downturn is an opportunity to the investors to collect value stocks since most share prices felled significantly below its intrinsic value, and there is an opportunity prevailing in investing MIDCAP Stocks, which are indicating significant growth potential.

http://www.ft.lk/2012/07/25/prospects-of-midcap-stocks-in-colombo-bourse/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home